I had a data visualization appear on one of my social media feeds today. It showed the changing Western Front during World War I.

I’m not much of a military buff, but I found this interesting because I had never realized that the Germans got so close to Paris in early 1918. The German’s Spring Offensive was a last ditch all-out attempt to secure a strong position and force France into seeking armistice terms before the Americans arrived.

In the process of this big advance by the Germans, they over-extended themselves and distanced themselves from their supply bases.

They did the same thing in WWII during the Battle of the Bulge in late 1944 - another last-ditch attempt to force the Western Allies into a peace treaty.

What struck me about the data visualization was the similarity to financial markets.

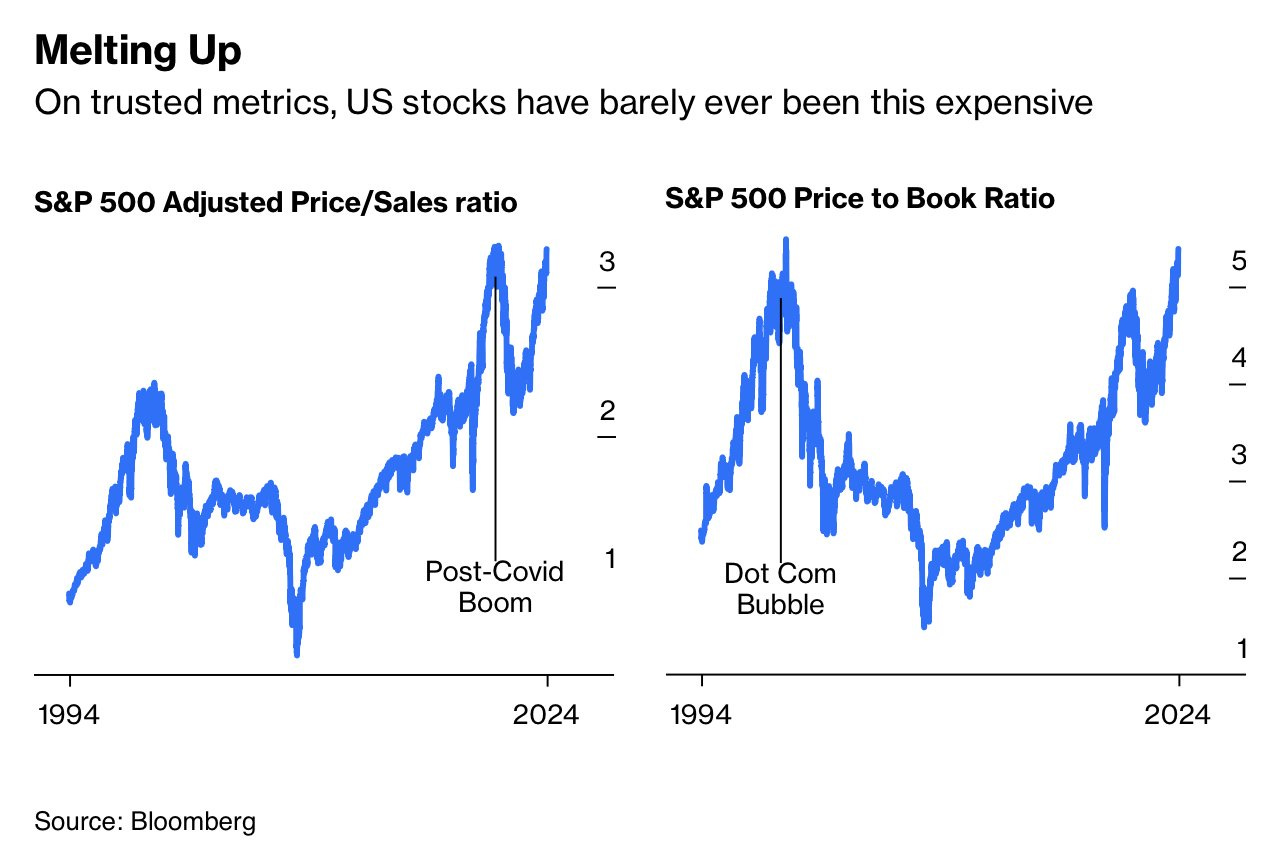

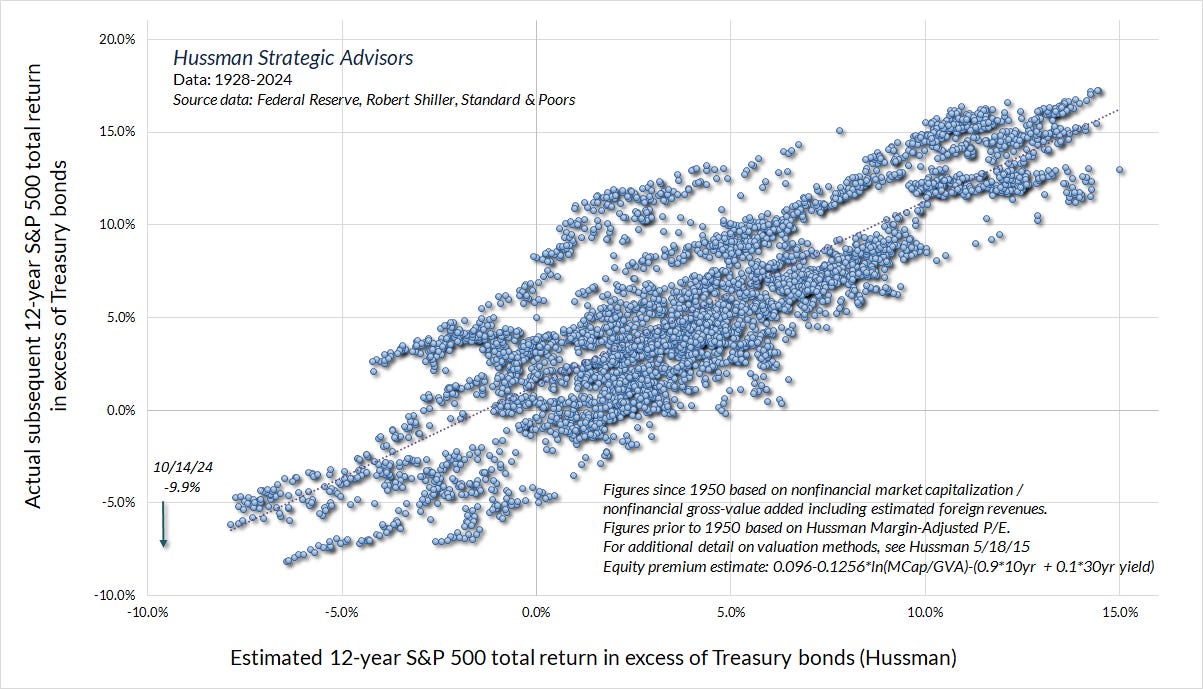

Toward the end of a bull market, we see a strong run in stock prices. A strong ‘advance’, if we are to use military terminology. With hindsight, phrases like “melt-up”, “blow-off top” or “exhaustion” are used to describe the last-ditch advance. And like strong advances late in a war, it’s often the issue of re-supply that is a key point of failure.

In a military campaign, it’s food, fuel, munitions, and replacement troops that need to be supplied to the frontlines. In markets, it’s company earnings to support the valuations being paid.

I updated my model to assess how far stock valuations have moved from their supply base (earnings). At the end of Q2 2024, the S&P 500 was 60% away from its earnings relative to interest rates. Based on today’s market valuation, it’s closer to 70%.

Psyops

And just like a military campaign, while stocks are advancing, the opposition - interest rates - are being pushed back and taking casualties. This is ironic because higher interest rates (including higher for longer) should detrimentally impact stock valuations, but the “soft landing” propaganda corps have been in full swing influencing greedy hearts and soft minds.

Interest rate volatility (MOVE Index) has been considerably higher than stock market volatility (VIX Index) for the last 2 years.

The blame on higher interest rates and interest rate volatility is being placed on the re-emergence of inflation. And now that a new generation has experienced inflation, they can’t get it out of their minds, so they believe inflation is lurking everywhere and that it will be an ever present danger. They imagine they have inflation bogeys on their six and are constantly spinning in circles to check.

In actual fact, the inflation rate has been coming down in an orderly fashion. At least, in most places around the world. However, in the U.S. they do their inflation data differently with the result that inflation has followed a jagged path lower.

At present, U.S. inflation is at the top of one of its zags (or is that a zig?) and interest rates are following suit.

If we look at U.S. inflation compared to the percentage change in the price of oil (scaled down and advanced by 6 months), we see a correlation that suggests there is lower inflation ahead for the U.S.

But one-quarter of the U.S. inflation rate is made up by Owner Equivalent Rent (a measure of housing costs [shelter]). That’s a lagging input which is holding the U.S. inflation rate up. Owner Equivalent Rent follows the path of the change in the value of house prices by approximately 16 months. And that also suggests a lower inflation rate ahead.

So, it appears that interest rates have their supply lines secured while stocks don’t.

Military Intel

Here’s some more satellite images of the state of the stock market’s supply line:

Strategy is a long game. Tactics, too, can seem to take an age, especially when you’re on the front line. Current tactics are primarily waiting for the stock market to use up all its ammunition, run out of food, and run out of replacement buyers.

Certainly the stock valuations for small businesses are running out of supplies. Their earnings don’t support current valuations being close to all-time-highs.

And that is not a comforting piece of data for the supply of new recruits. On the contrary, it suggests fewer people will be signing up to serve their stock market and deliver the earnings that will support it.