In Part 1 I outlined the broad framework for contextualizing and thereby correctly interpreting the economic outlook. I took you from the largest and slowest cycles, but all the more meaningful because of this, and sequentially layered increasingly smaller cycles within the bigger picture.

At the end of the list of 5 points that I laid out was “markets”. This was something of an abrupt ending and scant on information, in addition to being slightly misleading, which I hope to redress in this post.

In what way was it misleading? It would have been better labelled as “the business cycle”. This is what most people who describe themselves as being “macro” focus on.

Point 5. The business cycle

The business cycle and markets are closely aligned. Many of the charts that I have posted on this site are business cycle charts, showing the cyclical nature of the economy - its boom & bust nature.

Part 1 illustrated how we are coming to the end of major cycles (i.e. demographics, plus a diminishing of cultural trends, which will ultimately force changes in policy frameworks etc.), so I hope that you can understand how we are positioned with regard to the current business cycle.

Let me run through a summary of where we are at in the current business cycle by backing up a few years:

In late 2019, the U.S. economy was beginning to slow of its own accord. It had been through a decade of growth post-GFC and was beginning to wane because nothing lasts for ever and the accumulated excesses had finally come home to roost … plus the Fed had been raising interest rates from 2016 through 2018.

Early in 2020, the catalyst that would tip the economy into recession after a Fed rate hiking cycle appeared in the form of Covid-19. A global pandemic. So far, this is all normal stuff - rate hikes lead to slowdown with a pending recession that often requires a catalyst. What was abnormal was the global government response. Governments panicked thinking that the world economy would come to a complete stop and threw money at people, most of whom didn’t need it. Only industries like travel; tourism; hospitality etc. really needed the economic boost. Everyone else worked from home. As a result, waves of free money caused behavior of excess that extended the existing economic cycle and compounded the pre-existing accumulation of excesses. The bubble that was got inflated that much more.

Online shopping took off as did day trading & markets, and money that was earmarked for travel etc. was diverted into consumer goods or speculated on the stock market (or crypto). But everyone wanting to buy so many goods (because travel was off the table) caused problems for supply. Prices jumped and inflation arrived!

Central banks thought inflation was a 12-month thing - i.e. it would roll off on a year-over-year basis. It didn’t! 1-year later, businesses had to raise their prices to recoup their lost profit margins. Consumers also required higher wages because the cost of everything had risen. ‘Shit!’, thought the central banks, and they set off with multiple jumbo rate hikes at a record pace, making up for lost time to bring inflation under control.

And that’s where we are today. My 3-year summary ends where it started, with the economy slowing as a result of interest rates rising and a recession underway … but a much bigger one with a harder & sharper ending than if the policy errors around Covid hadn’t occurred.

A picture paints a thousand words

Let’s look at some charts that illustrate the relationship between the business cycle and markets (apologies if you’ve seen some of these charts before).

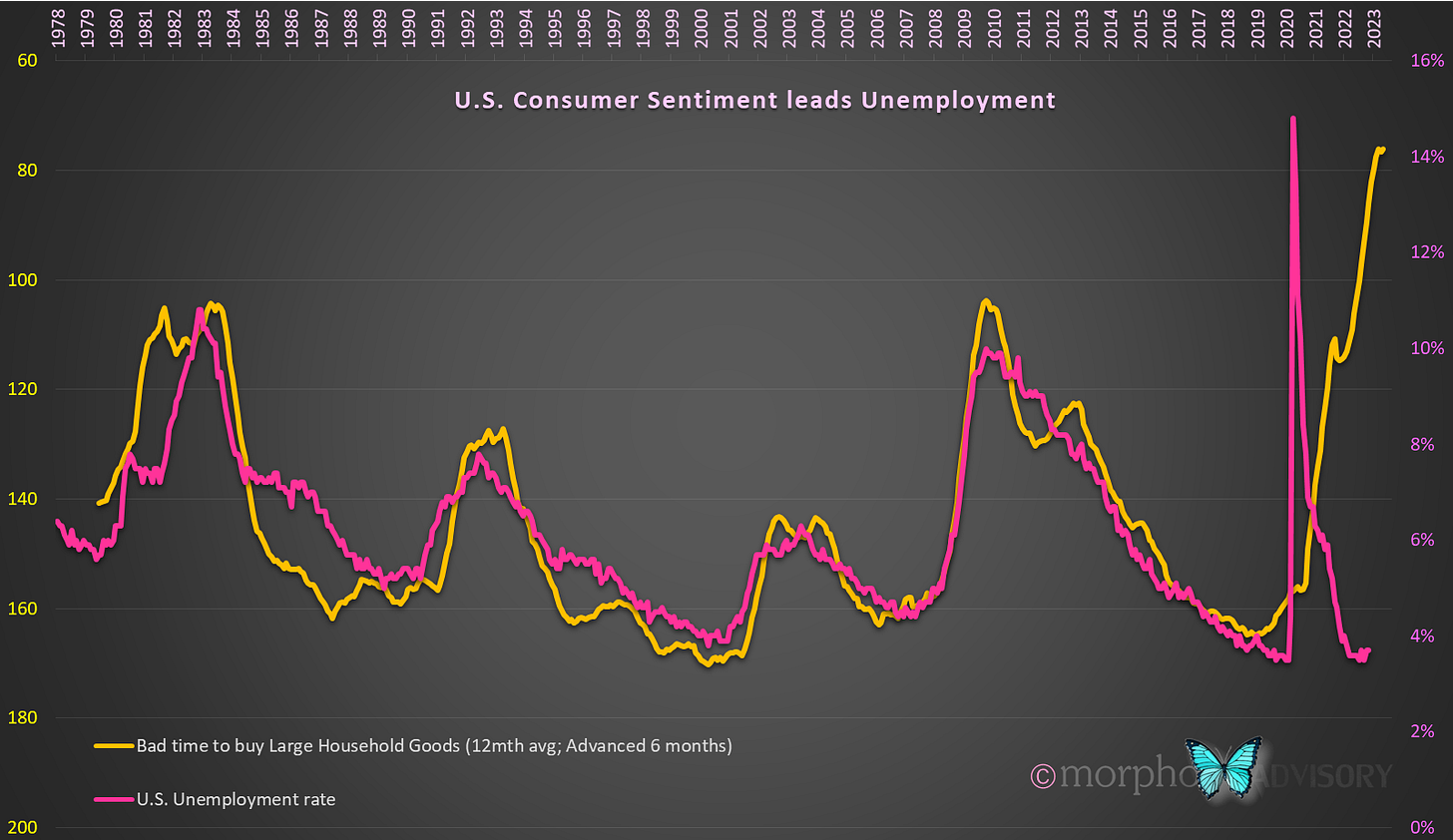

Hmmm, seeing as the consumer makes up almost 70% of the U.S. economy let’s start there.

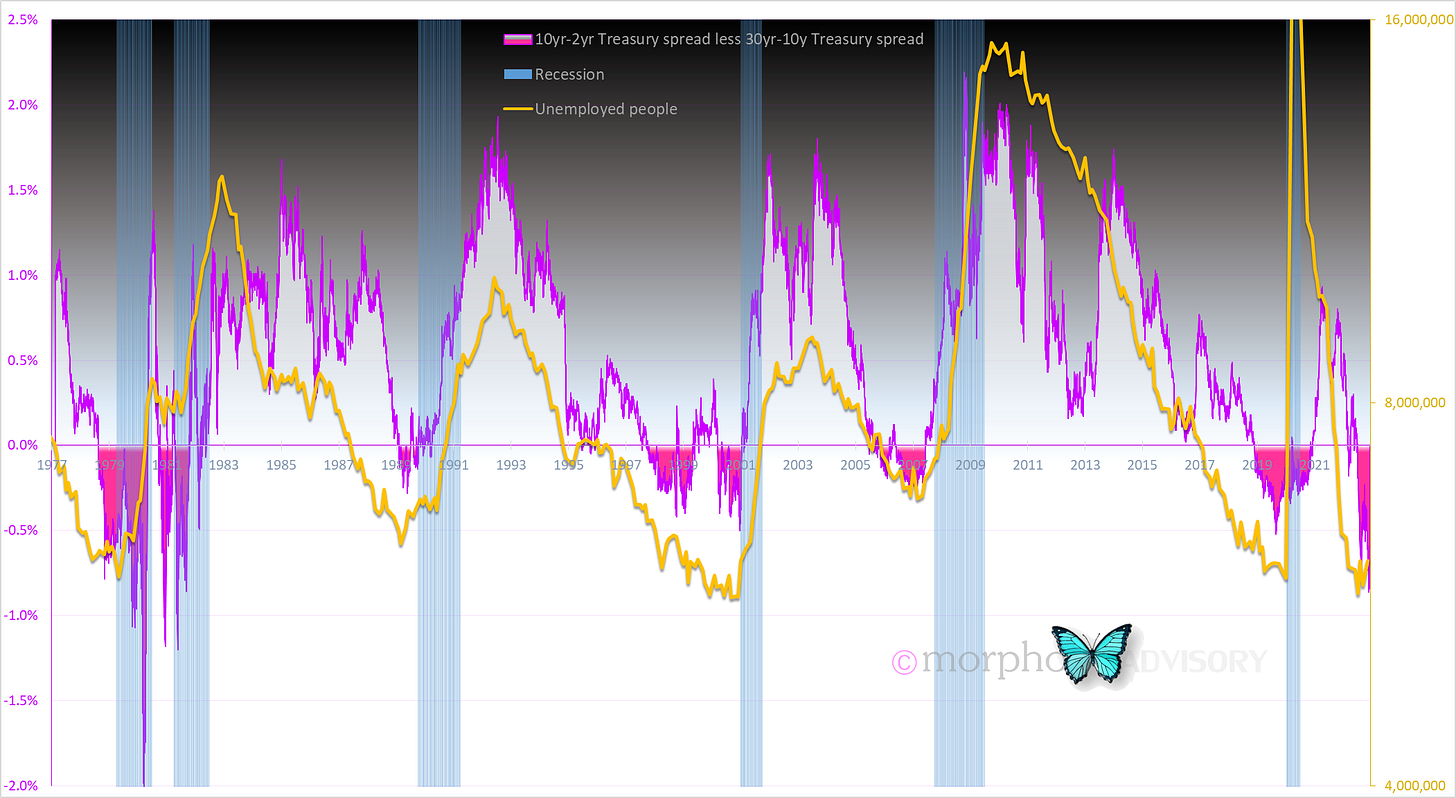

Consumer sentiment is a good indicator of where the yield curve is going … usually. The consumer suggests that the yield curve needs to steepen, which means the Fed needs to drop their Fed Funds rates, which they usually do when things turn to shit, so it should happen in the next 6-12 months. Last time inflation was a problem (back in the early ‘80s) the yield curve was volatile and lagged the consumer’s interpretation of things as per the chart below, and that will probably happen again this time, too.

The Fed will want to see unemployment rise before the ease off on the tightening … or inflation falling back toward 2%.

The rise in unemployment in this cycle should be pretty dramatic given the extremes of the current tightening cycle (its size & speed).

It’s already affecting asset markets, like real estate, which also suggest unemployment is about to jump.

The stock market, too, has been hit. So far, it has only fallen as a result of the revaluation caused by higher interest rates, and in line with economic activity (no one is yet pricing in the drop in earnings that a recession will cause - so much for markets being forward looking).

In conclusion, the business cycle … and therefore markets … need an occasional reminder not to get carried away into excess (e.g. too much debt; too much speculation; too much consumption etc.). This happens by way of central banks, like the Fed, raising interest rates, which ultimately leads to rising unemployment, and that resets the cycle … the business/market cycle that is. The the Fed drops interest rates and it all starts over again.

BUT DON’T FORGET THE CONTEXT!!!

A much larger cycle is coming to an end, which coincides with the end of this business cycle.

An aging population, many of whom are retired or retiring, are about to suffer from a negative wealth effect, i.e. their retirement savings will reduce in addition to the fall in their property value. That is their only income, and interest rates are unlikely to stay up for long with the recession that’s coming. Additionally, an aging population results in a shrinking economy (as seen in the economic headwinds faced by Japan since 1990 & Europe since 2000). On the plus side, it also results in a lower unemployment rate, but this ‘slice of the pie’ is not enough to offset the the fact that the overall ‘size of the pie’ has gotten smaller.

Putting it all together

I hope these two articles help you with understanding and interpreting the economy and its cycles. Once you understand these, then you can narrow down your research and identify strategies for how best to invest across the cycle. For example (in very broad terms and using only stocks):

early to mid-cycle: small/mid-cap stocks

mid to late-cycle: large-cap (everyone wants in and momentum is with the passive index-weighted large-caps)

cycle end: cash/bonds etc.

Once you develop a risk management process (or risk identifiers) you can then add emerging markets; commodities; volatility; and other alternative assets & strategies to your equity investments and so enhance your portfolio.

Happy New Year! Thanks for being part of the journey in 2022.