The reality is that, in the world of finance, the truth moves slowly. This is frustrating to most humans, who have a predisposition for wanting things to to happen quickly. This is the fundamental divide between investors and traders - timeframe.

It’s a slippery slope

We find ourselves in a world in the throes of recovering from the impacts of a pandemic. Additionally, we are also in an age empowered by technology that has resulted in the rapid distribution of information from anyone who feels the urge to express their opinion, and the concept of truth is more subjective than ever. Trying to make sense of the whole mess is difficult for most because there is so much opinion-based noise about, plus they’ve never developed their own financial understanding and therefore must rely on experts. Sadly, in the world of finance, many of the experts merely possess academic knowledge that fails in the real world - a point I’ve mentioned on previous occasions so won’t go into here, but rest assured that I know this based on 30+ years of professional experience in the field.

Possibly the worst combination of this situation is the number of financial experts who are now active on social media that have gained tens of thousands of followers. There is a widespread phenomenon observable from these people. They have drifted from their professional role, which typically require them to have an investor mindset (i.e. think robustly about the longer-term) and they have begun playing to the gallery (their followers), reveling in their new-found fame and its impact on their ego. But social media fame requires a continual stream of posts and, invariably, it drags the quality of these experts content even lower as they pander to the masses. These experts have fallen from an investor’s focus on economic data to a trader’s focus on market noise. It is a sad state of affairs when professionals ignorantly drift from the intended purpose of their role. As an example, we now find ourselves in a situation where one impact of the pandemic has been a jump in inflation. However, if anyone on social media suggests that the current inflation surge is likely to be relatively short-lived (maybe a 1 to 2 year event), they are lambasted and vilified by supposed experts to cheers from the galleries (those who trade likes for likes). It is such behavior that will keep the general public ignorant of the workings of the financial world, which is the biggest tragedy because the experts that oversee the governing institutions of our financial framework are destroying our existing system and it is more important than ever for the general public to be aware. It also reinforces my experience that the world of finance seems to draw in more than its fair share of people with plenty of room for upside in their character.

Status Report, Mr Sulu

Let’s summarize the consensus view of the global economy as at right now:

Inflation is prevalent and rampant

Central banks need to act to curtail the ongoing threat of inflation

Interest rates need to rise

There is a worker shortage

There is strong demand for goods

Stock markets are making record highs

In summary, the economy is strong

If you’ve read my previous writing you’ll know that I think that what is observable on the surface is not a true reflection of what lies beneath. As usual, I’ll let data tell the story.

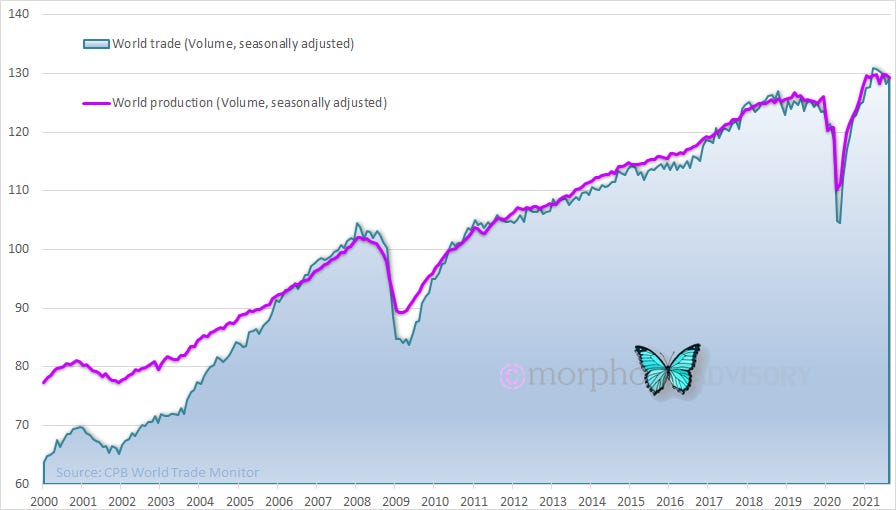

I’ve had another look at world trade data after not bothering for 3 months. Back in August it had an interesting tick down (using data up to May 2021 at that time). Now it’s had a bit of time to develop I though I’d go back and review how it’s turning out. Even though we are now in November, the data available is only up until August 2021, but that extra 3 months of data is interesting.

World trade and production volumes seem to have flattened out in 2021. This seems to be at odds with the consensus opinion of the state of the economy.

There has certainly been a bounce back after the global economy was shutdown in 2020 due to COVID-19, but where is the continuing strength - the follow through?

When you look at the annual growth rate of both world trade and production you see a pattern that is familiar to those of you that look at other economic data, such as PMIs or GDP etc.

But, that flattening in the volumes of world trade and production in 2021 as illustrated in the first chart above got me thinking. What if I looked at a 6 month growth rate instead of the traditional 12 month (annual) growth rate?

The growth in world trade volumes doesn’t look so healthy over the shorter timeframe, barely still positive from 6 months earlier.

The picture is even clearer in the world production volume data, which says that world production hadn’t grown at all over the 6 months to August 2021.

Surely, if we are in the high demand economic environment that the consensus view would have us believe then production would be growing to meet that demand, wouldn’t it? Producers would have customer orders to fill, no? Maybe it’s just a momentary pause - shorter-term data can do that, but maybe not.

Has this economic recovery with its ancillary inflation simply been a base effect compensating for last year’s global economic shutdown boosted by a shitload of stimulus? It’s possible. As I’ve suggested before, there has also been a large amount of saved travel funds that have been diverted into capital goods because travel plans have been frustrated. Additionally, there is an increasing proportion of the population that are retiring (due to the shutdown and due to demographics), which typically correlates to a spending splurge on capital goods to see people through their retirement.

I’ve called this economic recovery a false dawn before and I’m still of that opinion. I also hold to the opinion that the recovery from the COVID-19 shutdown has created a head fake - making everything seem good when in actual fact, underneath it all, the fundamentals for economic weakness remain.

Are we on the threshold of central banks making policy mistakes at the worst possible time? That would certainly be in keeping with character … but I’m not sure they even consider the economy anymore - just the markets.

Postscript

My paying subscribers are familiar with my proprietary trading model, but I thought I’d throw in a couple of charts from it here to show that it works on economic indictors and not just tradeable financial markets.

Seeing as we are looking a world trade, here are charts for the Baltic Dry Index. They suggest some alleviation in shipping pressures. Will the supply chain problem narrative persist to the same degree that it has? Maybe it’s just the seasonal year-end drop off, but it’s a pretty big season and a pretty quick drop compared to most.