Transitory inflation

Transitory inflation seems to be an inflammatory phrase these days. Perhaps that’s simply the social media impact, where everyone feels a need to express their view. I guess that’s what I’m doing here, although this is more of a response to the response.

I mentioned in an earlier post that I believe people are getting a little confused on the matter of inflation, mistaking the large price jumps we are experiencing for being the same as saying that inflation is here to stay. Inflation refers to the percentage change in prices. If inflation is here to stay to the degree that we are currently experiencing then prices will, by definition, accelerate to infinity pretty quickly1. The following chart produced by Callum Thomas of Topdown Charts is an excellent illustration on the matter. In the chart he shows the correlation (and a high degree of causation) between the price of oil and headline inflation. But what he also does, for the sake of convenience (i.e. it’s not a projection of the expected path for the price of oil), is to assume that the price of oil remains unchanged from current levels. The result, as illustrated, is that the implied rate of inflation drops toward zero.

In my earlier post linked above, I point out one key difference of the COVID-19 crisis compared to other crises. That difference being that because of massive and sustained Government fiscal intervention, this crisis did not result in a drop in consumer demand as is normal when there is an economic downturn. Rather, it increased consumer demand by raising disposable income through stimulus payments, which when paired with the inability to spend because of lockdowns, created a massive store of pent-up consumerism.

The usual flow of events during an economic crisis goes something like:

interest rates rise making borrowing more expensive to service

people spend less on other things as money goes to servicing debt

companies cut costs due to lower revenue to preserve profitability and limit loses

people lose jobs

markets tumble

spending slows down further due to reduced income and increased uncertainty

companies cut back more

more jobs are lost

etc. etc.

The usual process of economic crisis is a failure in demand (i.e. spending drops). However, in the COVID-19 crisis, people got paid to not work and in the U.S. they are still not working and businesses can’t get the employees they need. What this shows is that Government intervention is THE key cause of the current jump in inflation. People have not slowed their spending because they are not feeling the usual uncertainty associated with job losses due to the Government buffer. They are enjoying an all expenses paid holiday. The upshot of this has been that we experienced, and continue to experience, a failure in supply (i.e. people still want to spend the money they saved during lockdown (because they couldn’t go out) plus the stimmy payments they received).

I confess that I did not foresee the impact of Government intervention on the economy until well into the piece.

Shame on you if you fool me once.

Click & Collect culture

The problem with the COVID-19 crisis is that it, due to its highly infectious nature, has slowed the process of producing and shipping goods and raw materials, even though the global economy has the productive capacity to provide the goods people want. In fact, the global production of goods and the the volume of global trade has been at a point of equilibrium since 20062, as the following chart shows.

What this charts illustrates is that there is no rationale for the current spike in inflation other than excess money meets delays in sourcing stock. It is purely competition for temporarily limited supplies, i.e. consumer impatience. In today’s click & collect culture everyone wants things now. We have become so accustomed to the immediacy of same day shipping and overnight delivery (if not earlier) that we have lost perspective.

Economic Jenga

On-going Government fiscal intervention is causing consumer price inflation and on-going Quantitative Easing is causing financial asset price inflation. Has the United States stumbled its way into the Japan and EU situations? That is quite possibly the case. Any reduction in Government agency support will likely lead to an economic and/or market reaction. But how long will the establishment continue to use the federal balance sheet to protect the people from economic reality? Knowing Governments, once they start implementing a policy it is nearly impossible for them to stop. Will the outside world force them by causing the U.S. to face a sovereign debt crisis? Possibly, but that’s not an immediate concern.

Federal intervention is acting like beta blockers, the pricing signals that make people consider their spending aren’t getting through. If Government agencies prolong their intervention then inflation is likely to continue to some degree, which will lead to consumer stress of a different sort. In a traditional crisis it is income (or certainty of income) that drops causing people to not maintain previous lifestyles. In this current crisis, with on-going fiscal stimulus, people will eventually - if it’s not too late already - be unable to afford prior lifestyles because the price of goods and services will move beyond their reach. Yeah, I think I mentioned something about inflation being like an accelerated tightening cycle in a previous posts.

The Government is damned if they do, damned if they don’t - it’s just a matter of time. And on-going lockdowns, masks, mandates around vaccines and vaccine passports etc. is growing the likelihood of civil unrest, which will further distort the situation.

BOLO

In the meantime, I’m watching what key Government agencies are doing. It is their actions that is a key driver of what is happening in the economy and in markets at present. Just as quickly as they intervened they can withdraw their support - the support that was described as “emergency” action, but somehow continues.

I’m also watching to see if the temporary constraints are giving way, with supply finally catching up to the strong surge in consumer demand. It’s early days yet, but we may be seeing the first signs of this … or is that just the COVID-19 Delta variant at work, further delaying supply?

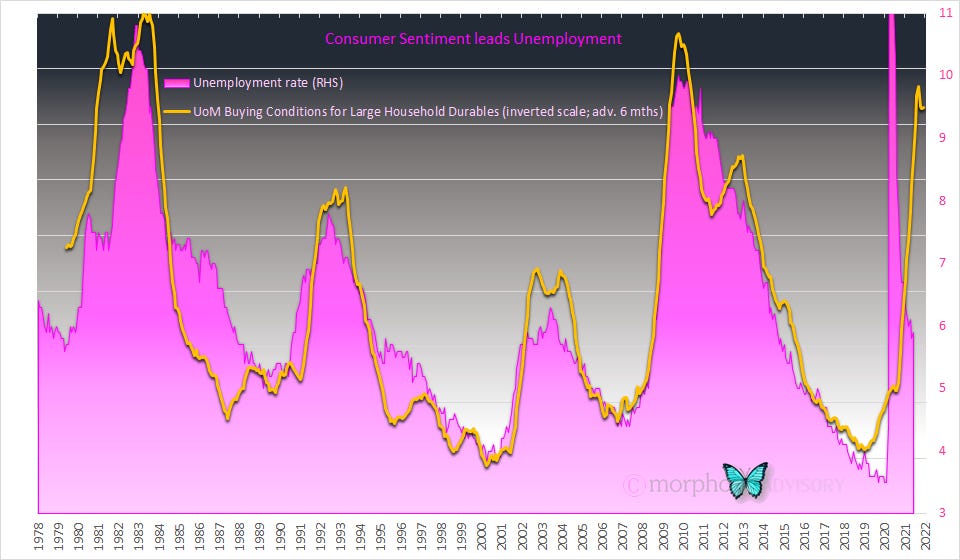

Maybe it’s diminishing demand due to the higher prices causing consumer spending to slow? Consumers are currently saying that it’s not a good time to buy larger assets, which historically has portended difficult times ahead.

The current spike in inflation is due primarily to temporary supply problems rather than being a sign of an overheating economy. This inflation, just like a monetary policy tightening cycle, will have the impact of reducing demand (i.e. there will be less disposable income because of higher prices). A reduction in demand will lead to a more traditional economic slowdown and market event.

Obviously, Governments and central banks will feel forced to continue their intervention. Maybe people will now be conditioned to believing their intervention will save the day? But all that debt! Perhaps we’ll go through seasonal cycles like the Dust Bowl during the Great Depression where annual drought over multiple years prolonged the hard times? It is easy to believe that new variants of COVID-19 that are more contagious or vaccine resistant could spring up each year. Whatever happens, expect volatility.

False Dawn

Many traditional economic indicators suggest that the crisis is over and that we are at the beginning of a new growth cycle. The steepening of the yield curve has already peaked, which typically correlates to a post-market crash period that is followed by years of recovery. The jump in the unemployment rate during mid-2020 now appears to be recovering. Trade and economic activity fell in 2020 also, but they too have shown a strong recovery. Yet, I remain unconvinced. I am unconvinced because this crisis was a non-traditional crisis (you may recall the word “unprecedented” being used a lot). It played out on the supply side, which is ironic as I think we’re nearing the end of the supply-side economic experiment and its trickle down ethos that gives gifts to the wealthy believing that it will benefit all3. I believe we are yet to see the longer lasting demand side impact as a result of people receiving that periodic reminder to live within their means - this time via an inflation induced higher cost of living.

As I said above, there is enough global production capacity to meet demand, it’s just that the ability to move goods and raw materials at speed has been disrupted, resulting in transitory inflation. The following chart shows that U.S. production has not grown for the last 15 years because it hasn’t needed to.

What stood out to me when I produced the above chart was clear peaks and troughs in the growth rate that I have highlighted in the following version of the same chart.

It clearly shows that WWII caused a massive rise in production, but outside of large-scale war, production growth moves in sequence with population growth, as the following version of the chart further demonstrates.

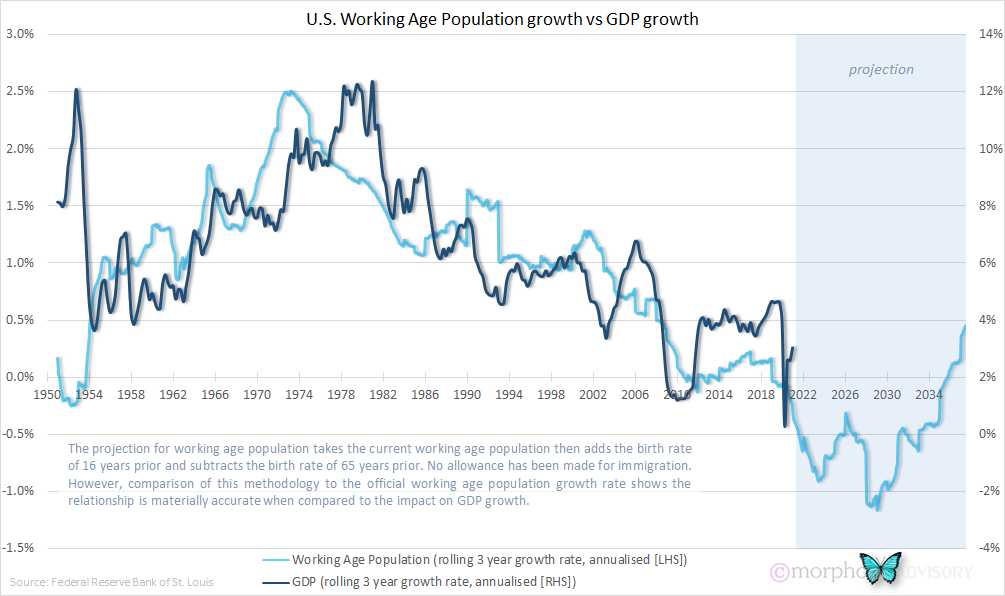

In addition to highlighting the relationship between production and population growth, the chart also shows that both production and population growth have been steadily falling. In fact, both are now experiencing no growth. Essentially, the economy is dying of old age. O.K., that’s a bit dramatic - perhaps slowing in its old age. But things are about to get worse, as the following chart shows.

The working age population in the U.S. (the productive component of the population) is currently below zero and will remain so for for the next 15 years or so.

Three-card Monte

So, while everyone is distracted by current supply problems and seeing indicators of a strong economy, as signaled by rising asset prices and inflation, the greater threat is going unnoticed. Supply problems combined with COVID-19 lockdown restrained spending that has recently been unleashed are creating the perception of strong consumer demand. As a consequence of these two facets, the economy has been in a transitory ‘catch up’ mode rather than commencing a new growth cycle. This was just a single freak wave that has caught everyone’s attention, but they are failing to see that the tide of consumer demand is going out.

I was caught off guard, looking the wrong way at the start of this thing. I called the downturn unlike many, but I was fooled by the response and its implications. This time I think many have been lulled into believing we are in a new growth cycle (or at least, back to normal) and, should the need arise, that on-going intervention will continue to save the day. The many will be slow to realize that a greater unfolding is at play, which is exactly the setup required for such an event to materialize.

Shame on me if you fool me twice.

This only happens when a unit of currency becomes worthless, i.e. hyperinflation. Despite the current lack of fiscal prudence by various Governments, we are a long way off from that scenario, in my opinion.

There has been no need to expand productive capacity because it comfortably meets consumer demand. Remember when China bought up global commodity supply chains and there was a global commodity boom just before the GFC? Yep, there’s plenty of productive capacity, but we now have declining population growth across the developed world, which means a slowing consumption growth rate.

Supply-side economics believes that if you cut taxes for the wealthy then they will invest their wealth and create jobs for the less wealthy. A nice theory, albeit simplistic and erroneous. People become wealthy by creating businesses based on ideas, and those that take risk should profit from their actions. However, without new ideas, no amount of tax incentives will create wealth or jobs for others. Tax cuts simply make the wealthy wealthier, it doesn’t give them new ideas to invest in. Wealth itself is sufficient incentive for those with good ideas to take risk, regardless of tax rates. The supply-side economic theory has served to create a massive wealth gap across society as Governments gambled with other people’s money. That puts me in mind of the following Bible verse, which we might be just about see play out in nations that have employed supply-side theories:

Proverbs 22:16 (NIV): One who oppresses the poor to increase his wealth and one who gives gifts to the rich — both come to poverty.