News of wars and escalating tensions are everywhere and the list of new conflicts seem to be growing daily.

Bombs and bullets make for spectacular headlines with full color images and high resolution coverage of destruction, death, and suffering. Such spectacles also distract media and other overseeing institutions from more mundane hostilities that grind away against ordinary citizens and households day after day and are escalating even now.

Some leaders use external conflict to distract their population from their own internal issues while others have a desire for conquest and to extend their personal power. Then there are those who simply can’t tolerate other people holding to different ideas and see a violent response as the only course of action.

This planet is certainly a challenging place for higher lifeforms who are having to contend with matters of conscience and compassion.

The U.S. demilitarized zone

Across the developed world there is another war zone that has been raging for several years now, even for those of us that are not living in a zone of physical conflict. And most households are living directly in the firing line between opposing forces.

Central banks and central government are at war and household finances are the ammunition being spent. Between higher interest rates and higher taxes (a.k.a. tariffs), U.S. households are collateral damage in this economic war.

The central bank wants inflation at more acceptable levels and has raised interest rates to achieve this (to slow economic activity of households).

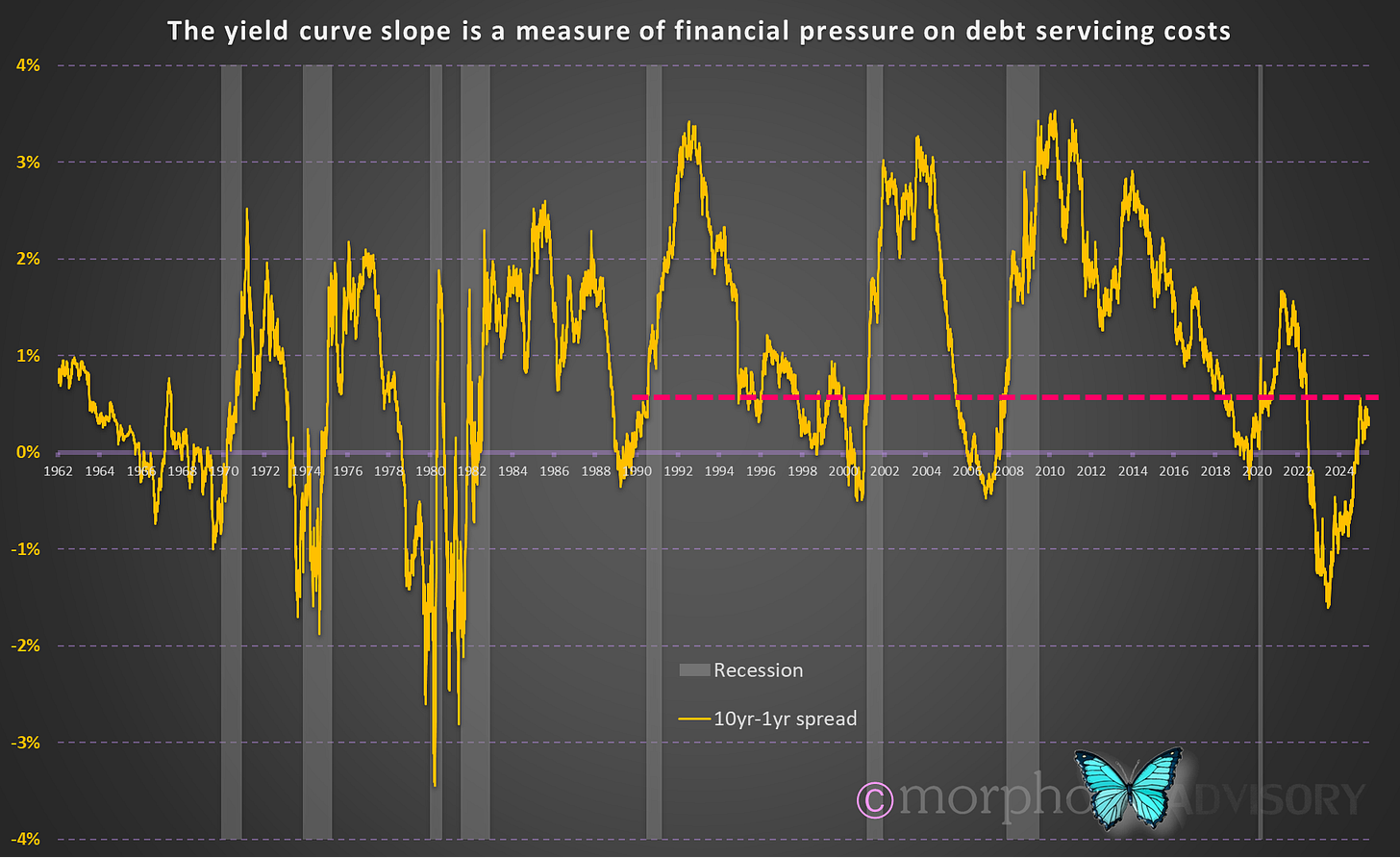

The yield curve is one way of assessing central bank financial pressures for borrowers. The following chart shows the difference between the 1-year and 10-year treasury yields.

And the following chart shows the method of yield curve evaluation that I developed (designed to work even in a zero/negative interest rate world), which shows the curve as still being inverted (i.e. restrictive financial conditions).

By contrast, the federal government is OK with inflation but wants interest rates low, so that they can borrow and inflation will make their debt shrink relative to the size of the economy and servicing that debt can still be manageable (to this end, a recession is an acceptable payoff and the current administration has said that this might be the case). In the meantime, tariffs are a way to raise tax revenues while telling everyone that it is a tax on ‘those bad people over there’ instead of U.S. citizens (… until U.S. citizens go shopping a few months down the line).

So here we have U.S. households paying significantly higher interest costs and facing new consumption taxes … on top of which there will be state sales taxes.

Resilience testing

We read that the U.S. economy is resilient because GDP growth and the unemployment rate both report that there is no need for concern, which only encourages both sides in this conflict to stick to their resolve.

Neither side will crack until U.S. households crack. [A battle of wills is easy when it’s not your own bank account that’s on the line].

U.S. consumers have been spending more money, which makes GDP growth look good, but once you adjust for inflation, they’ve really just being spending more money to buy the same amount of goods and services as before. And when the tariff impact begins to flow through, the spending itself will reduce because interest rates are not moving (at least, that’s the current thinking).

The only thing that will keep the U.S. households going in their addictive habit to consume is more income.

Shoot first ask questions later

The YouTube algorithm randomly decided to throw the following suggestion at me.

It seems like gun store owners in the U.S. are seeing the same behavior they saw prior to the last recession - gun owners selling their personal armory to generate cash (yes, things are that tight). It’s anecdotal, but aligns with other economic trends. And you know me, it sent me down a rabbit hole in search of U.S. gun sales data to see if there was any information to be gleaned.

There was, and it was interesting because it was countercyclical.

Those of us from outside the U.S. have always marveled at the U.S. obsession with firearms and the militant belief bordering on religious fervor by certain sectors that the Second Amendment to the United States Constitution is like a God given commandment. But it’s clearly a cultural thing and each to their own.

Here’s what the gun sales data shows: when the going gets tough - economically speaking (really tough, not just a little bit tough) - U.S. citizens buy guns. And when the economic situation improves, they stop buying them (and even sell). Nevertheless, there is a period leading up to an economic recession (slowing economic growth) when gun sales growth is also weak (i.e. more people wanting to sell than buy) as owners need cash more than another firearm.

There is an inverse relationship between U.S. gun sales growth and the economic cycle (in this instance measured using the ISM Manufacturing Index). But there are periods of divergence prior to economic recessions where cash is needing to be generated via asset sales (i.e. guns) as financial pressures build. The above chart includes arrows to show the periods where there is a divergence in the cyclical correlation. Each of these was prior to an economic recession (2001; 2008; and 2023-2025). This is yet another illustration of the economic pressure U.S. households are under (and have been for some time).

The worst bit is, in this time of heightened tensions and militant attitudes, when recession does hit, U.S. households will once again rush to their local gun store because gun ownership at any cost is de rigueur during such periods, but will they have restraint in their use this time around in the current environment?

ESG policy permitting (most don’t), you would think that shares in a firearms company would be good countercyclical investments on this basis.

Looking at the above chart, it’s a mixed bag. The 1990 and 2008 recessions saw Ruger’s share price fall, while the 2001 and 2020 recessions saw prices rise. What’s interesting about that combination is the relationship to asset wealth (especially house values) rather than cash flow wealth (income).

In 1990 and 2008, there was a loss in real value of people’s real estate, which made them feel especially poor. In 2001 and 2020, house values remained elevated, so why not throw that new gun on the credit card because people were still feeling wealthy enough to afford a gun to shoot at the approaching recession. So, watch what house prices do. I expect them to come off as they have remained artificially high given what interest rates have done, which would not be favorable for firearms companies.

In any event, a company such as Ruger faces the same problem as all small-cap stocks: a stalled/falling share price during the period when interest rates rise.