Humans have a major flaw in their operating system: sensory data is all processed in a single location - the brain - and the brain’s processing software operates on a broad spectrum, including logic, intellect, imagination, intuition and emotions. This is only a “flaw” when settings on this human spectrum are not correctly calibrated appropriately for the task employed.

Finance is a realm where the ‘best’ settings are at the intellect and logic end of the spectrum …. in theory. But human’s are involved.

Reef fish

Former New Zealand Prime Minister, David Lange, once described financial markets as “reef-fish”. He used the analogy because of the darting motion of a school of fish swimming together in a tight cluster that changes direction suddenly based on the behavioral feedback of other members in the school. It’s a fair assessment.

This is the world of traders and market price action and, like fish, where the attention span is mere seconds. Interpretation of any situation is influenced by what others are doing.

The short-term nature of this realm also allows imagination and emotions to have undue influence.

Supposedly, capital markets and investing are ultimately about:

the pricing of capital

the valuation of cash flows, and

a market of exchange

But that’s big picture, long-term, logical stuff. These days, no one cares about the core business of financial markets (except for businesses). It’s all about, “Did my position close in-the-money or out-of-the-money today?” and the financial media is all OK with that because it makes their job of meeting the daily headline deadline easy.

Putting all that together, we now have a distorted perception of what the role of financial markets is, especially in terms of its relationship to the economy.

#nofilter

The use of filters is so pervasive online that a hashtag has been created to signal that something is so good that it doesn’t even need a filter #nofilter, which in itself tells you the purpose of a filter - to enhance an outcome.

Perception filters are a sci-fi plot device, but one created with an awareness that humans are susceptible in this manner (just ask any marketing person). However, it has simply been exaggerated in fiction to be in the form of a piece of technological equipment that enables some advanced society to remain undetected. The scary bit is that current technological advancements, specifically A.I., are taking us to that place where the present forms of perception manipulation that are widely employed can be empowered by technology. And sadly, perception manipulation is never used altruistically. Rather, it is used to sell stuff, to gain personal power, or influence perceptions on a matter. If you can’t see through the filters now, you’ll be screwed with what’s coming.

Politics

What got me started on this topic was politics. I was asked about the outcome of the U.S. election on markets. I said, “Don’t know, don’t care.”

Government has surprisingly little to do with the economy.

Before you react, let me highlight a few things.

the financial media would have you believe otherwise, I know. I’ve mentioned before that we humans (with our logical + emotional brains that work by generating pictures in our head) are biased toward narrative (i.e. stories). Journalism generates a narrative for us, one that coincides with events, and our brains jumble it all together and we accept that because our mind needs to have a story for what is happening. The stories that financial journalism feed us are not true (OK, they’re partially true, which makes them even more dangerous because it’s partway credible), but it’s the only story being put out that we don’t have to hunt for - it comes to us. So, it’s easy because we want to believe …. and we don’t want to have to think for ourselves.

when was the last time you stopped buying groceries because of politicians, or going to work, or buying a house or a car, or traveling, or buying clothes, pursuing hobbies etc.? Nitpickers will say, “During Covid-19, the government did this…”, but what I’m getting at is that your behaviors and those of society, don’t change with governments. Yes, a government policy may mean you alter the way you do something, but you’ll still do that something (e.g. buying an electric car because of a tax break rather than a gasoline powered car).

I stopped watching news many years ago. I see it in passing on occasion and it still follows the same format, which goes something like this:

[Event happens]

[News anchor summarizes event]

[Roving news reporter gets soundbite from government official]

[Government official states party line in such a way that it implies that this is a serious matter and unspecified actions (other than “taking it up with colleagues” or threatening a “review”) will be undertaken to address the matter]

[Roving news reporter and news editor accept this as a complete story and send it to air]

There’s no real journalism going on. There’s just the perception filter that makes people believe that the government is at the center of everything and that the media is keeping us informed. Government are only too happy to keep up this perception of their importance, and journalists like having access to an easy source that gives an air of credibility to their story without much effort.

Politicians promise us that they’ll create jobs and grow the economy. That’s complete horseshit! They don’t have that ability. They can create policies that create the incentives for people to start businesses, but they can’t grow these things themselves. The only way for a government to do this is by growing the government. When it comes to the economy and job creation, that comes from consumers (like you and me) and from businesses. Yes, government is a large employer, but the consumer is still the backbone of the economy, and jobs come from businesses, which are started by entrepreneurs (some of which eventually grow into institutional enterprises) and employ consumers.

Perception is reality

I’m retarded. My brain lacks something that allows me to participate in the collective deception of perception, e.g. group think. On the contrary, having autistic wiring results in me wondering why the mass of humanity acts like morons. Then I remember that other people have to fight through a wall of chemical signals, emotions, relational connection, social conditioning, and other stuff that I don’t got. While this gives me a sense of clarity to analyze data, it also means that I miss how long people can accept illogical information and stay ignorant to the truth as they happily run with a generally accepted narrative - because that’s what everyone else is doing and they want to fit in (I gotta work on understanding that as an outsider). We humans are social animals …. except me and those with the same retardation that I have.

Current market sentiment is that that people want to believe everything good and nothing bad. For example, a poor U.S. payrolls report last night was brushed off, being blamed on hurricanes and strike action.

As I pointed out in my last post, there are questions within the Fed around their labor market model at present (i.e. it has been overstating job creation quite significantly). That’s on top of the downward revisions to the payrolls data that has been both substantial and persistent for the better part of two years now, which happens during economic weakness.

Eventually, perceptions will catch up with reality. In the meantime, markets continue to run with the fantastic belief that despite:

the most concentrated market leadership in history;

extreme market valuations;

record levels of debt;

the highest interest rates in decades;

aging demographics;

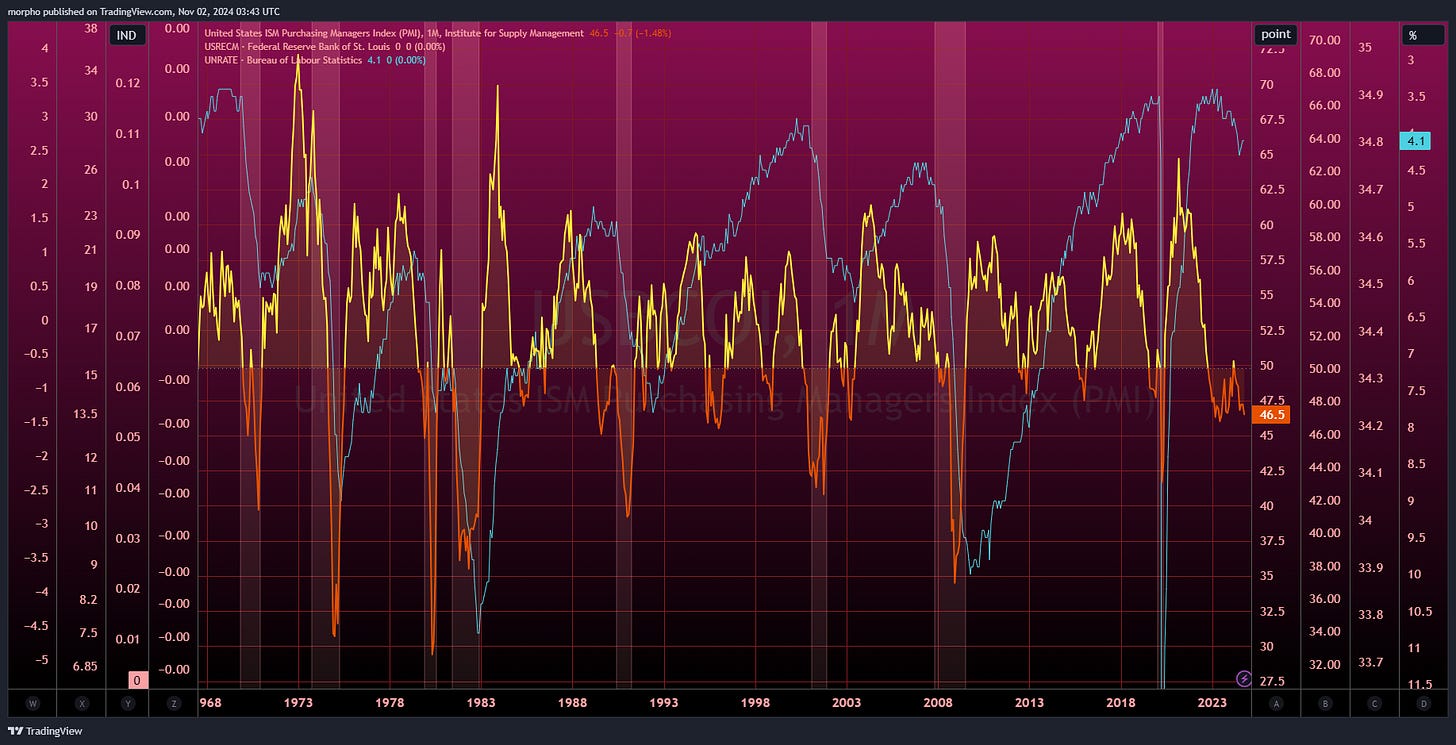

the contraction of the manufacturing sector;

a falling Quits rate (at recessionary levels);

a rising unemployment trend; and

year-over-year growth in vacant houses for sale (at recessionary levels)

… everything is fine, things are sustainable and growing. It’s all good in the ‘hood.

What could possibly go wrong?

But speculation is rife. Look at Gold and Bitcoin …. or maybe don’t.