In an attempt to get my head in the game (a-la Troy Bolton) post-holiday, I’ve been scanning data and other sources to get an update on the underlying picture (in the unlikely event that things had changed in such a short space of time).

I’ve been saying for a couple of years that the global economy is weak generally, and the U.S. economy is weak, more specifically. That tends to be a side-effect of monetary policy tightening cycles.

Anecdotally, people everywhere are feeling the pinch that higher interest rates (directly or indirectly) are having, yet the headline data portrays the U.S. as having a strong and healthy economy.

Why do I say the U.S. economy is weak?

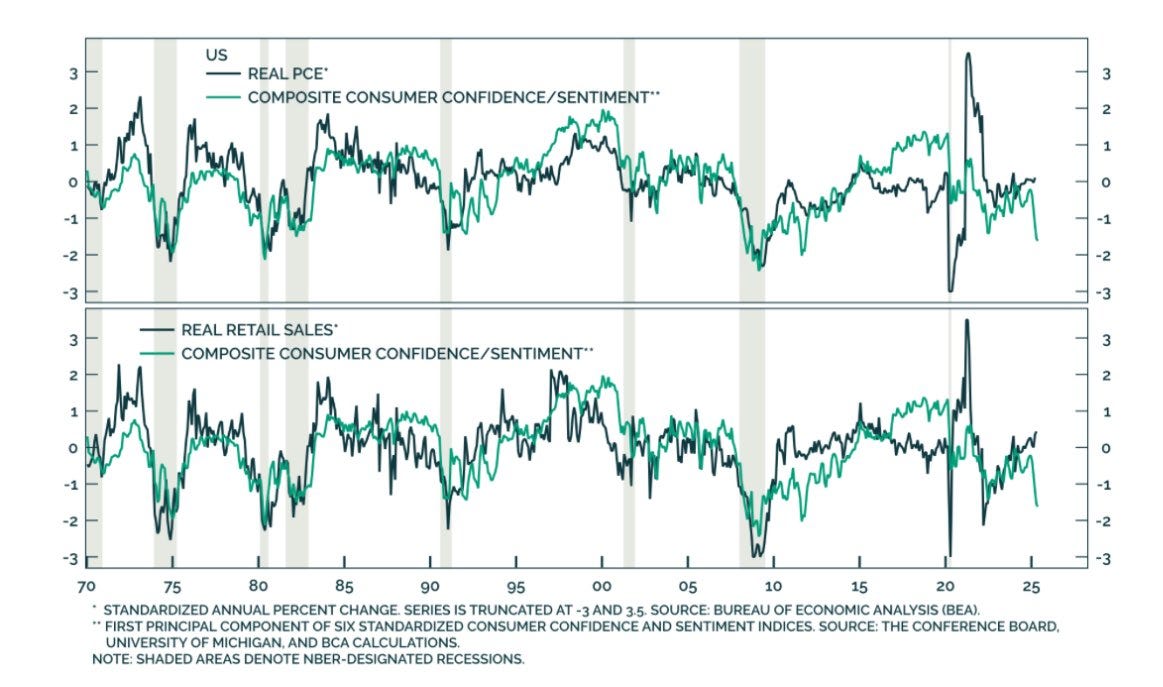

High inflation followed by high interest rates are squeezing household budgets with the result that the consumer is in the toilet (i.e. not in a good position financially). Their confidence is down, and when confidence is down, they cut back on spending.

The consumer feels squeezed between expectations of lower income …

… and lower job security …

At present, the U.S. consumer has rarely felt so low.

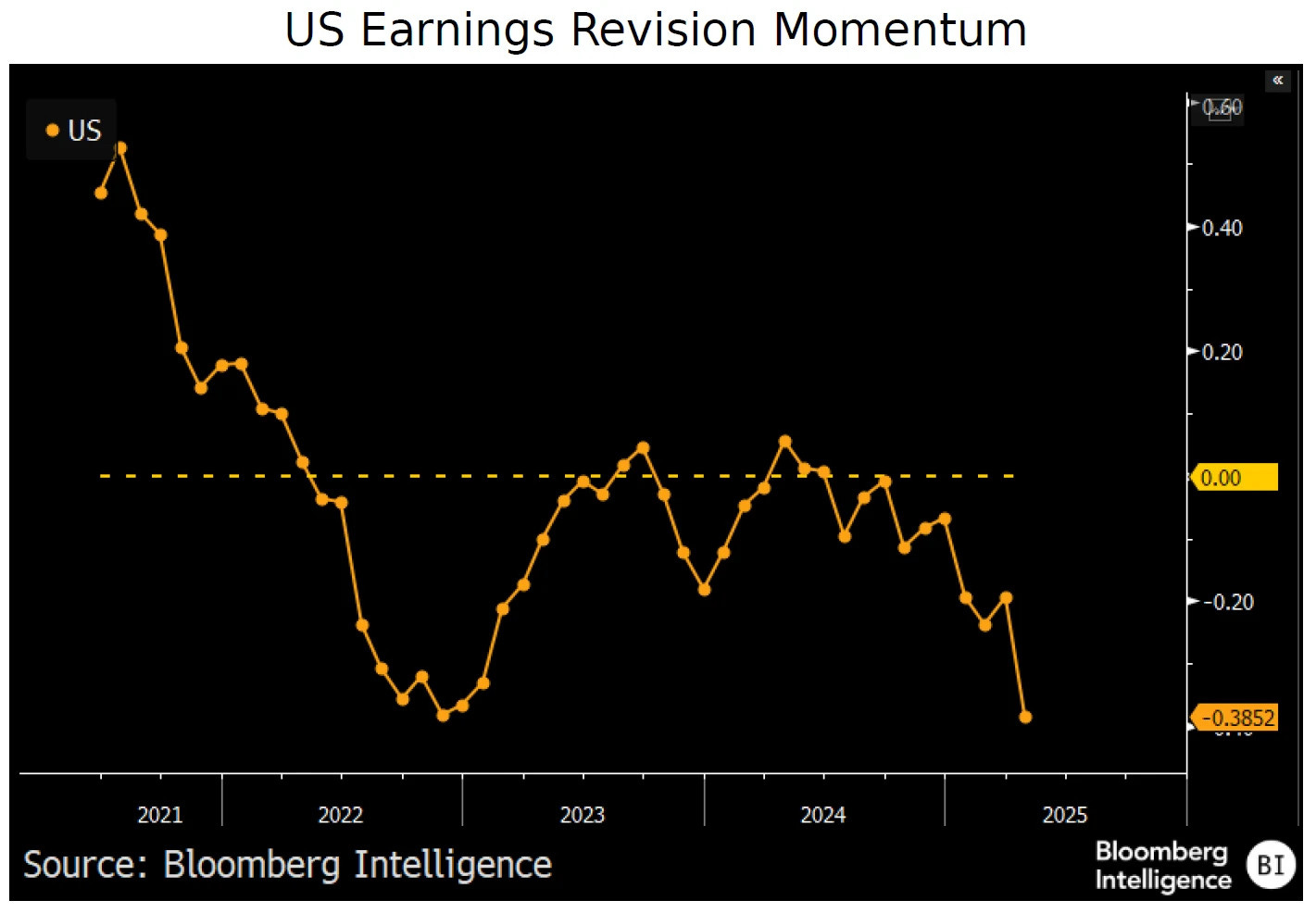

And when households cut back their spending, so too do companies …

But with inflation being slow to fall in the U.S. (mostly because of how the U.S. incorporates the largest component of their CPI - housing & accommodation, which has a long lag) and now with rising risks of additional inflation due to tariffs, which are supposedly one-off, but if it becomes tit for tat, then who knows?, so erring on the side of caution rather than “looking through”, the U.S. Federal Reserve is holding rates at elevated levels.

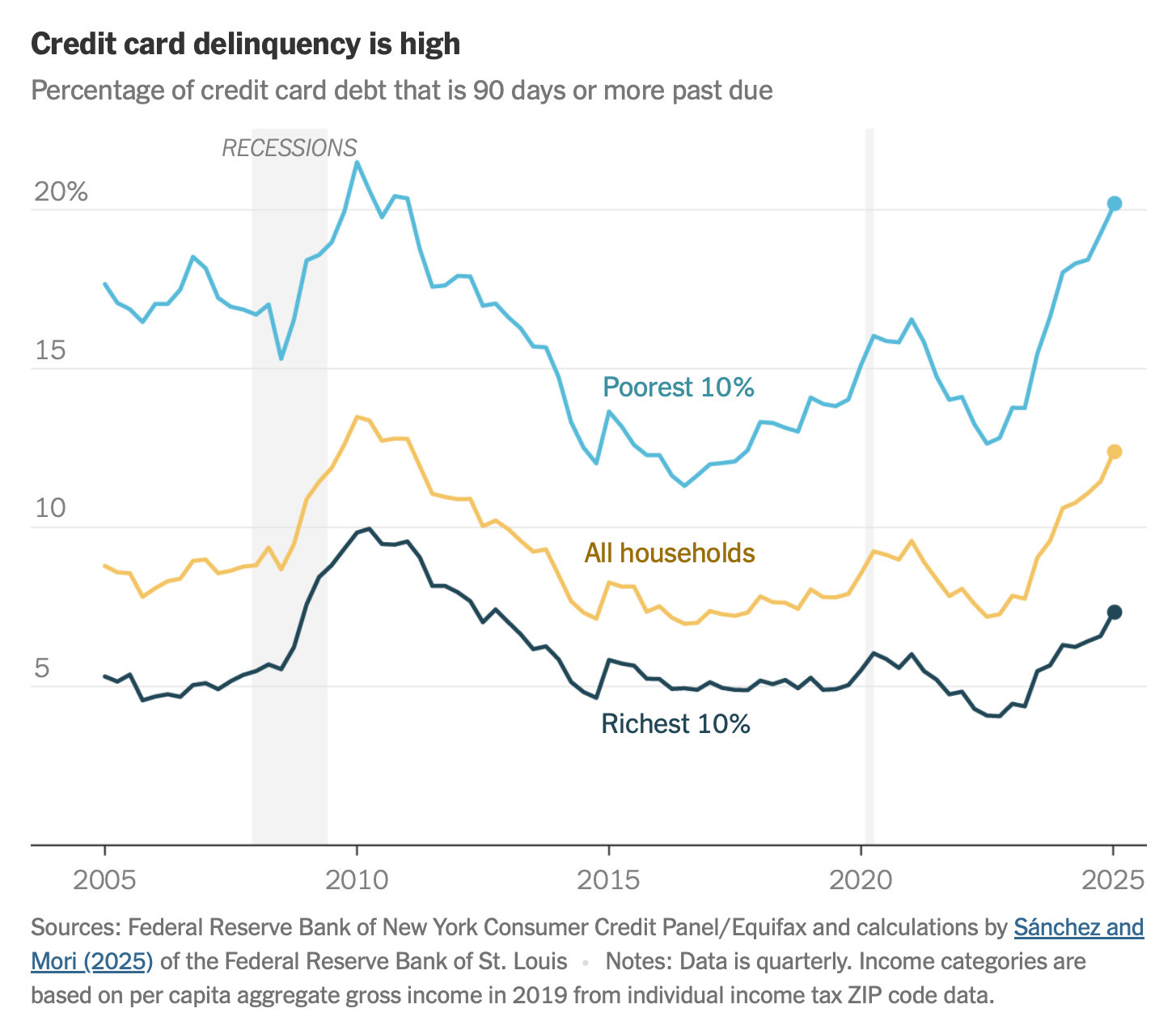

The longer rates stay up, the more people get squeezed. They begin to default on their credit card repayments …

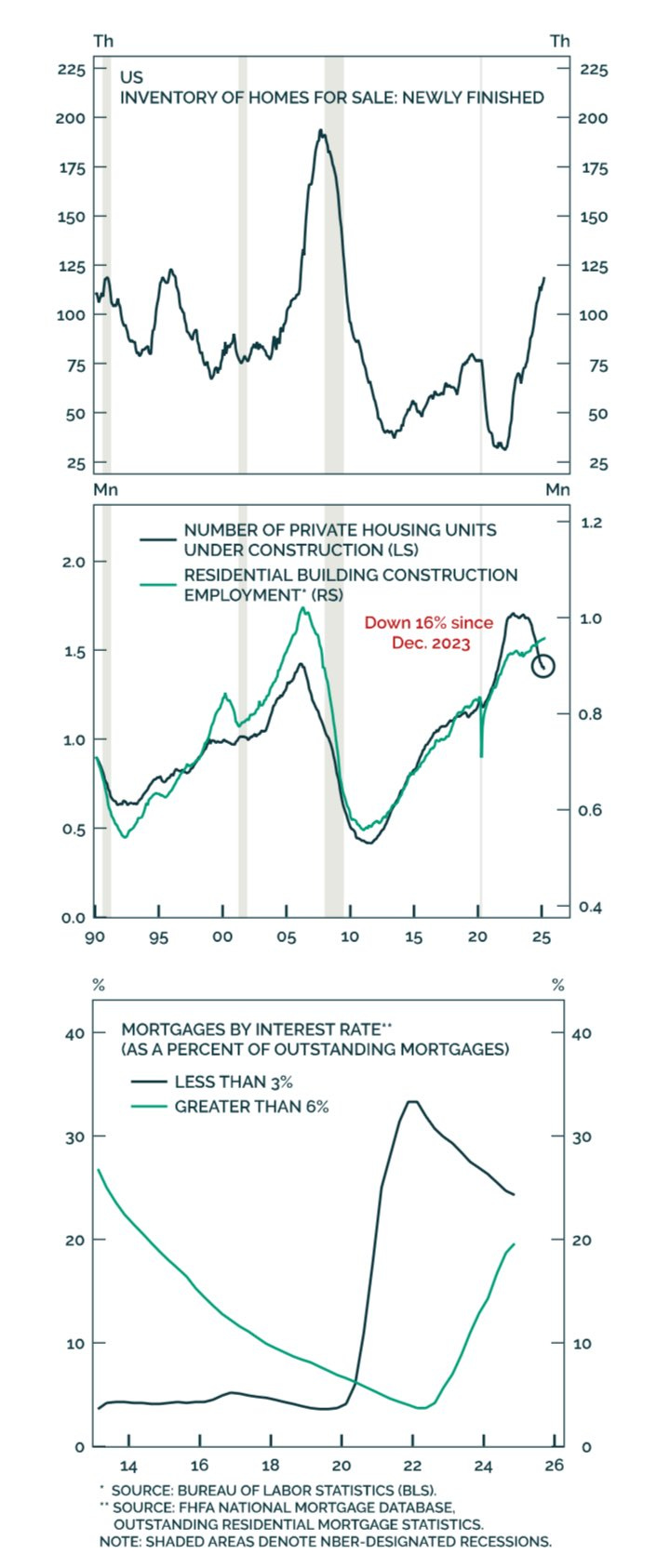

… which forces households to refinance their mortgage, but that exposes them to the large jump in mortgage rates that has occurred …

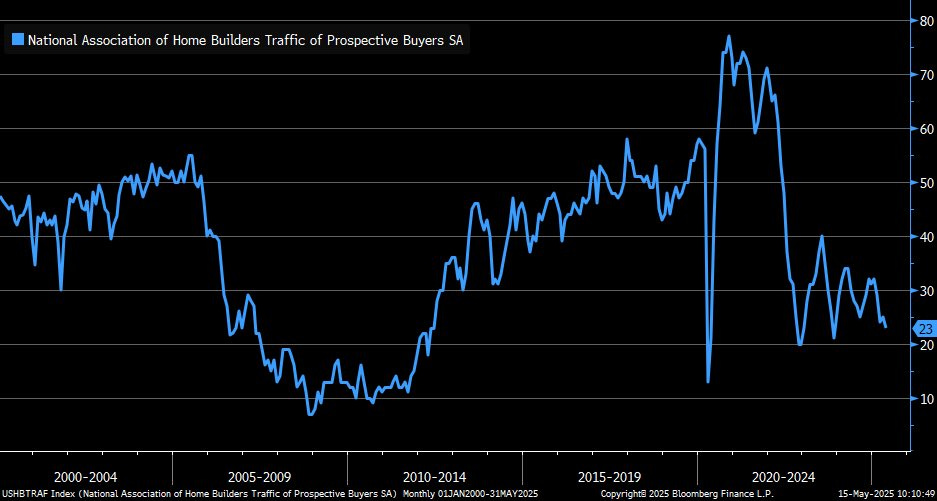

… and those high mortgage interest rates explain why there has been a slowdown in housing construction and an increase in housing stock that is not selling …

Who can afford a house when listing prices are still at high levels even though the cost of financing a house has doubled or tripled?

That expensive cost of money has put a pause on the economy, globally as well as in the U.S. In fact, conditions have been poor for the last 2 years or more.

What would make the headline data in the U.S. say otherwise?

However, the U.S. has shown economic growth superior to the rest of the world over the last 2 years.

Why?

Think about how GDP is calculated. It’s the sum total of every transaction in the economy (including inventory produced). In order to make GDP grow, people can either spend more, or you can increase the number of people spending.

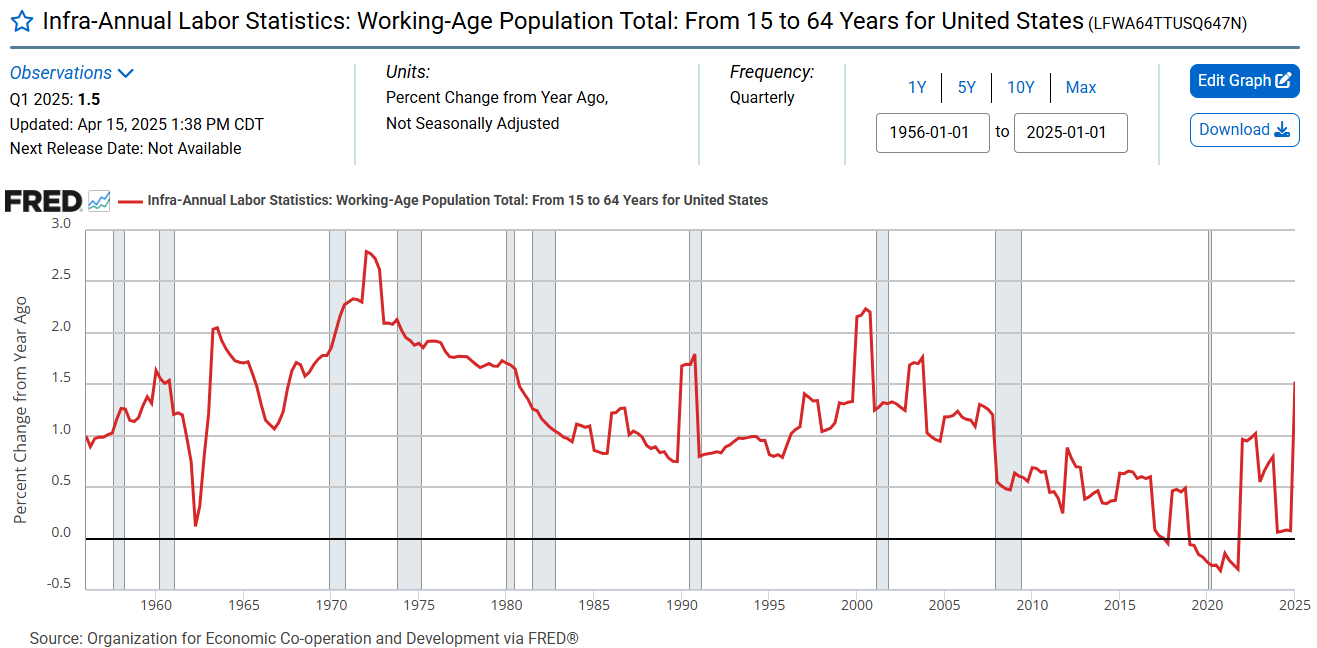

For the last several years, while the world has been experiencing a rapidly aging population …

… the U.S. has experienced an explosion of migrants …

Millions of people have been added to the U.S. economy, reversing the downtrend in working-age population growth.

Will it last?

I was fortunate enough to have just been in the U.S. on holiday just last month, and this is what I observed: the U.S. is not a service economy. What I mean by that is, the U.S. that I experienced doesn’t see service as quality-related, their idea of service seems to be more quantity-related (i.e. more options). Quality of service is where a person sees what needs doing and addresses that need in a manner that makes the recipient of the service feel valued. The U.S. seems to be dominated by large corporations and the ability to provide service is very proscriptive, i.e. staff have no latitude, they just follow a process. At times, I felt like I was talking to machines who were treating me as a transaction by which they would be measured … except when I was dealing with Mexicans (or whatever nationality they were - central/south American). These were the people in service roles in the hospitality industry that had a greater ‘human’ aspect to their service (and they were in the majority when I was in the southern part of my holiday), which was genuine and friendly, and they were diligent and willing to do the hard and often menial work (I saw a front of house hotel employee who assisted me with check-in also mopping floors later on). Undoubtedly, they are also cheap labor.

I mentioned my observation to a friend who happens to be a regional representative of a U.S. company and it caught his attention. He told me that he had recently had a conversation with the CEO of the U.S. company he represents across Asia. He asked the CEO what the biggest concern was of the various parties involved in the business and industry. Surprisingly, it wasn’t tariffs, despite being an exporting business. It was ICE (Immigration and Customs Enforcement). These people were afraid their business would be raided by ICE. If ICE takes away their workforce, then they couldn’t survive. The CEO said that U.S. citizens wouldn’t do the work, and certainly not at an economic price, but it wasn’t just a matter of money. They wouldn’t do it at any price because U.S. workers won’t do dirty jobs, he said. This is a CEO of a fairly substantial organization repeating what the key players in his industry tell him.

So, if mass deportations continue, they could be killing the golden goose that has made America great for the last couple of years. Maybe this town ain’t big enough for more than one golden goose?

Price price baby

I was looking at the S&P 500 the other day and I observed how quickly the market has bounced back from “Liberation Day”. It’s true that I said in mid/late-March the market needed a second leg down and a lot more fear before we’d get a big bounce, and that is what happened.