One thing drives another out

“Well, now, what was I going to say?” said Mr. Butterbur, tapping his forehead. “One thing drives out another, so to speak. I’m that busy tonight, my head is going round.

- Barliman Butterbur (The Fellowship of the Ring, Chapter IV, “A Knife In The Dark”)

Financial markets are very much like the forgetful proprietor of the Prancing Pony inn at Bree who allowed busyness to distract him from delivering an important message.

It is because of this that I like to step back and observe the process rather than get caught up in the multiplicity of isolated details. That’s where my compatriot market strategists with their orthodox neoclassical economic training go awry, as I alluded to in my last post. Their training is based on a theory of supply and demand finding points of equilibrium. By contrast, I believe that in the real world, economics is a dynamical system, never finding equilibrium but in constant motion.

If you’re interested in understanding the difference between neoclassical economics and dynamical systems, here’s a link to economist, Professor Steve Keen’s, YouTube channel. He’s a bit scathing of economics as it is currently taught and applied. His take reminds me a bit of former Governor of the Bank of England, Mervyn King, who once quipped that the way central banks operate is, if there is a difference between what’s happening in the economy and what the central bank's models are saying, then it’s the economy that’s wrong and needs to change.Seeing as I mentioned my last post in which I referred to one party in particular applying their neoclassical approach to come up with an orthodox interpretation of current economic conditions, let’s have another look at it. Goldman Sachs (GS) think that the economy has found a point of equilibrium. But looking at some of their own work through the lens of an economy in continual motion (i.e. a complex system), their own data reinforces my interpretation.

GS produced this chart of Investment Grade Interest Cover Ratios, which shows that companies are experiencing some combination of higher interest payments and falling revenue, i.e. margin compression …. in plain English, that means less profit.

I’ve taken the liberty of extending the current trend in the Interest Cover Ratio (adding a freehand purple line) because the Fed is yet to start reducing interest rates (they start next week) and it will likely be a year or more until they’ve finished, which suggests the easing of current financial pressures will take time to flow through to both consumers and businesses. And that means businesses will have to take matters into their own hands to shore up their weakening outlook for profits.

Recent data releases that have captured the market’s attention have been around inflation and employment numbers, and recent numbers weren’t too bad. This has been the one thing that has driven another out, so let’s step back and put it all together in context.

The economy was weak a year or more ago, but then seemed to recover somewhat, as indicated by multiple manufacturing PMIs. However, recently things have turned down again.

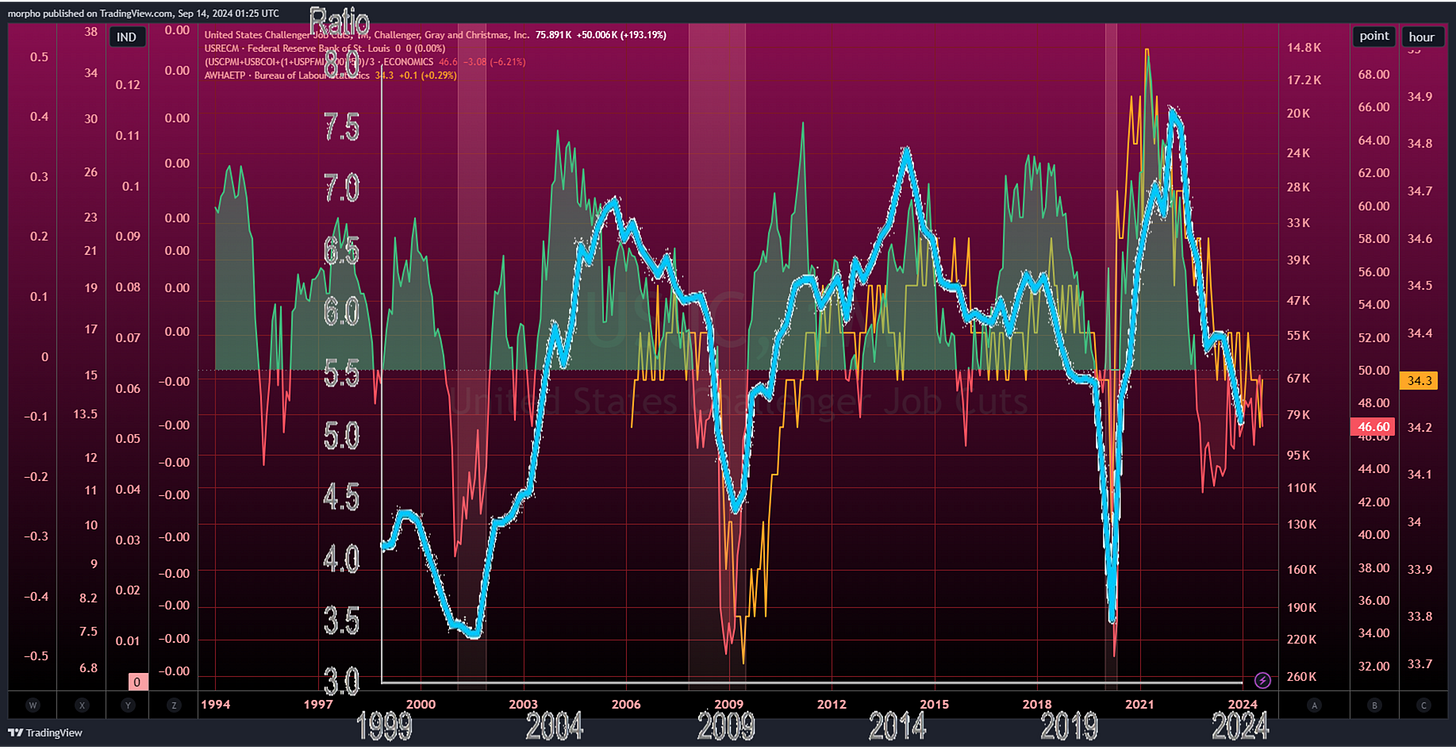

From the end of last year, unemployment began to rise, but not rapidly. However, in the early stage of economic slowdowns, employers prefer to reduce their employees hours. And that is especially the case given how hard it was for businesses to find skilled workers only a couple of years ago (i.e. don’t be in a rush to dump staff that might be hard to get back again).

The trend in reduced hours worked by all private sector employees aligns with what the manufacturing sector is experiencing.

Now, if we add the GS data on investment grade Interest Cover Ratios ….

Here we see the same cyclical themes playing out, i.e. a slowdown that’s just gaining momentum. The corporate and household interest cost reduction will be slow to come as the Fed measure their rate cuts and, in the meantime, I suspect corporate revenues will also see reduced growth, compounding the problem.

In short, everything is doing pretty much as expected and is still on track for the hard landing I’ve been expecting.

Well, flux me!

It’s not each data point per se, it’s the pattern of incentives and behavior. And that brings me to an observation: often those who are specialists fall into the trap of believing that their field belongs to them, e.g. theologians believing that they are rulers of their religion; or economists & central bankers believing that the economy is theirs; or politicians and other elected officials believing they control society. All are wrong. Religions belong to their devotees; the economy belong to all those who transact in it; and elected officials serve their constituents. In other words, it all belongs to “the people”. The specialists play their role in their respective field, but they are only a part of a much larger whole though their work may place them closer to the action on a day-to-day basis.

I analyze the ebb and flow of “the people” in the economy - the dynamical system approach for a complex system. “The people” are the ones who determine what happens and whether there are recessions. It’s their behavior that counts. Observing the specialists and their institutions, and listening to their interpretations that they come up with by talking amongst themselves, removes us from the real world.

The irony is that “the people” look to the specialists for answers and the specialists are supposed to have some because they are supposed to observe “the people”, but they don’t because they are too busy observing themselves.