High inflation and rising interest rates have had an impact on everyone by now. We have all adjusted, and many have been protected to some extent by having fixed borrowing costs. However, when it comes to economic recessions, it is usually via indirect exposure that the reality of recession is ultimately brought home to us.

How is your employer doing in terms of their profitability?

Corporate earnings growth has been falling since the post-Covid boom of 2020/2021. Undoubtedly, this is largely due to the impact of high inflation.

Certainly, freight volumes have been down and the inflation-adjusted revenue associated with theses freight volumes has fallen to a greater extent.

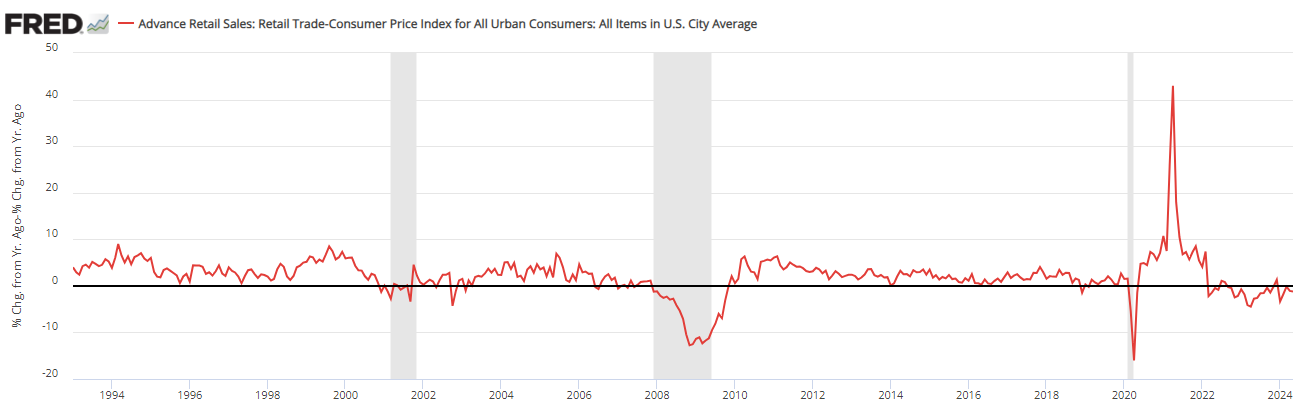

Real retail sales (i.e. inflation-adjusted) growth has fallen for the last 2 years.

Because I have used inflation-adjusted numbers, that captures the cost increases incurred by corporations and the price increases they have passed on to customers to protect their profit margin. The net impact is reflected in profitability growth, which suggests profit growth has stalled if not fallen slightly.

Yet, there is another risk at play in the background.

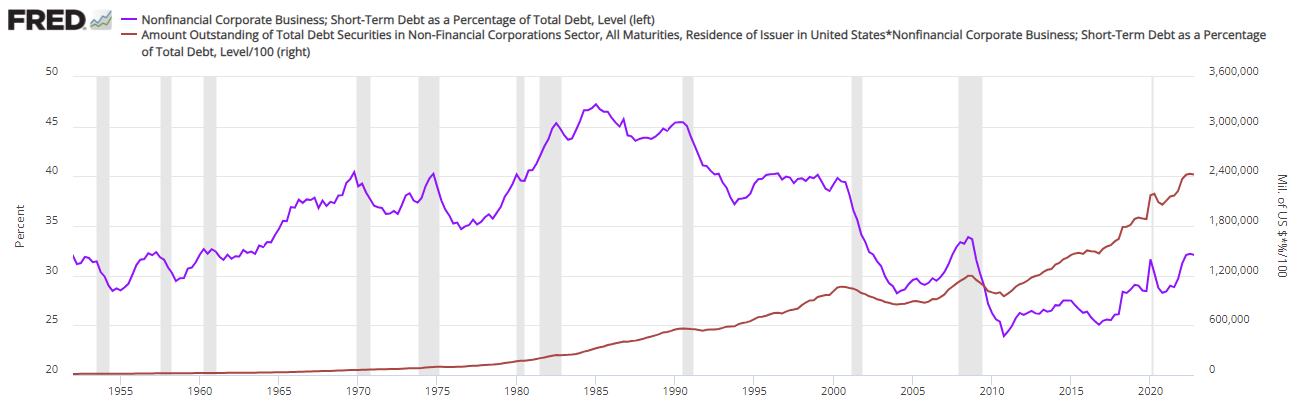

After the Global Financial Crisis (GFC), central banks around the world dropped their official cash rates to zero percent, with many nations experiencing negative interest rates in subsequent years. This action resulted in longer-term borrowing costs also falling.

The above chart shows that corporate borrowing accelerated post-GFC and an increasing proportion of corporates opportunistically borrowing for longer periods to lock in these new lower interest rates. However, as time went by and more debt matured and needed refinancing, corporations saw that interest rates weren’t going anywhere, so they began to increase the amount of short-term borrowing they were doing, to reduce their borrowing costs further still.

With more debt than ever plus a growing amount exposed to short-term interest rates (approximately one-third of all corporate borrowing), the rapid rise in interest rates of the last 2 years means corporate America is exposed to a jump in borrowing costs that I estimate to be between a 50% to 100% cost increase on U.S. $2.4 trillion of debt. This is a cost that they can’t recover through price increases.

The only alternative is cost reductions elsewhere in the business.

U.S. unemployment recently reached 4%. Still low by historic standards, but it’s not the absolute level that’s important, it’s the cyclical trend - a point that most economists and financial commentators miss.

With inflation being persistent in the eyes of the Fed and interest rates therefore remaining higher for longer, corporations will be feeling the impact on their profit forecasts as more debt matures and requires refinancing.

Corporations are responding. Initial jobless claims, which jumped in late 2022/early 2023 - mostly notably in the tech sector, have begun rising again. Continuing claims have also begun turning up after remaining static over the last year.

There is still plenty of scope for further corporate cost-cutting in the current cycle to protect their profit margins. It seems superfluous to mention this, but corporations exist to make a profit. I don’t know about the U.S., but here in New Zealand it is a requirement of their incorporation to aim to make a profit. For listed companies, the profit motive would be even more apparent.

Analytic Avenue

So much for the educational insight, let’s have a look at some interesting charts that show very similar things from multiple perspectives. I’ve also refined the new insight that I showed you in my last post to make it better.