Groupthink

The essence of financial markets as a complex system

This last week, I was asked if I could provide a single source that gave a sense of my complexity framework for financial markets and the economy. I couldn’t. So I’m rectifying that here and attempting to bring all the parts I’ve accumulated along the way together and summarize my system.

I’m no academic - I prefer the real-world - but I do think conceptually. I will attempt to insert some academic words, so that those with more knowledge on the matter may get an idea of what I’m trying to convey.

What are complexity theory, dynamical systems, complex systems etc.?

I’m no expert, I simply have some small grasp on the subject - enough to know that I believe that markets and economics are this type of system, and that my trading algorithm is evidence of this being the case in fact.

Here’s a cut and paste of short definitions:

It turns out that my trading algorithm is a dynamical system. Furthermore, it captures the nonlinear dynamics and self-organizing collective behavior of humans stemming from my observations of layered patterns of unconscious behaviors. It also displays self-similarity (which I often refer to as “fractal”) in that my algorithm scales over variable time frames and periodicity.

I’ll use the above terms and some of the words in the above definitions to describe my framework. I may get them out of place, but I hope you can understand what I mean.

Play the ball, not the man

In football (“soccer” for our American friends), there’s a saying, “Play the ball, not the man”. It can be used in various situations, like tackling a player inside the penalty box (make sure you get the ball and don’t give away a penalty), and also not getting thrown off-balance by players doing fancy step-overs or other ‘dummy’ moves (watch where the ball is going, not the fancy and distracting body movements).

In the realm of financial markets and economics however - especially within the context of complexity, the opposite is true (if you want the best results). Watch the collective ‘man’.

Humans. I have been one all my life, and I have also been a people watcher from my earliest years, plus I’m someone who has been very much aware of their inner process for as long as I can remember. This is the starting point of my understanding and my process, and even my trading model and the algorithm that makes it work.

Humans are “social” beings. During their formative years, they have no developed sense of their own value system. Because of this, they take on the value system of the collective society around them. Furthermore, most humans never grow up and develop their own value system, they just continue to accept the one they have absorbed.

“Isn’t it funny how you’re always born into the right God” - Ricky Gervais

Being “social” by nature, humans generally avoid doing or saying things that would put them at odds with socially normative behavior and beliefs for fear of ostracism (hence individuals not developing their own value system - too risky because it comes at a social cost). I could go further, but let’s keep it close to the topic of financial markets.

Having sat on investment committees for years (decades even), I know that the professional financial fraternity have their own version of this social behavior. “We don’t want to take a position that, if we’re wrong, we end up as the worst performing fund”, is common thinking that keeps asset managers close to the pack.

This is where my personal value system ran up against the orthodoxy of the institutional investment industry and I chose to go it alone. Institutions want to huddle in conformity and grow via sales and marketing and clipping the ticket on the long-term upward growth of markets and its impact on the total funds under management. I wanted to improve the service offering in an industry that doesn’t want anything but the status quo. Seriously, for the most part, institutional asset managers are not looking to develop new innovations or breakthroughs to gain an edge or enhance their service, which is why the 60/40 portfolio of Modern Portfolio Theory (developed in 1952) remains the primary investment vehicle of today. What other ‘sciences’ are still stuck in 1952?

Essentially, asset management has been a gravy train and only the rise of passive investing and the race to zero fees has been the major development to challenge this, but even then there are intermediaries that package the zero fee funds and on-sell them at a mark-up to the investing public.

In the realm of asset management, new ideas are like a circling predator around a school of fish - something to be feared.

Further proof of financial groupthink

Personally, I think acceptance of my work should be both immediate and obvious. The charts speak for themselves in terms of efficacy (choose almost any security and any time frame and I’ll show you context and any impending phase transition) I have presented them in real-time over multiple time horizons across a wide range of assets and asset classes, and still I get very little response. What I have developed is so groundbreaking and so obvious to a trained eye that it should stop professionals in their tracks and have them clambering to know more and use my system. But no. Why not?

Cluster thinking.

As I said above, humans as social beings don’t think for themselves - even the professional ones. They want to know what others think first. They’ll only invest if others are investing. They’ll be swayed by the perceptions shaped by endorsement of a brand name institution. They’ll let the financial media shape their opinion. I lack credentials (no fund, no investors, no Wall St firm on my CV, no published work or brand name academic institution etc.) to give credibility and endorsement that would cover someone’s ass if they were ever questioned. This human behavior is why marketing works, making people throw money at brands that are supposed to elevate the perception that others have of them etc.

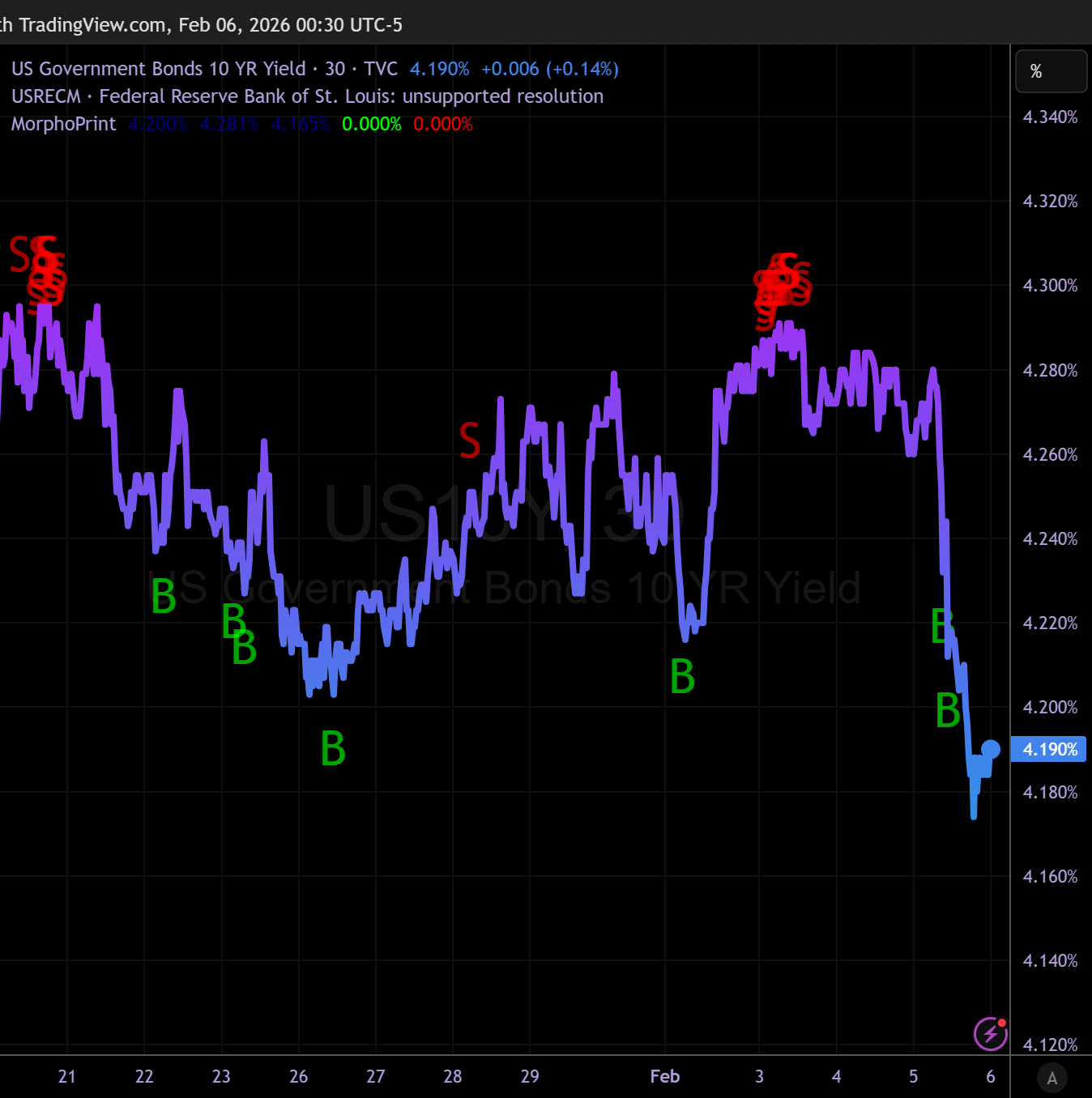

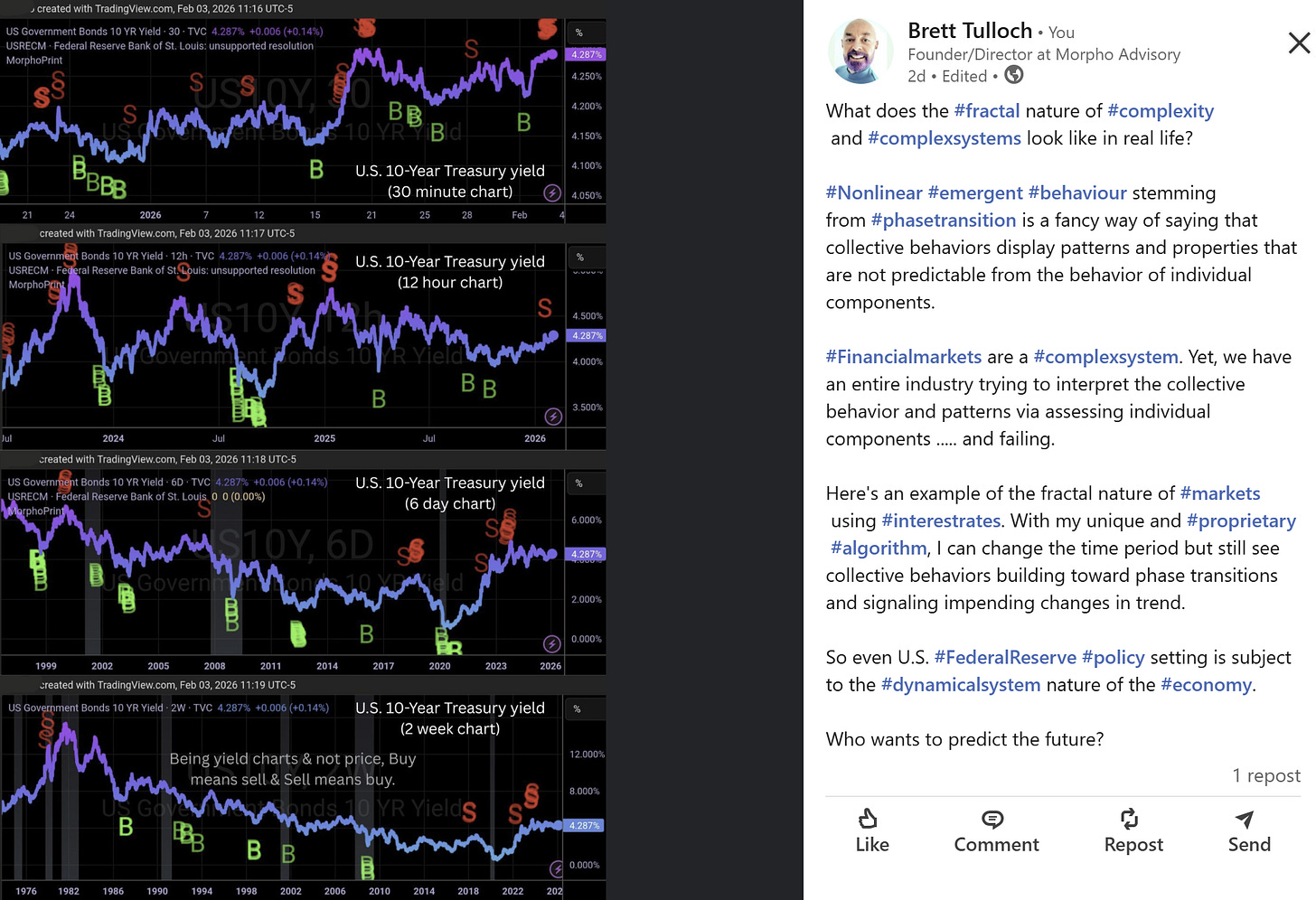

Incidentally, here’s an update on that 30-minute U.S. 10-Year Treasury chart shown at the top of the image above.

That’s another excellent signal from my algorithm.

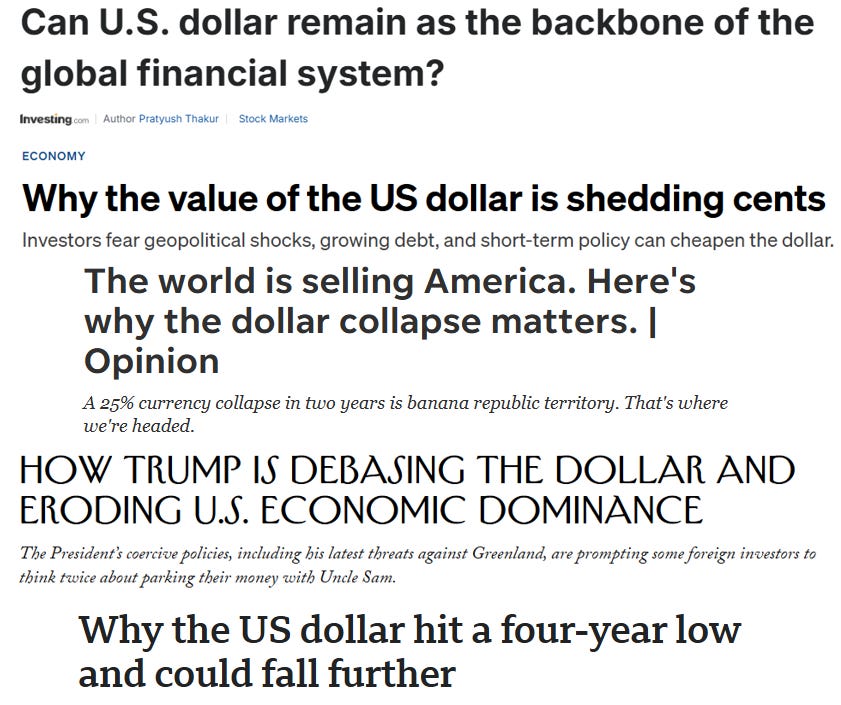

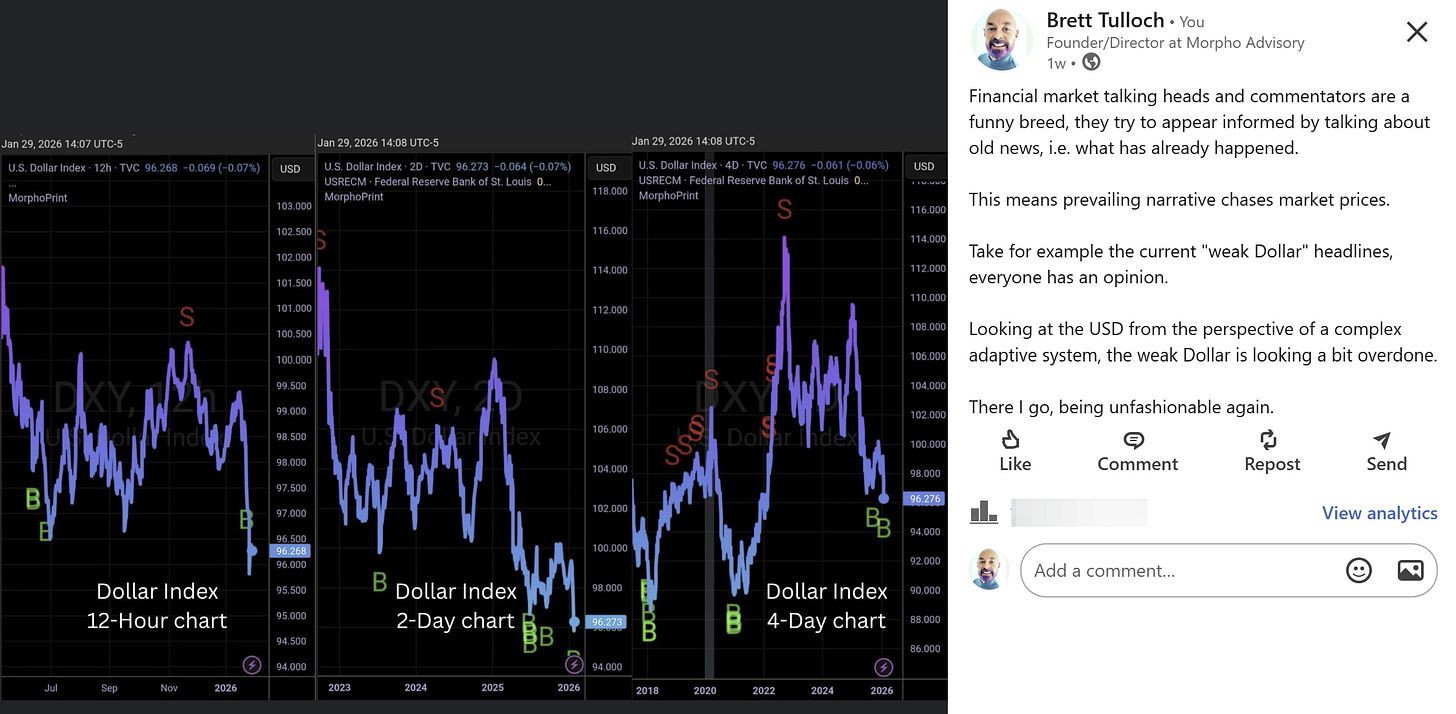

Here’s a recent example of how the professionals think (financial media and asset managers). The U.S. Dollar was going to Hell in late-January 2026.

At the time and just for fun I decided to juxtapose the cluster thinking wave of news headlines, social media comments, and general sense of panic with my dynamical system trading model in order to gain objectivity.

As I stated then, I say again: “Prevailing narrative chases market prices”. It doesn’t apply any forward thought, it is reactionary and follows, which is why groupthink fails as an investment methodology to add value. But it remains industry standard.

Here’s an updated chart. It appears the Dollar bounced. Who would’ve guessed?

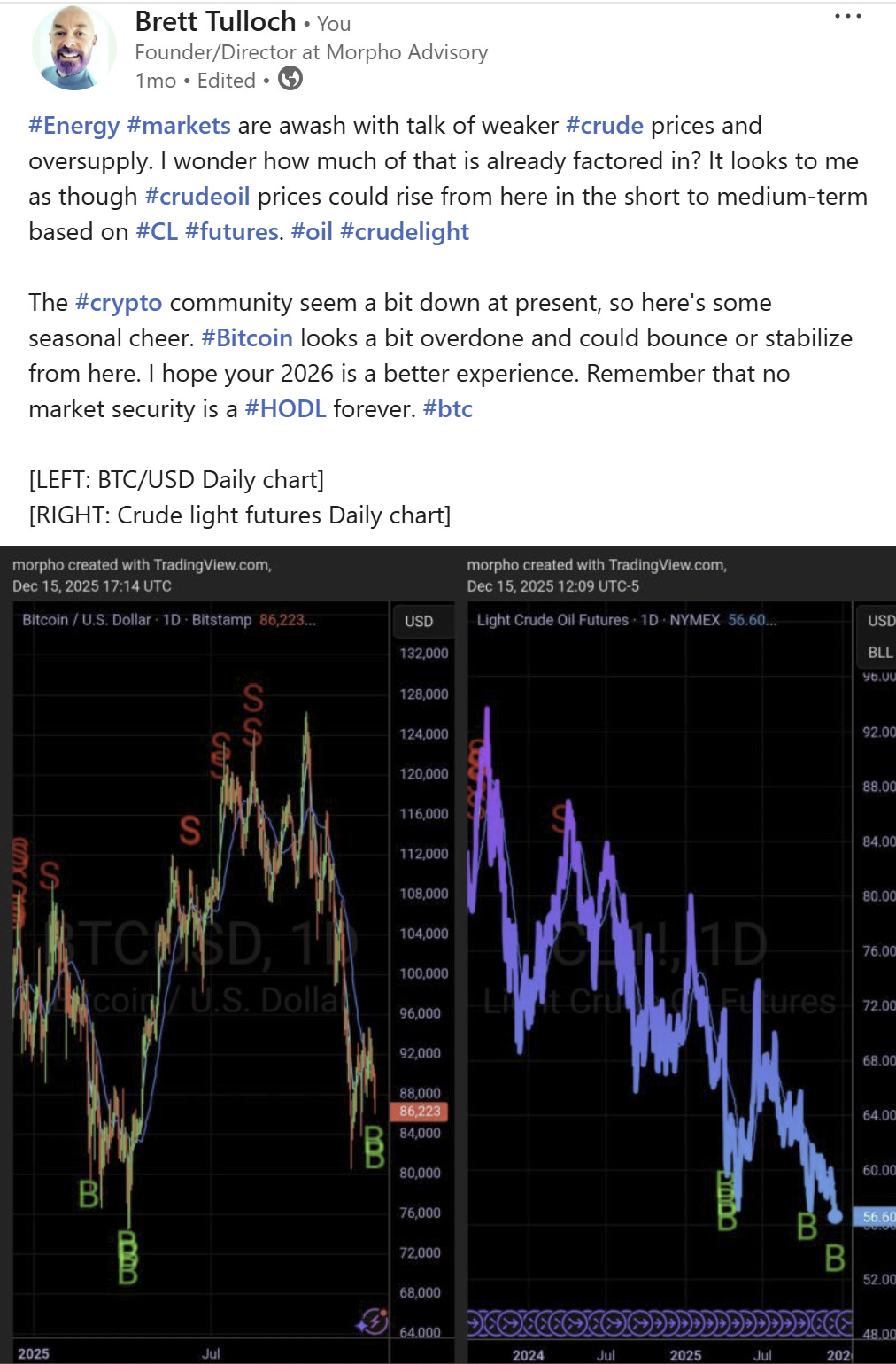

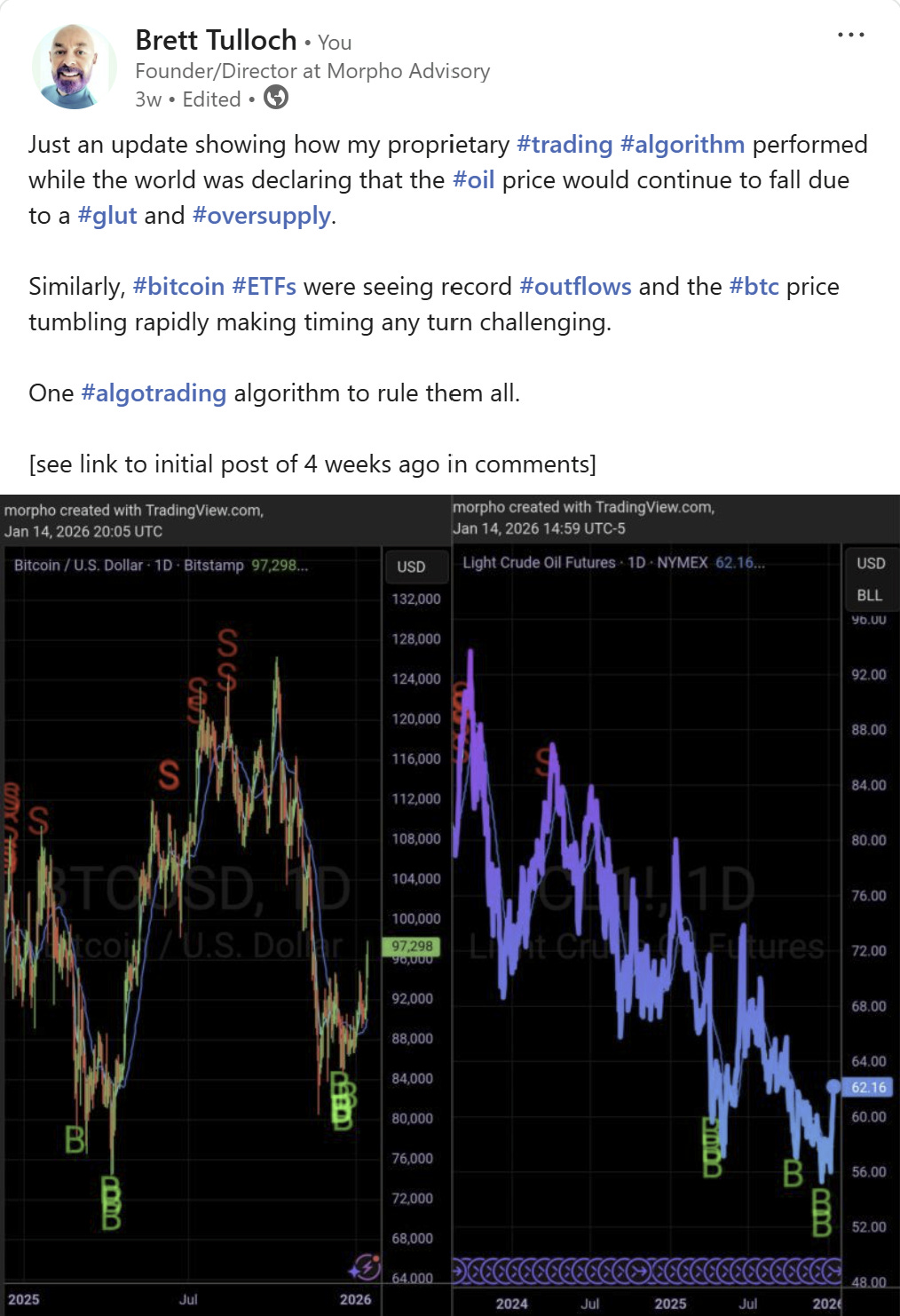

Here’s another example using crude oil. In late 2025, the headlines relating to crude oil were all about oversupply and the oil glut.

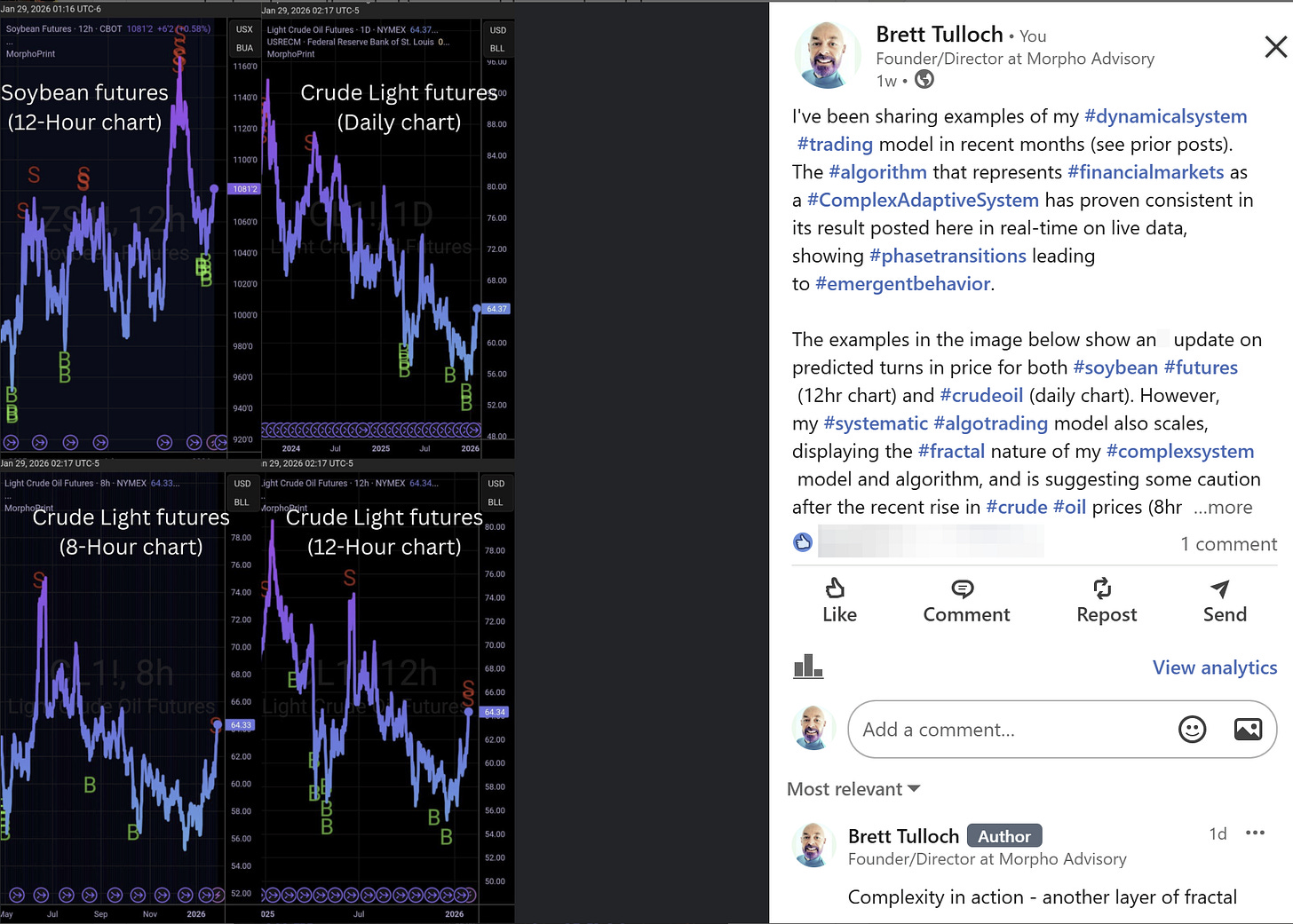

I posted a number of responses to this outlook, including multiple updates - just to show how my complex adaptive system methodology accurately captures the behavior of financial markets.

Here’s a sequence of posts in date order:

I point out that I know nothing about oil markets and haven’t been involved in currency markets actively for some time (other than hedging cross-currency exposures). I also haven’t been a dedicated fixed income portfolio manager for almost 10-years.

I have no knowledge of crypto to speak of nor soybean futures, yet I have used my complex adaptive system algorithm to identifying phase transitions and emergent behavior (turning points in price and new trends), just as I have in equity markets and equity market volatility.

The common link is that economics and financial markets are human activities, and humans display their collective unconsciousness alongside their individual rational decision-making.

We have long referred to “fear and greed” in financial markets and investing, and that’s close to the mark. Humans don’t understand themselves let alone themselves in relation to the collective. Emotions are reactive and irrational, social behaviors are unconscious.

I have observed the collective unconscious and I have encoded it. The results speak for themselves.