It’s beginning. It starts slow and gathers pace, but it happens … and is happening.

Crossing signal

The turn is in on the economy, and now the reaction begins. Companies need to respond to lower earnings because they exist to make profit - it is a requirement of their incorporation. If earnings are falling, then costs must fall faster.

Back in June, I pointed out the decline in freight shipments and expenditures. Since then, the freight sector has had a few … well, I won’t call them surprises because we saw it coming - let’s say, adjustments.

Last week, UPS cut its 2023 revenue outlook, citing weakening demand. Two months ago, UPS asked some of its pilots to retire early …

Yesterday, Maersk announced a 94% profit plunge in the third quarter and 10,000+ job cuts.

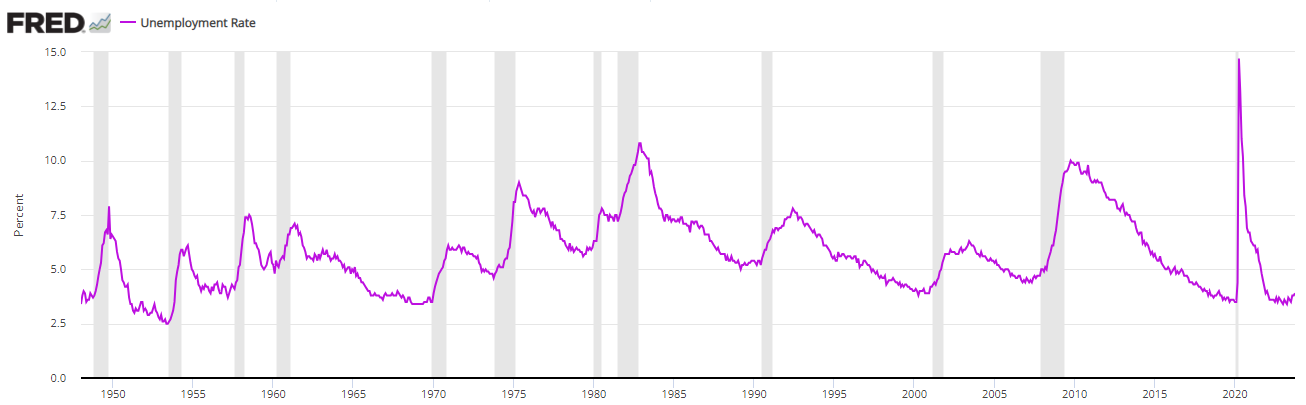

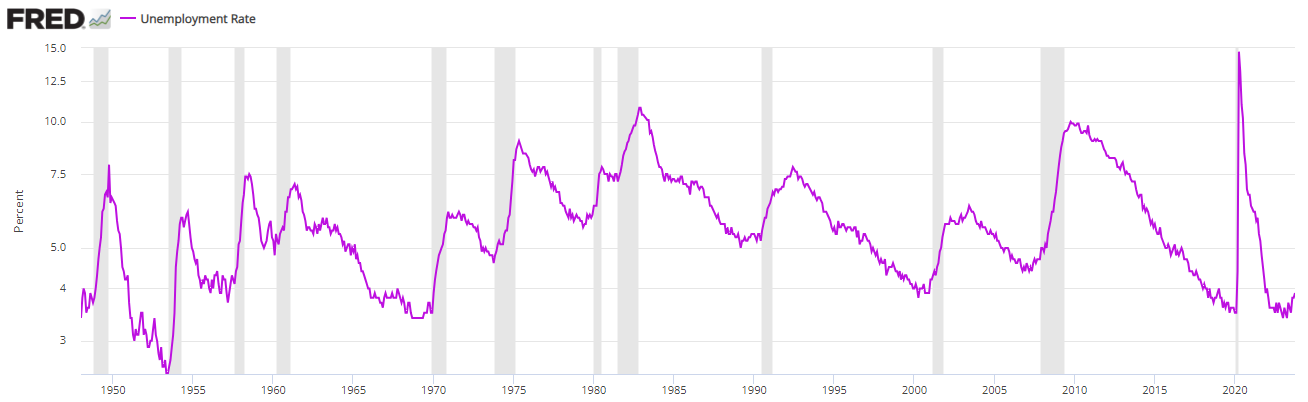

Also announced yesterday, the U.S. unemployment rate ticked up to 3.9%. No one seems concerned, however, because the stock market was up. In fact, officials said that they need to see more unemployment … and they will (they couldn’t stop it now if they tried).

If we change the vertical axis to a log scale, we get a more definitive picture on the turn in the labor market.

There are plenty of other indicators like Housing Starts and Permits that show unemployment will continue to run higher. Really, a bit of common sense tells us what is happening:

Freight is falling because inflation and high interest rates have cut into household budgets, so everyone is tightening their belts and online shopping has to slow down or stop.

The reduced consumer spending is causing revenues to fall for businesses, so they have to cut costs, and cost #1 is staff.

Truck stop

I couldn’t resist posting this one, and seeing that trucks are involved with freight, why not. 6 months ago, back in May, I posted Mother Trucker with the following chart and suggested that those halcyon days couldn’t last.

Getting back to UPS, Maersk et al. These companies are often considered bellwethers of the economy. Obviously, with both UPS & Maersk sounding warnings on their earnings and cutting staff cost, their shares took a dive.

These global freight carriers show a good correlation to the economic cycle and act as indicators for turns. Interestingly, the Fedex stock price remains elevated, right up there with the S&P 500. They are not immune to the downturn in freight, so I expect that it’s just a matter of time that they, too, take a tumble (along with SPX).

What I find fascinating is the bigger picture observable in the above chart of stock prices for these global freight companies. They signaled a massive turn in 2018/19, which took us into 2020 and the Covid-19 pandemic. Of course, Covid resulted in free money, both via handouts AND in zero percent interest. This free money period temporarily saved the 2020 economy BUT at the expense of the 2023-2025 economy. I am convinced that what might have been a fairly ordinary recession in 2020 has now been juiced up to the max as people made long-term commitments on the basis of the free money economy of 2020/21. You can literally see the consumer excess in the wild swings of the stock prices of Fedex, Maersk, and UPS. Free money resulted in massive leverage, speculation and consumption. And now it’s all over.

Not only are people struggling with the high cost of living and debt servicing, they’re about to be hit with concerns of whether they’ll hold on to their job.

The above chart shows that manufacturing sector employment leads broader employment conditions into and out of recessions. Both are saying “into” at present.