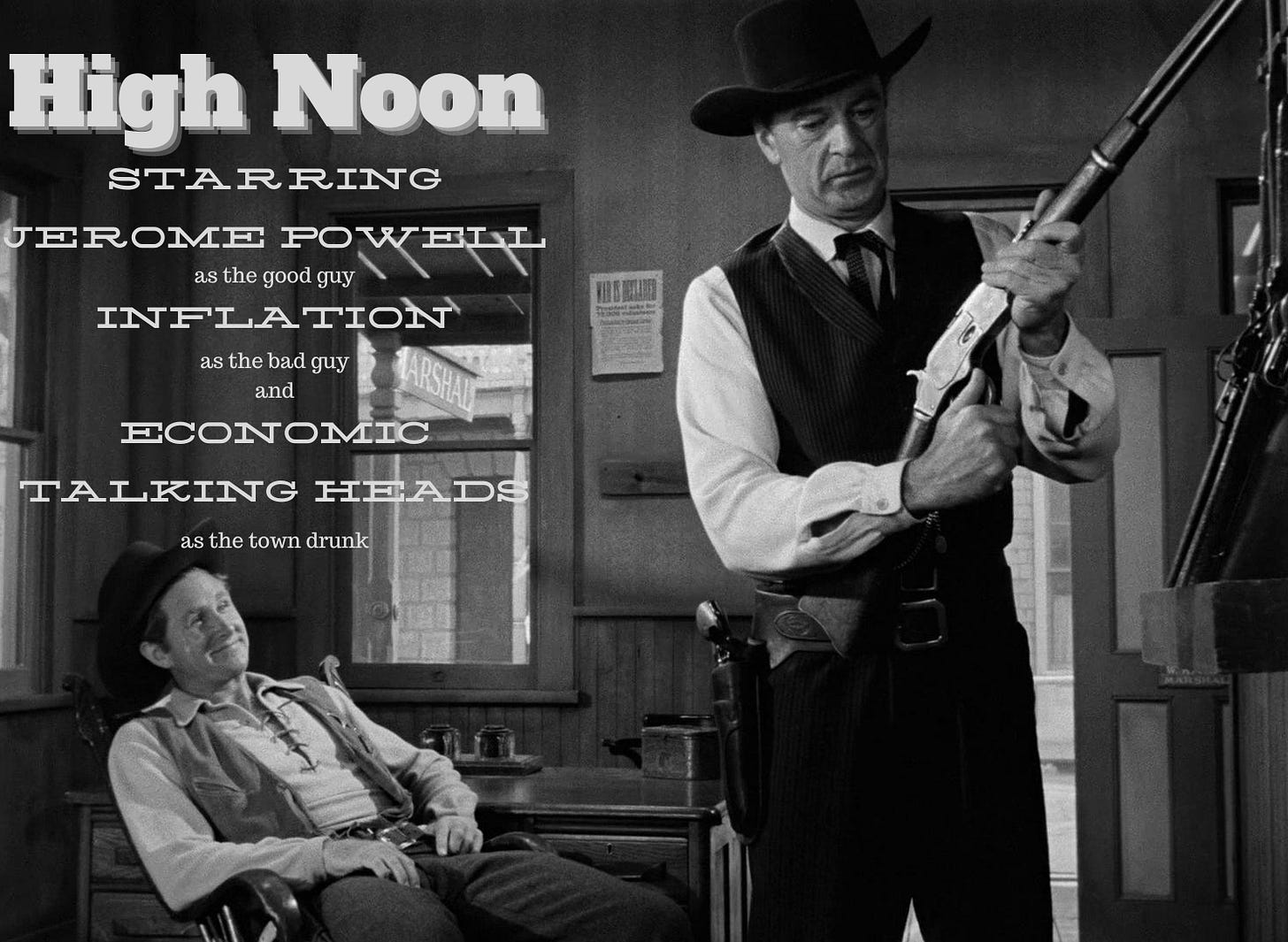

The crowd is excited about how Inflation has come to town again, wearing his black hat to signify his “bad guy-ness”. For the last few months, murmurings have rippled through media spectators and townsfolk with most saying how he’s here to stay this time and that Marshall Powell may just have to accept Inflation living large in his town.

However, for the same reason that I said last August that inflation was going to have a pause in its fall, I’m now saying we’re going to see another couple of months of inflation holding up before its fall resumes. This is going to whip the talking heads and bond markets.

For people who think differently

But before I get to presenting my analysis on inflation, I want to offer the following educational piece, which I think is brilliant and insightful. I’m surprised that I haven’t seen it before now.

This video is an episode from RT’s Renegade Inc. called The Finance Curse (published 6 March 2017) and talks about the banking system. It is U.K. focused, but the principles involved apply across the developed world. Richard Werner is beautifully articulate in describing how banking and our modern world of finance works (mostly in the 2nd half of the show, but the whole episode is useful to watch). Not only does it align with my own understanding, but hearing how banks trade in securities reinforced my own view that tokenization of every aspect of the economy in addition to the sort of unit pricing we see in the asset management industry can replace our current concept of currency, including both fiat and crypto. Wealth is the production of goods & services as per Adam Smith and portability plus transferability of wealth can now be done by making all aspects of goods and services tradable capital market securities via tokenization and the blockchain. I initially threw this original idea of mine out there in my first post on this Substack almost 3 years ago (there’s a link in the post to a PDF article).

Gunfight

Right, back to inflation and what’s looking like an interesting 6 month period ahead of us.