Neurodivergent

Differing from neurotypical analysis by way of actually thinking

Divergent tendencies

Last Christmas, I gave to my family, but the very next day, I posted on Substack.

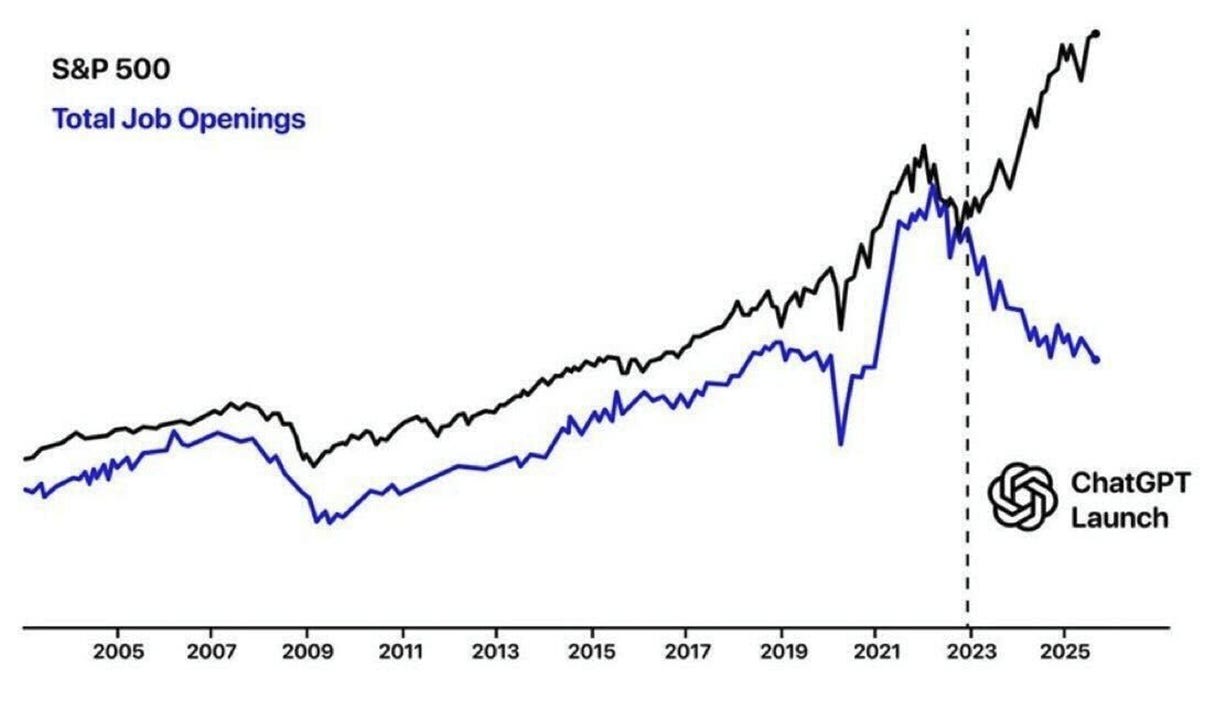

That Substack post was a challenge to the prevailing narrative that went along with the following chart, which implied that the U.S. stock market was diverging from U.S. job openings because ChatGPT (and AI, generally) had disrupted the economic order. People were only too happy to pick it up an run with it because it said what they wanted to hear.

In essence, I said that such a narrative was complete bullshit and was merely the human propensity to engage in wishful thinking whilst engaged in speculative euphoria.

I provided some evidence by way of a chart of interest rates, which showed the same divergence to the stock market as U.S. job openings.

When I combined these on the same chart it was easy to see that AI hasn’t broken the economy but it is, in fact, the stock market that had broken with reality.

Anyhow, back to work in 2026, preparing investment strategy bits ‘n bobs, and what do you know? The same divergence is everywhere. So where are all the long-serving industry professionals and global investment strategists and Wall St. analysts when the AI stock market rah-rah is being pumped out?

It’s true that there is plenty of commentary coming out suggesting caution in terms of stock valuations, but there is very little analysis that has any quantitative backing.

So, for your viewing pleasure and your intellectual edification, here is a sample of further supporting evidence that proves that markets are currently higher than users of drugs allegedly coming out of Venezuela.

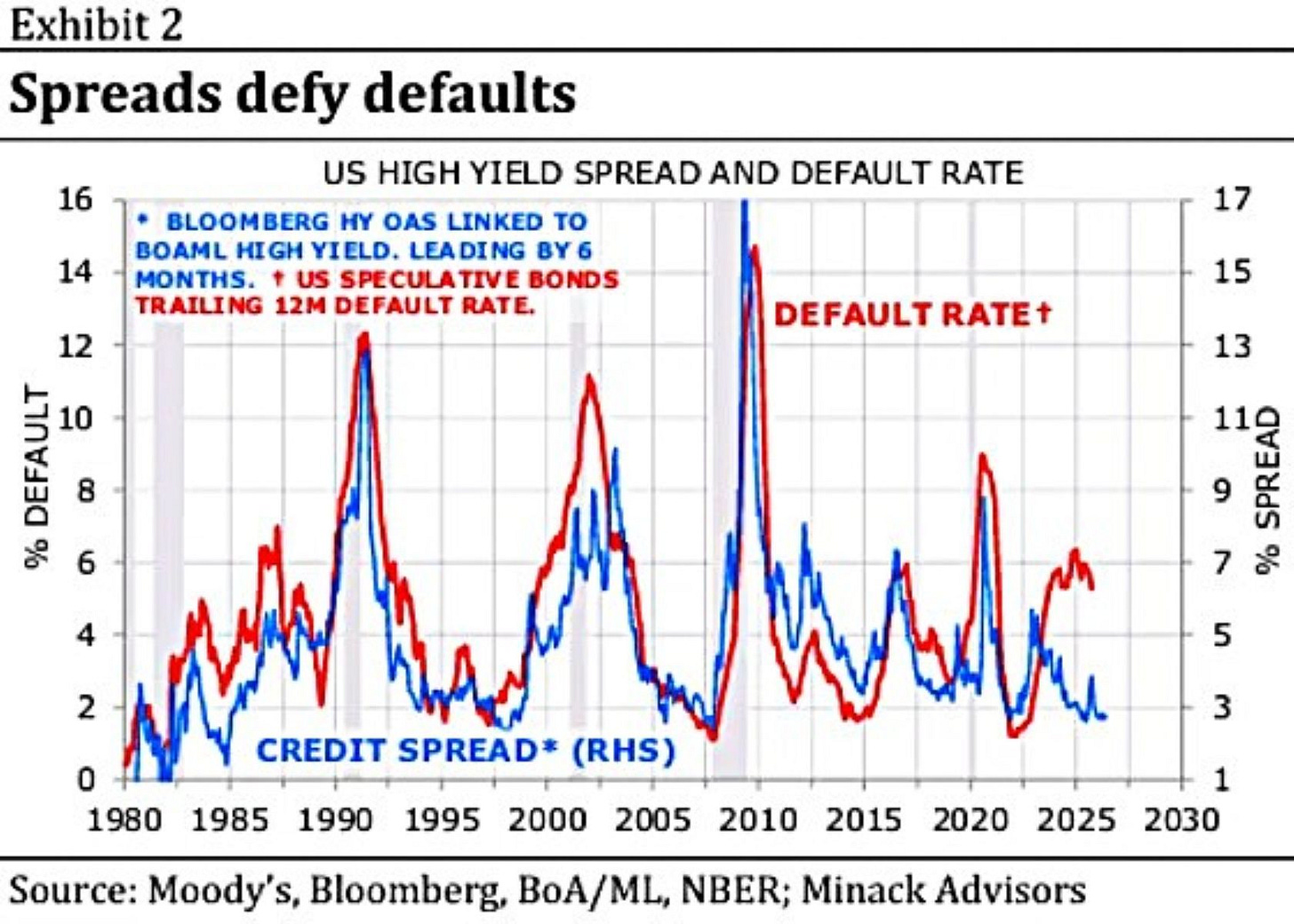

Credit markets are showing a divergence from corporate default rates over the same time period.

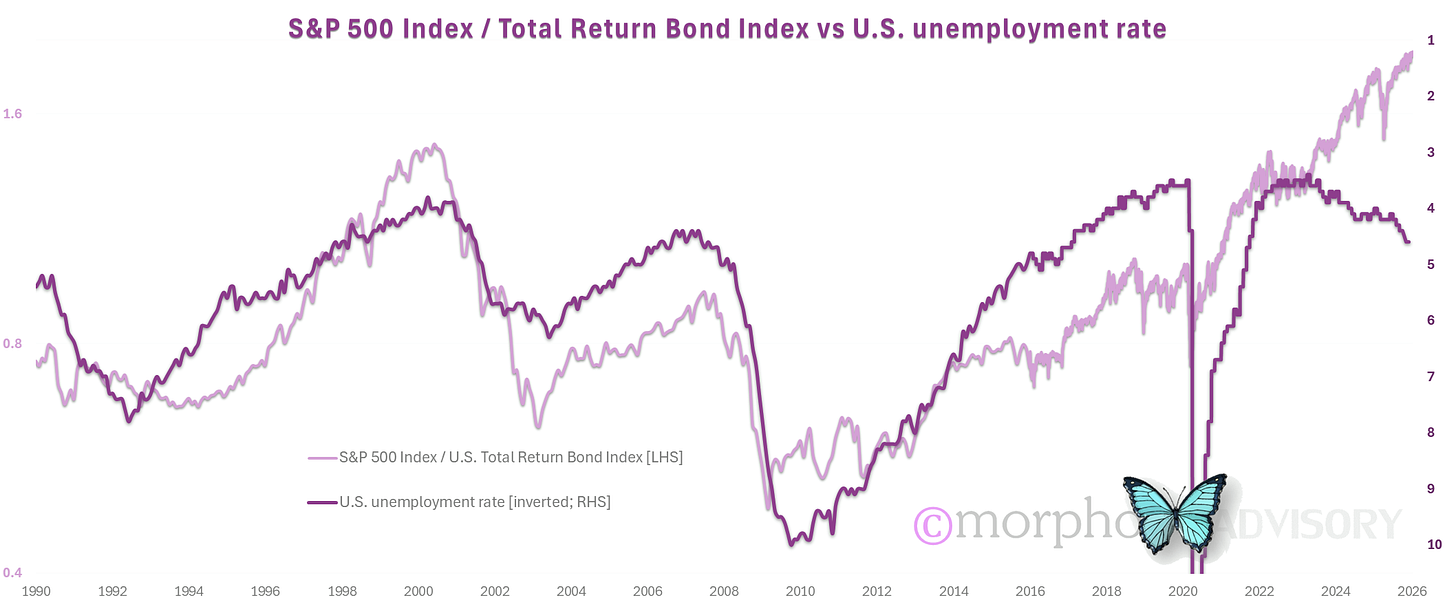

Perhaps the divergence between the U.S. unemployment rate and the relative value of the stock market to bonds will persuade you?

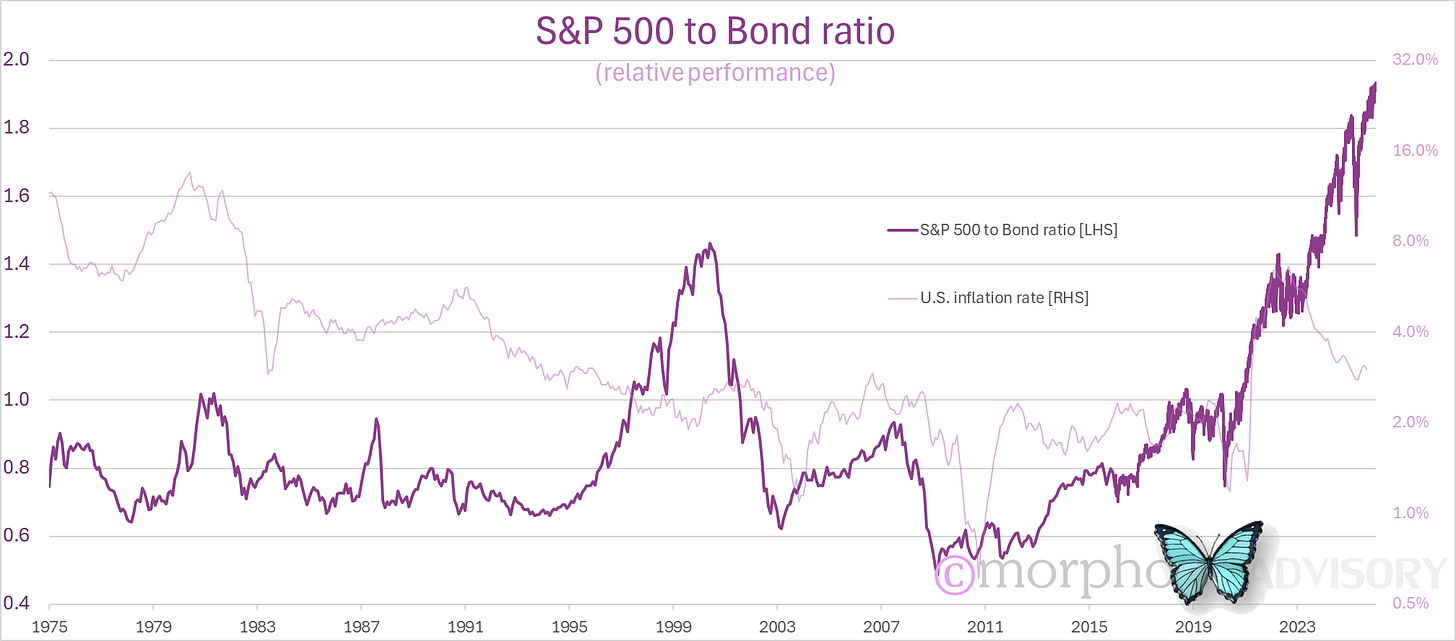

No? But it’s showing up in the inflation rate’s divergence from the relative value of stocks to bonds, too.

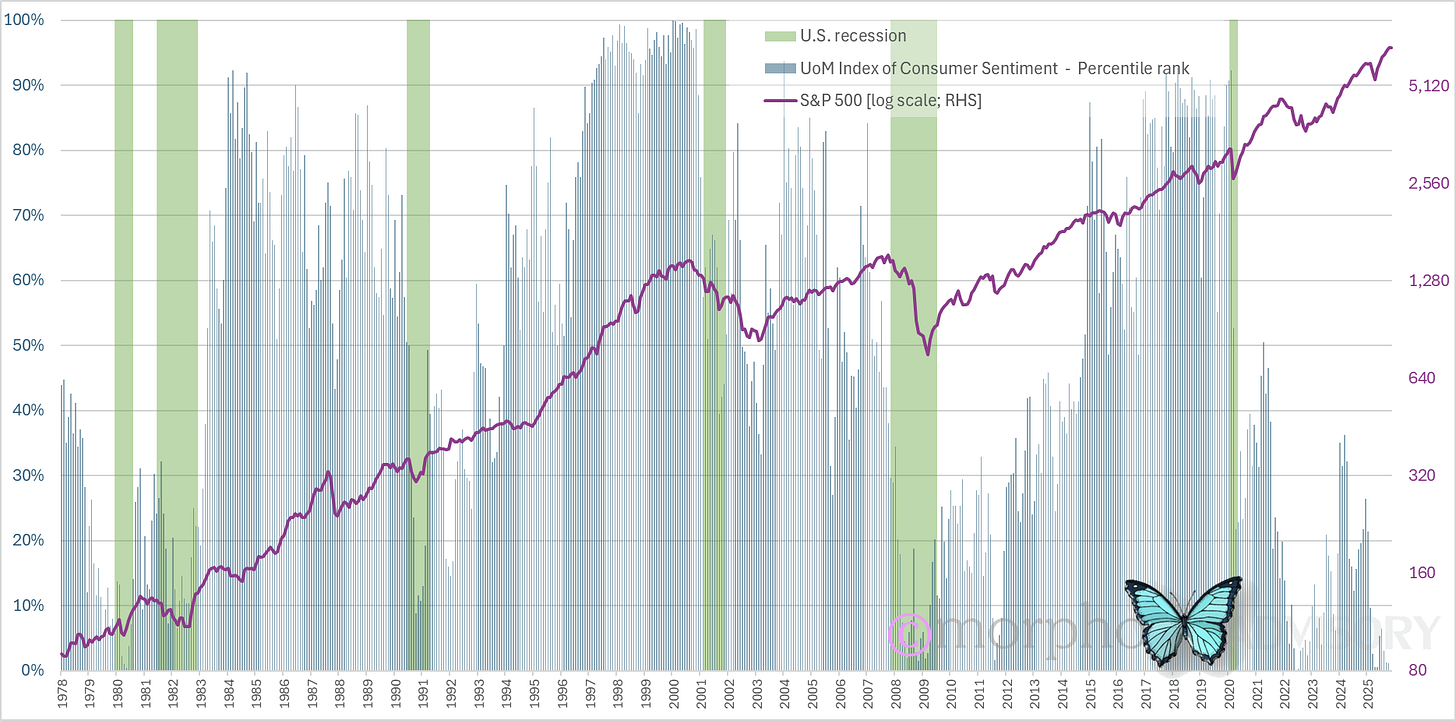

You can even see it in consumer sentiment, which is currently at the 2nd lowest reading of all time (since data started being collected in 1978).

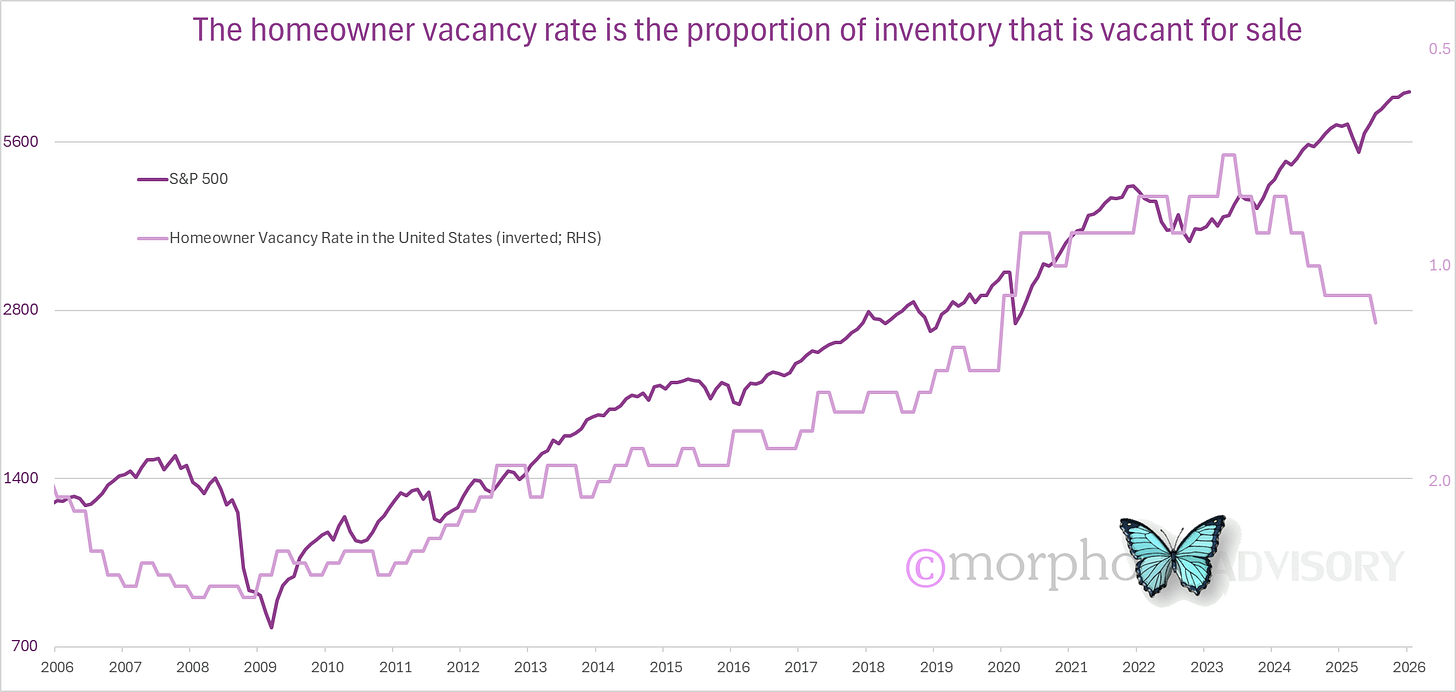

The housing market is also showing the divergent tendency.

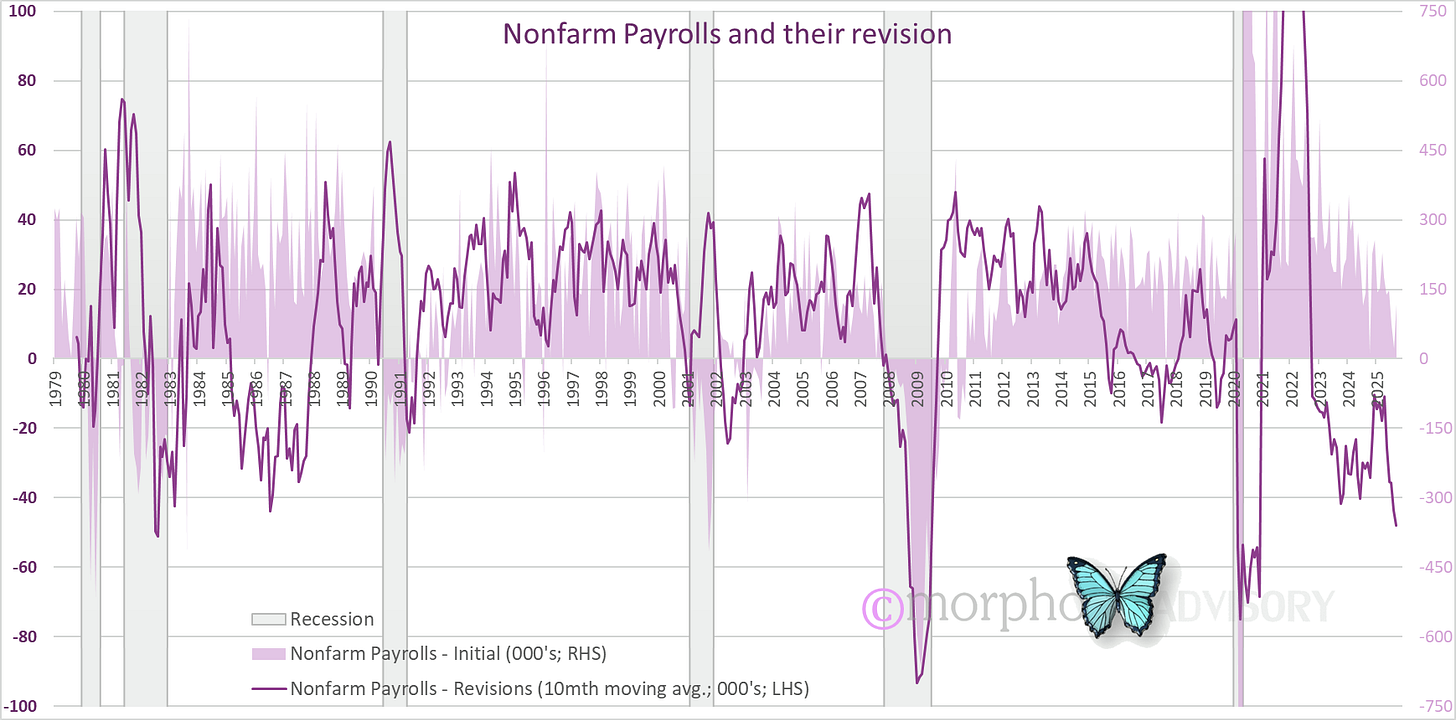

Then we have an acceleration to new cycle lows of the downward revision to U.S. nonfarm payrolls data.

That’s a whole lot of hard data suggesting that there’s plenty of economic rust under that shiny coat of paint that stock market pricing is portraying:

labor markets

housing

interest rates

consumer sentiment

inflation

default rates

data revisions

How much evidence do you need to see that current financial market behavior is like a drug induced mania that eventually has to come down from its artificially induced (AI) high?

People are investing in hot air (narrative - a nice story), and I’m the one who is supposed to be mentally impaired with my “spectrum” wiring. But then again, you have to have something lacking in the area of social wiring (like a being a child or having ASD) to declare against all normative convention that, “The Emperor has no clothes!”

“Markets can remain irrational longer than you can remain solvent.”

― John Maynard Keynes