And another month slips by.

I took myself away for an urgently needed road trip these last 2 weeks. If you look back through my back catalogue you’ll see I do it around this time each year. This time was another motorcycle tour here in NZ, where I visited the central North Island to do a few walks and hikes in native forest and in the vicinity of a few mountains.

However, I’m now back and the work environment demands attention, so I thought I better see what has been happening and get up to speed (yes, I did check markets periodically while away).

We’re at that point in the cycle where there really are only a few things that need to be followed, which are:

economic activity;

employment; and

sentiment.

Actually, these things are fairly consistent across the cycle, but because I’ve been refining my process, I can get a good overall feel just from these metrics … with the occasional input from other variables. Less is more when it comes to getting clear insight.

Economic activity

The ISM Manufacturing Index (ISM) came out better than expected a few days ago - it was even above 50, which means an expansion in activity compared to the prior month. The market liked this. It is worth noting however, that at 50.3, the expansion was barely breakeven compared to the previous month. This was the first expansionary reading for the ISM in 16 months and it essentially meant that activity went basically sideways from the month before.

As you know, I’ve created an aggregated model of economic activity using multiple regional indices like the ISM. Even with the positive ISM number, my aggregated PMI index remains in contractionary territory (below 50), and has been so for 18 months. That means across the USA, for 18 consecutive months, economic activity has been contracting when compared to the prior month.

Employment

Employment is getting tighter, as expected.

Job openings (the availability of work) are continuing to contract.

On top of there being less jobs available, layoffs are increasing.

The Challenger Job Cuts report only covers large-scale job cuts (i.e. those affecting 50 or more workers) and does not include smaller-scale layoffs or job cuts in the public sector.

The narrative that goes with the report is interesting, too. Companies that make these layoffs give their rationale for the layoffs. In January, it was mostly “restructuring”. In February, it was mostly “restructuring” followed by “closures” of plant or stores, then followed by “cost-cutting”. In March, it’s mostly “cost-cutting” followed by “restructuring”. This is ‘corporate speak’, i.e. the window dressing. This progression shows that despite the “restructuring” line still being heavily used (i.e. the company trying to present itself as dynamic with the layoffs being needed to position itself better for the future), there is little point in pretending anymore and “cost-cutting” is now cited openly with the blame being put on economic and market conditions.

Sentiment

Markets remain divorced from economic reality.

The American Association of Individual Investors (AAII) investor sentiment continues to party on.

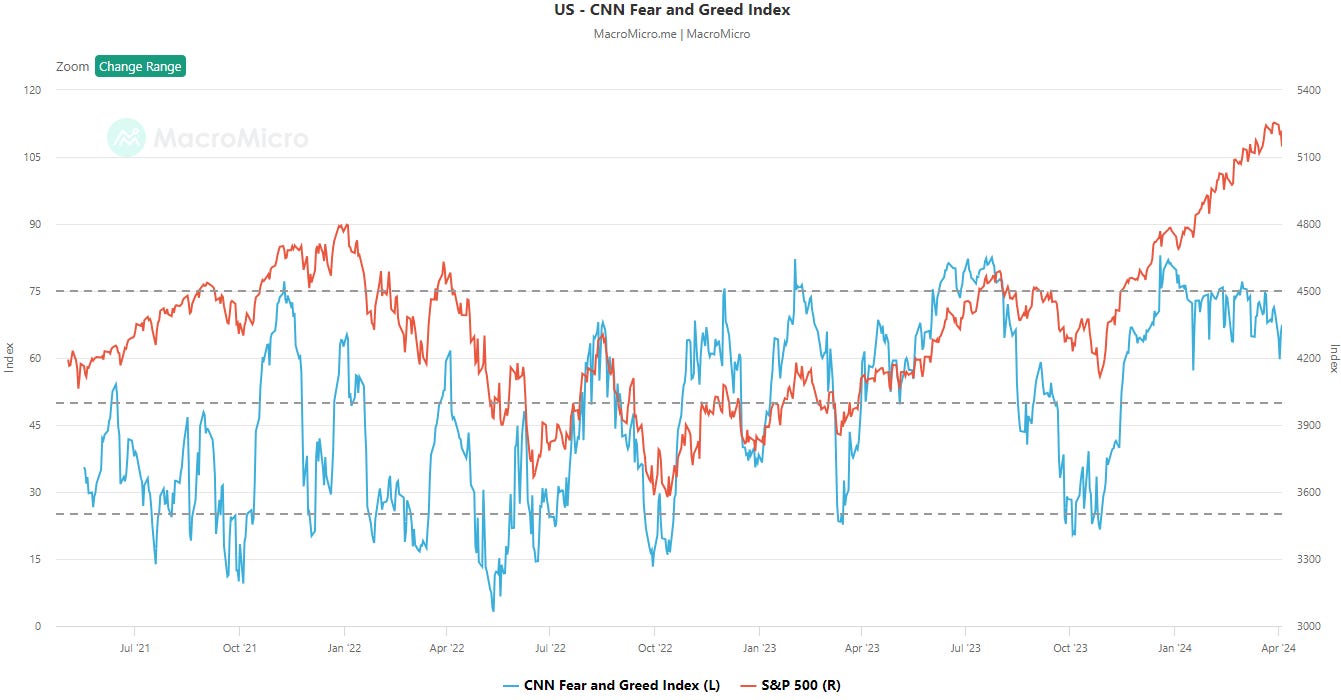

Before last night’s small drop in the S&P 500 Index, the CNN Fear and Greed Index had been sitting in the GREED zone since 15 November 2023. That must be a record for running without taking a breath.

In summary

… nothing has changed.

A while back I described the change in markets over my almost 35 years of being involved, and used the analogy of clothing styles. Before the advent of the internet and the disintermediation it brought, markets fit the economy like clothes - the form and function of the human body (economy) is reflected in the attire (markets).

But the internet let anybody join in on the trading gig, and markets got noisier. Subsequently, the fit of the markets to the economy has become like the “sagging” style of the time.

This is due to most market participants - many professionals included - not appreciating that the market is a place of exchange of securities (capital), commodities and financial instruments used in commerce, which is a fancy way of saying supply & demand meeting valuation of cash flows and the cost of capital.

Speculators are playing in the economy, but only see price and don’t realize what is behind the price.

Going back to my clothing analogy, today’s market is more akin to the renowned NZ international design competition called the World of Wearable Arts (WOW). Using the human body as a blank canvas, designers create works of wearable art to be exhibited in the annual awards show.

Essentially, today’s market barely fits the economy at all and certainly holds no practicality in terms of functional clothing.