Quantimental

I dabble in both of the dark arts (fundamentals and quantitative)

The quants go mental

A funny thing happened to me on the way to the LinkedIn.

For some reason I decided to post something on LinkedIn a week or so ago. Call it inspiration. I usually don’t bother with that platform - other than links to my Substack posts. I find LinkedIn a bit crap to be honest, but that may simply be a reflection of the sub-sector of the industry I have been exposed to and my general lack of social connection. However, I had noticed that certain other sub-sectors are much more engaged and active in creating and sharing content. These are typically of a scientific or academic background. They post some good shit. Interesting and thought provoking.

Anyhow, I decided to throw out a teaser into the ether of social-network-dom, and I spattered it with a bunch of hashtags because, why not? I don’t know if users follow hashtags or search using them, or if the post algorithm references them.

I went with the big guns first up to see if another sector of the online universe would take the hook. I posted my trading model.

The image was of a handful of charts of copper futures taken at the same point in time but over different time periods (i.e. chart periodicity). I just wanted to illustrate how my algorithm can work dynamically regardless of the time horizon, and how each layer of periodicity can inform the others. Then I also threw in monthly U.S. Industrial Production data at the end for shits and giggles, to further illustrate how dynamic my algorithm is.

Part of the reason I posted was because of all the reading I had done on posts by quants, data scientists, machine learning and LLM peeps, algo traders etc. all said that the trading algorithms developed by large quant funds typically only have short trading lives before their efficacy has gone, or something along those lines. I wanted to show that it was possible to have longer-lived algorithms. I also suspected that the algorithms that quant funds develop don’t have the dynamic range of mine.

The quant industry is, by and large, focused on the realm of market microstructure and interpreting that realm through the lens of stochastic processes, just as the world of science for the last 100+ years has moved from the world of the very large (celestial mechanics, gravity, and black holes etc.) to the world of the very small (quantum mechanics). I’m more in the world of the large scale and my quantitative application has come from that angle. I have looked at the big picture to gain context for how environment has shaped behavior, but I have also applied a multi-disciplinary approach (e.g. tools such as exegesis).

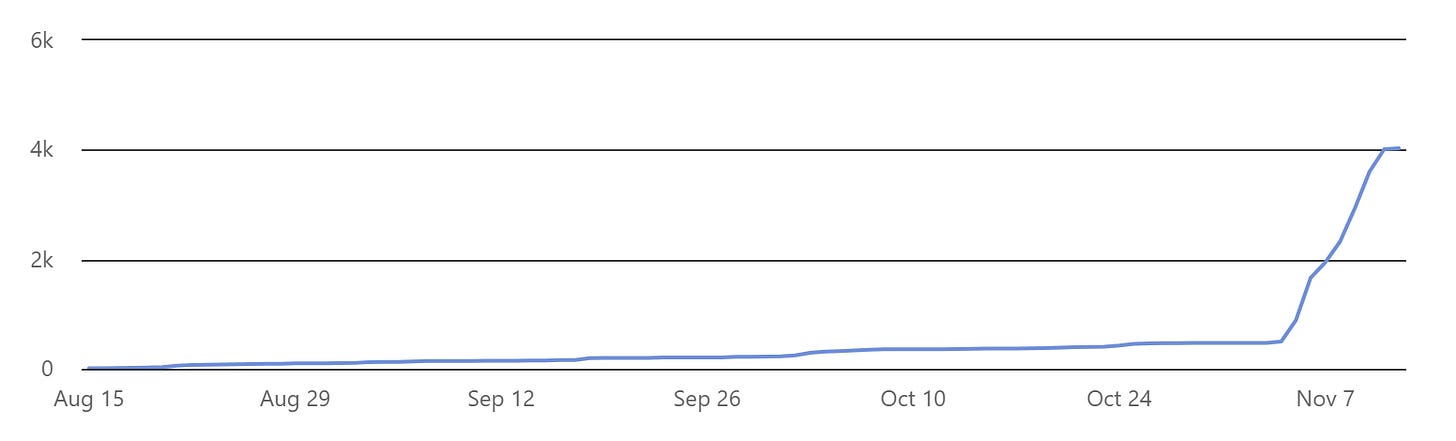

Anyhow, I seem to have gained some attention with my post.

It’s not “viral” in the global sense, but certainly viral for me by contrast to any prior response to my posted content. Like I said, I typically only post links to Substack. After all, who can be fucked maintaining multiple platforms?

I’m sure there are plenty of people out there who get these sort of numbers on the regular. However, I have few connections on LinkedIn (I’m not one of these “500+ connections” people) and I’m not a very ‘social’ person. So, this response is based purely on the content.

Most of the people who viewed the post had “Quantitative” in their title and the biggest hits came from major financial centers (London, New York, Sydney etc.) and company names such as Millennium, Goldman Sachs, JPMorganChase, Macquarie etc.

It’s all a bit of fun, really. I’m not chasing an audience or trying to convert any engagement into sales. I’m just being a tease. On that front, I thought I’d drop another tease while the LinkedIn algorithm is hot for me.