What price do you place on your values?

I was thinking about the coming market event, and this resulted in my thinking drifting toward the concept of valuation. Valuation has always intrigued me.

Decades ago when I bought my first house, I started to wonder about how everyone felt wealthy based upon their house valuations. I live in New Zealand and New Zealanders have long had this obsessive (and more often than not, irrational) fixation on residential property and its value.

Even in my twenties I was aware that only a small fraction of all residential houses were ever being bought or sold at one time and that capital gain for all via revaluation was illusory (unless realized and some other living arrangements could be made). What was happening was that the marginal real estate transactions were occurring at a higher price than historic transactions, and all other homeowners in the area were perceiving that that value of their property must also be higher. They felt wealthy.

Interestingly, back then when I though about it, I came up with the analogy of a balloon (even though I wasn’t considering it a ‘bubble’ - I was merely observing behavior). I considered that the price of property was like the surface area of a balloon. As more molecules of air filled the balloon (i.e. only a few property transactions happen at higher prices and that sets the marginal price against which all property owners assess the value of their asset), all prices expanded (being on the surface). I came to the conclusion that such wealth is not real even if it was derived from a real asset. I realized that the balloon could deflate just as easily as inflate - conceptually.

This understanding about how valuation is derived is important because the same applies in financial markets (e.g. stocks). The key takeaway is that the marginal price (i.e. the last single unit bought & sold) in any market sets the value for ALL owners of that asset.

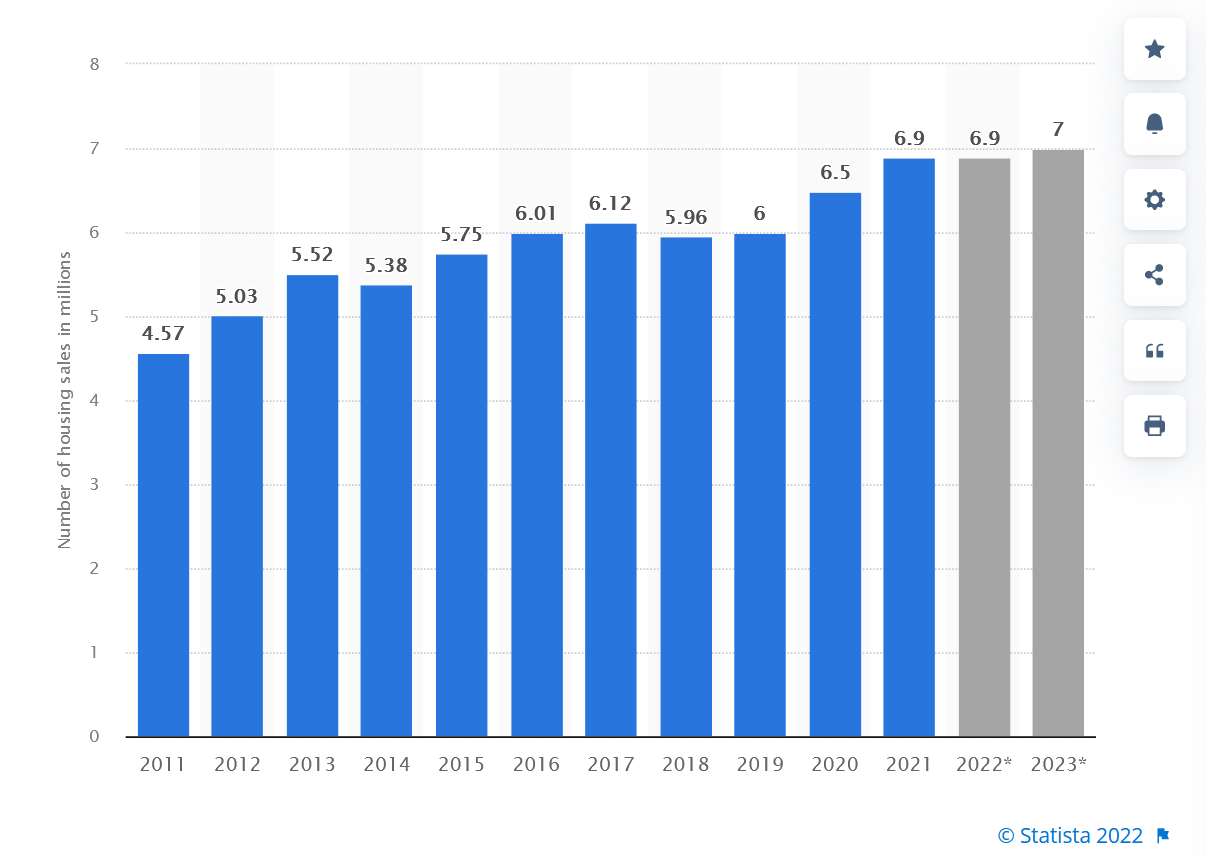

Over the last decade, in the United States, only 3.5% to 4.9% of the total residential real estate inventory has been bought & sold in any single calendar year. That’s all. Over that same period, the value of residential property has risen by 75%. Everyone who owns a property believes that their wealth has gone up to that degree. And that’s not even counting their stock portfolio.

That’s a long period of mental conditioning to the accumulation wealth in the minds of people - most of whom aren’t aware that it is not real. They believe it is. That’s why people are out for blood after a market crash. Their illusion (i.e. delusional faith) has been taken from them. The masses turn on those in positions of authority, and those in positions of authority point the finger at short-sellers to divert their wrath.

Scapegoats

In the Jewish tradition as told in the Torah/Old Testament (Leviticus 16) the scapegoat was actually a goat. Awareness of sin required the High Priest alone to go before the Lord and make a sacrifice for himself. Having done that, he then brought two goats, one of which was sacrificed and upon the other was placed the sins of the people (by laying on of hands and confessing sins) and it was then sent off into the wilderness - the scapegoat.

In the Christian tradition (New Testament), Jesus became that ‘scapegoat’ that bore away the sins of the people (all people of all time).

Short-sellers always cop the blame for large falls in markets. It’s a diversionary tactic - having someone else to blame, e.g. ‘Hey, we [your asset manager; adviser; regulator etc.] fucked up and didn’t read the economy and/or policy framework right and you lost half of your wealth, but look over there, it was those people who made it happen. They made money, which used to be yours.’

People who blame short-sellers are either dishonest, or don’t understand the concept of valuation upon which markets are built and are therefore unfit to be involved to participate in markets - as regulators; asset managers; advisers; reporters etc.

IN ANY MARKET, there is no selling without a buyer, and there is no buying without a seller. If a single unit of any stock is traded at a much reduced price (e.g. >50% below its all-time-high) - like during a crash, then that valuation is applied to all holders of that stock. Short-selling has nothing to do with it. It actually reflects someone trading based on emotions and at an irrational price (most likely mass hysteria is present, which has resulted in the emotional trading). That is to say, someone who formerly thought they were wealthy has realized that their ‘wealth’ has evaporated and now they have less than they started with and they want to get out NOW!, and put a stop to their financial anxiety.

The correct scapegoat is to blame emotional, irrational trading by people who were either ignorant, or possibly dishonest with themselves, about their own tolerance for risk when they entered the market. Additionally, market participants not understanding that markets deviate from fundamentals to the extent that human beings can be irrationally exuberant or outright panicked. It is these people who set the marginal price during the extremes, both at the top and at the bottom of the market cycle.

The exception to the rule

I said that, “there is no selling without a buyer, and there is no buying without a seller”, but in financial markets, this isn’t necessarily the only means by which the marginal value of a security is set. In financial markets, prices can be marked lower without even trading. For example, say the S&P 500 closes at 4,000 on Friday and over the weekend some event occurs. On Monday morning the price opens at 3,800. Maybe there is no trading that day but both the Bid and Offer are reduced. That’s a 5% drop without even trading. That’s another key concept that is a slight variation on what I said above, namely: an asset is only worth what someone is prepared to pay for it. During a market event (i.e. crash), liquidity disappears - there are no buyers, just sellers. This can result in market protection measures kicking in like Limit-Down trading halts etc., which are designed to stop self-reinforcing price signals, but they also dampen liquidity (i.e. the ability to find buyers).

Oh well, if you’re going to point the finger

The ultimate scapegoat is the regulatory framework that sends the wrong economic signals to people, e.g. using monetary policy to stimulate growth to try and keep it at some imaginary level that is considered to be sustainable by dropping interest rates, which encourages leverage and capital price appreciation-based speculation for multiple decades and which seems to work but only because it has a demographic tailwind that is about to evaporate and become a multi-decade headwind, so don’t expect the sort of strong economic/market bounce that we’ve had after previous market crashes, plus interest rates are already too close to zero (i.e. we’ve used all our ammunition already) so there is no support coming from that angle (and QE is a nonsense that could well result in a sovereign debt crisis over the coming period, too if they’re not careful).

Yes, I think there will be blood, and many will be facing a ‘wilderness’ experience in the years to come.

In the interim, short-selling could very well be profitable … just don’t tell anyone you’re doing it.