Zero-G drift

Newtonian economics

Layered forces of influence with nothing in between

We live within a planetary sphere of gravitational influence that itself operates with a larger sphere of gravitational influence (solar system) that is also a subset of a larger such sphere (Milky Way galaxy). There’s probably more layers, too. The space in between is called … “space” and is a vacuum. Aristotle is supposedly the first to tell us that, “nature abhors a vacuum”. Yet from our perspective, this vacuum exists because of the various layers of gravitational influence is sufficient to hold heavenly bodies at a distance.

This fractal arrangement also moves inward to our cells with their nucleus and spinning electron structure.

It’s surprising then, how little thought is given to human behavior operating under the influence of this universal pattern. It’s probably because it hits us at an unconscious level. At a conscious level, we’re more aware of our free will (perceived or otherwise).

Financial markets are drifting and they’re doing so based upon the last force applied to them, which was the velocity of a panicked drop hitting a firm floor of buyers resulting in a bounce.

Every body continues in a state of rest, or of uniform motion in a straight line, unless it is compelled to change that state by forces impressed upon it.

[Mathematical Principles of Natural Philosophy (aka Principia)] - Sir Isaac Newton

Buying and selling is an external force that can be applied to markets. But gravity remains ever-present.

Gravity in the context of financial markets is determined by the mass of the underlying economy, which fluctuates considerably more than heavenly bodies. Meanwhile, markets like to play in the upper reaches of the atmosphere (i.e. the exosphere where satellites orbit).

Not many people pay attention to the relationship between the financial mass of the economy and the gravitational influence it has on financial markets. There is this widely held and misguided belief that “surely, very smart people are looking at this all the time and would inform us?”

In November 2008, Queen Elizabeth II asked why no one saw the Global Financial Crisis coming. Even now, many economists have attempted to explain it, but you’d be better off watching the movie “The Big Short” to see that it was the confluence of human behavior (mostly greed) expressed through property speculation, financial institution bonus incentives, and a fuck-ton of leverage, with very few people looking at what might tip the whole thing over (i.e. gaining a contextual understanding of the operating environment).

This is where I, once again, lay out the contextual bit and tell you that the underlying economy is losing mass, which is a systemic risk for those playing at the edge of space. A loss of mass in the economy means the planetary gravitational reach gets pulled back, and it potentially occurs with the characteristics of a well know ‘loss of mass’ situation - nuclear fission (i.e. a rapid release of energy that sends financial markets back to Earth). We’ve seen this sequence before.

This last week we’ve been led to believe that the U.S. economy is strong because BLS payroll numbers were higher than expected. But BLS numbers are not real data, they are a calculation based upon a model that estimates, which works reasonably well in a ‘business as usual’ environment, but they are also subsequently revised and have been consistently revised lower over the last couple of years.

The following chart compares the BLS nonfarm payrolls to the ADP nonfarm payrolls, which went negative this week. Additionally, I’ve thrown in advance retails sales and the ISM manufacturing index to give broader context.

Manufacturing has been contracting for over 2 years. Real retail sales growth has been sluggish to nonexistent over the same period. In this context, the ADP numbers seem more likely. There are other datasets that confirm my interpretation, like construction spending.

But here’s one I think worth your consideration. Think about human behavior when financial conditions are increasingly uncertain and challenging, especially for a prolonged period. What do people do? How does their behavior change?

They cut back on their spending and they keep a little more money in reserve … just in case.

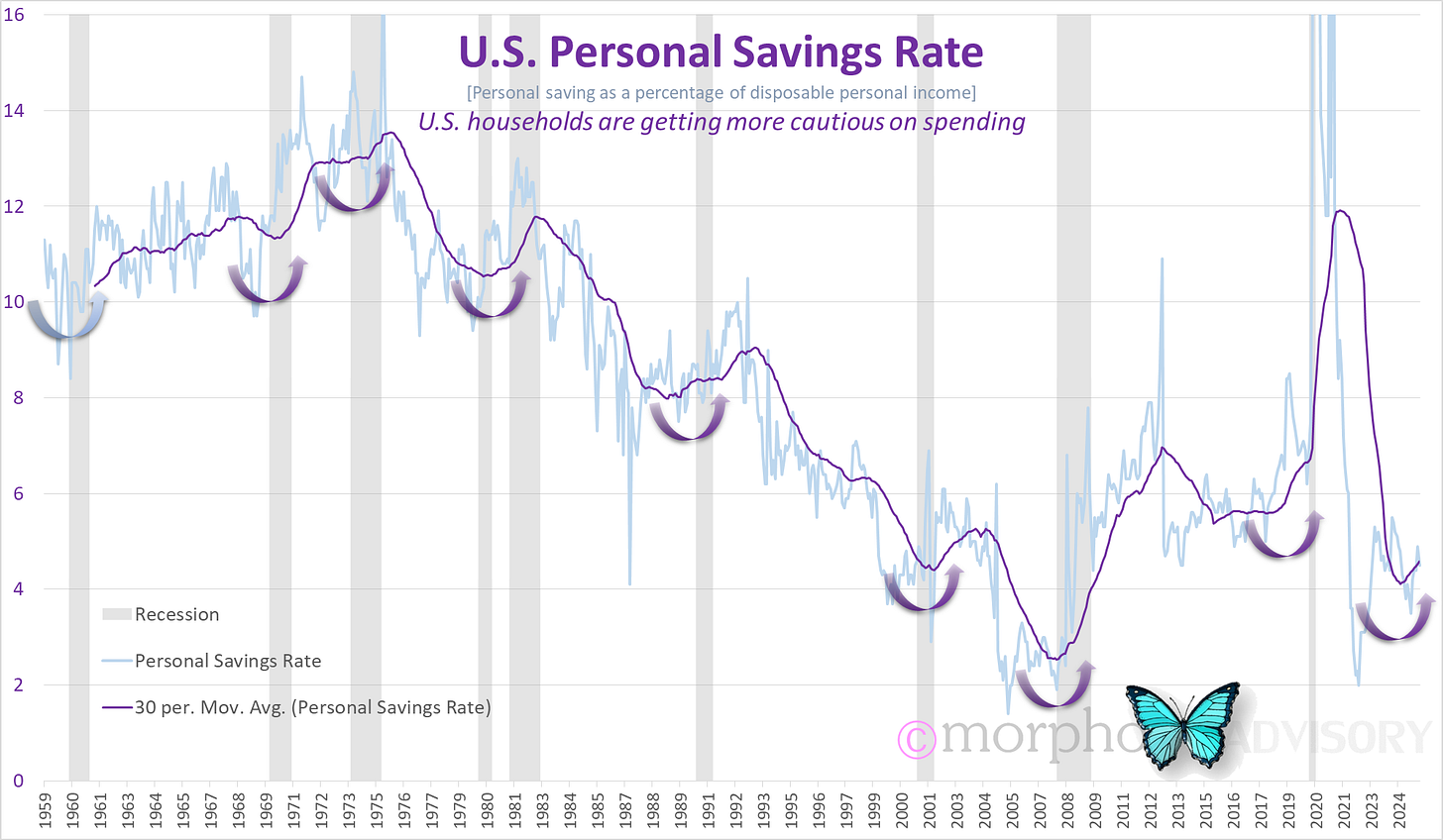

A two and a half year moving average of the U.S. personal savings rate smooths out short-term swings and provides an insight to behavioral trends. Since the boom times post-Covid-19, U.S. households have been trimming back on their spending as higher interest rates and rising unemployment create a more cautious outlook.

The bottoming and subsequent move higher of the long-term trend in the personal savings rate has coincided with the last 9 recessions. Will the current move higher be number 10?

Probably. That’s how officialdom (and all humans) work. Just like financial market speculation that deviates from the underlying economy increases until reality catches people out, so too do officials like those at central banks keep pushing their luck (they call this being “data dependent”) far beyond what Scotty would push the starship Enterprise (she cannot take much more, Captain). Only when things break does behavior change. Only when a new force is impressed upon human behavior are people compelled to change, just as Newton suggested was a principal of natural philosophy.