Sing hallelujah

The major headline economic data of late has been fairly positive: GDP; unemployment; and inflation. They’ve all been behaving. The stock market, too, has been on a righteous path.

The large institutional choir made up of Fed officials and Wall St. economists sing, “Hallelujah” as the Federal Funds Rate is lowered and give thanks for the miracle of a soft landing.

After church, they go back to their gated communities.

Meanwhile, in the real world ….

Life among ordinary believers - those who put their faith in higher powers, trusting they know what they’re doing - is not quite so comfortable.

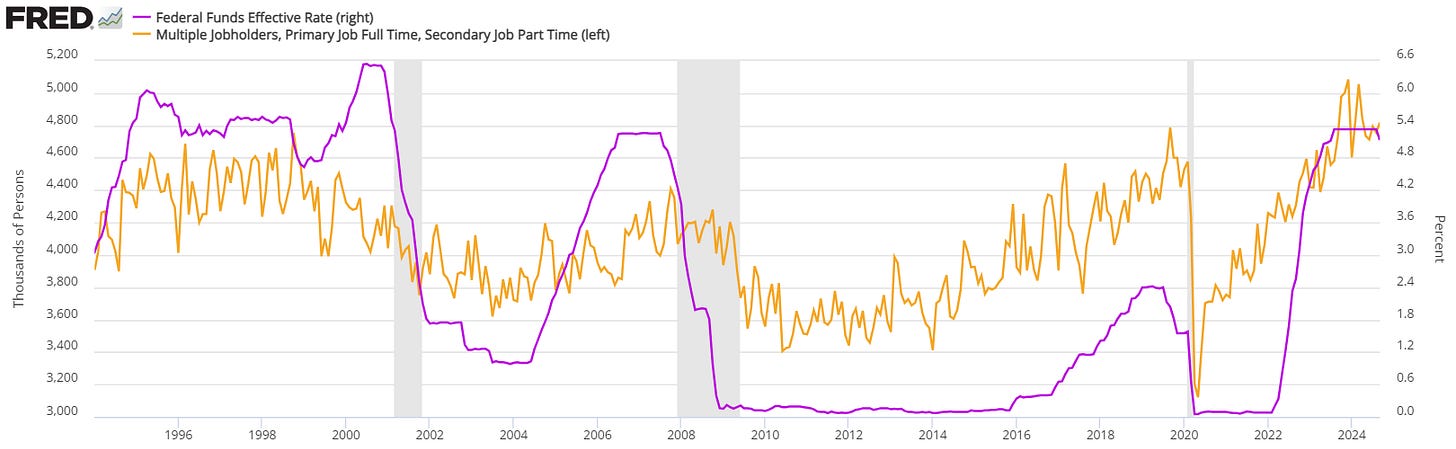

The need for a second job just to make ends meet is higher than any time in the last 30 years.

And by the looks of it, the first thing multiple jobholders do when interest rates start to fall is seek to regain some of their quality of life (i.e. time > marginal income) rather than rush to the shops. Either that or their second job is taken from them.

Already, it looks like the number of work hours is being reduced as economic activity continues to underperform, as indicated by multiple manufacturing indices.

How else can households make ends meet?

We’ve already looked at how U.S. households cope during such periods back in March of this year. They turn to their credit cards.

And credit card data isn’t painting the pretty picture preached from the pulpit of the U.S. Federal Reserve by Reverend Powell.

The data history is short, but the number of credit card holders paying the minimum balance is rising and near record highs, while the number paying the full balance off has been falling.

That means that U.S. households are exposed to very high interest rates that compound monthly.

On top of that, while wholesale interest rates and the Fed Funds Rate have been falling, credit card interest rates are rising.

So, are we really in a monetary policy easing cycle yet? Not for those living at the margin.

Their interest costs are still rising while their income is looking less certain.

Officialdom can preach the Gospel according to Soft Landings, but miracles of this variety are to be believed, rarely seen. I’m preaching the heresy of Thomas, full of doubt and requiring evidence.

The above chart of credit card interest rates relative to wholesale interest rates reminded me of another divergence we’ve looked at before.

Prior to a recession, not only do credit card interest rates continue to rise while wholesale interest rates fall, but so do small-cap stocks struggle and fail to make new all-time highs while large cap stocks continue to sail effortlessly to new highs.

Despite the positive major headline data (much of which is subject to revision), the details still suggest that this cycle is very much like every other cycle that ended in a hard landing.