My bad! It was late, I was tired. Had my thinking been less fuzzy, I woulda thrown in one more chart to support what I was saying in my previous post. But to refresh your memory, I’ll back up a little and repost the last part of yesterday’s riveting read.

Hmmm, where were we? That’s right, I was saying …

Be careful what you wish for

Have you considered what a Fed pivot toward lower interest rates means? It means there’s a new risk in town, a risk greater than the high inflation we have experienced.

The pivot that bulls are praying for will be as a result of an economy where millions are unemployed and there is elevated risk that activity stalls altogether, unable to regain momentum and we end up stuck in a lingering economic malaise like Japan and Europe have suffered.

Do you have that in a graphic novel?

Yes, we do have the

comic bookgraphic novel in stock.

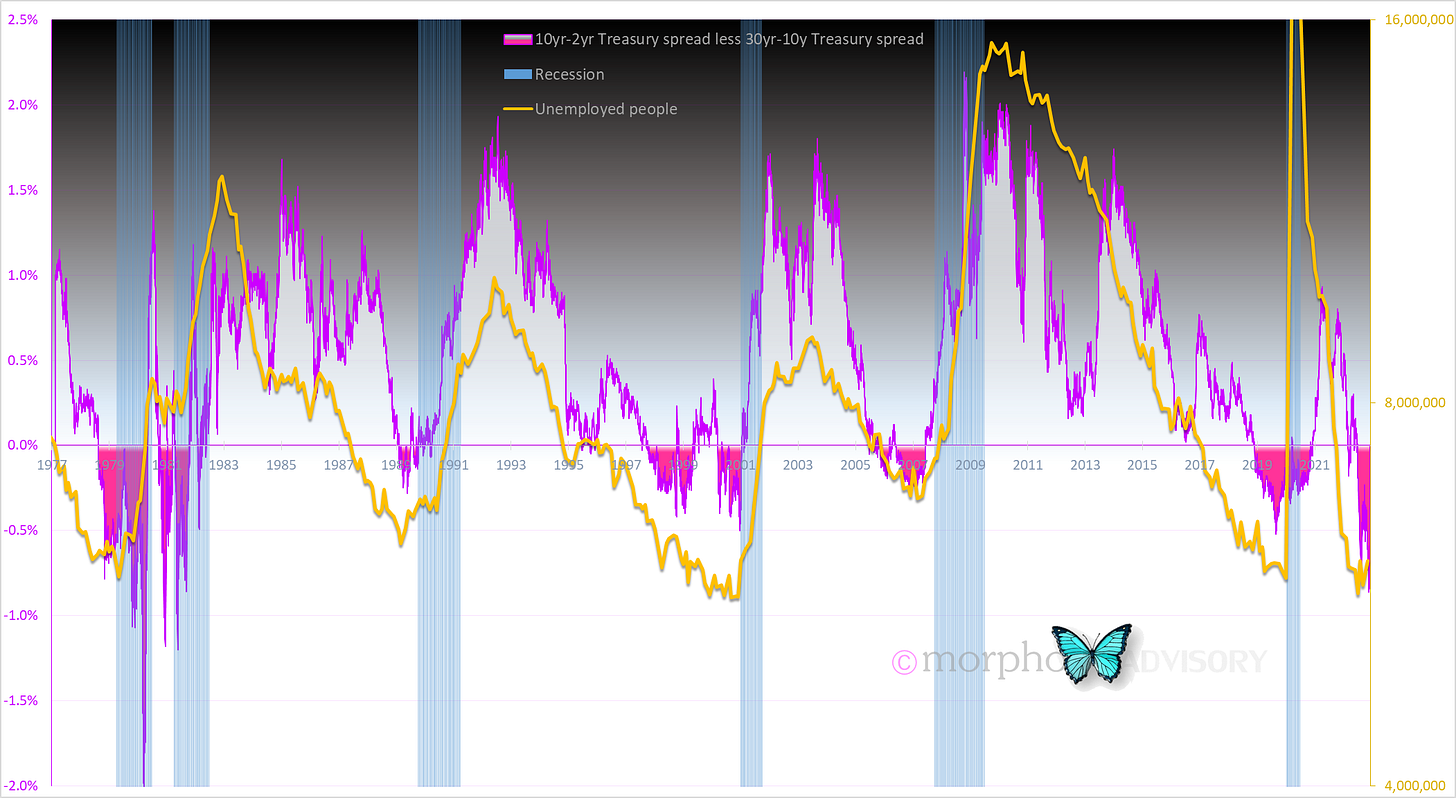

Let’s look at the yield curve. You have all, no doubt, heard that an inverted yield curve (like what we have at present) signifies recession is coming. Well, after the inversion comes a sharp jump higher in the yield curve slope (e.g. the difference between the 10-year Treasury yield and the 2-year Treasury yield). The sharp “jump” in the slope occurs because there is sharp DROP in the Fed Funds rate (i.e. it’s when the Fed pivots to reducing interest rates). That jump up in the yield curve is when the Fed hears the economy make an expensive sounding noise and they drop the cash rate bigly.

As the above chart shows, it is during the period where the economy fractures and the Fed does a rapid about face where we see the big falls in the stock market NOT GAINS like the current batch of bulls are hoping for (and speculating on).

That’s what I was saying. And now for the bit I left off.

If I replace the percentage fall in the stock market from its all-time-high (‘drawdowns’) with the number of people unemployed, you get a clear picture of what the Fed actually does when they raise rates and when they pivot to lowering rates.

Yep! All those Fed rate hikes start working slowly but surely, and eventually the economy creeps past the tipping point. Crash! People are no longer thinking about growth but cost cutting and survival.

That’s when the Fed pivots from raising interest rates to cutting them. Now they have an economy to save.

But, if you’re in the “pivoting is bullish” camp then you believe that “this time is different”, and if that’s the case then there’s no help for you because it’s never different this time.