I really am that good

World class! That’s what I am. In fact, ‘world-leading’ is a better description. I’ve never been one to put myself forward or brag and, as I’ve said before, it has been a life-long struggle for me to believe that I’m as good as others, let alone be better. Perhaps that’s why I’ve dug deeper & researched more broadly than others. Now however, over the course of recent years, I’ve come to realize that I am among the best in the world at what I do, having stepped outside the corporate world and begun to think for myself, using my 33 years of portfolio management experience as a base from which to build (not that I’ve seen everyone else's work, but from the observable outcomes it is clear that very few think different from the crowd).

I have three unique gifts that I believe set my work apart:

I am endlessly curious and my mind is restless in its pursuit of an applied understanding in whatever arena captures my attention (plus stuff stays in my mind & I can come back to topics after long periods when something new comes along and I think, ‘those things could be related …’ etc.);

I have an uncommon ability to look-through information to grasp the underlying shape & structure of things (hence the “morphology” moniker), and that’s why you’ll see that I focus on much larger cycles & constructs, and why I’m able to deduce unique insights;

I appear to have some talent when it comes to interpretation that escapes most others (to me things just appear obvious and I can’t understand why others don’t see it)

An outcome of these talents is that I also can decide when information is of little or no value and I can discard it so that I don’t contribute to unnecessary noise-making. This is why I am not a poster of huge volumes on social media. I see no point in creating an endless stream of information. My purpose when it comes to online content is:

to continue to refine my own process and enhance understanding;

educate others who don’t have a professional background in markets (… and just pumping out something on everything does more harm than good in this regard as I’ve pointed out before)

When it comes to refining my own process, I am researching entirely new insights. For example: my insights of SKEW that John P. Hussman Ph.D picked up on; insights on volatility; quantifiable insights on how the economy really works & structural stock market drawdown risk that upends conventional economic theory.

Each of those insights are entirely unique to me … never before discovered! And I have others that have enabled be to gain unique insights into the nature of asset price risk, which required me to develop unique measures of market risk (e.g. I have new methods for assessing risk in non-normal distribution environments that challenge nonsense like Sharpe Ratios & VaR etc.).

Yeah, so I’d say I’m good at what I do.

Imitators

The problem with my skill is that my best idea's often require people to be fairly competent & experienced to really appreciate & recognize the value of new things I bring to the table. Hmm, perhaps this is why I’ve accidentally slipped into the role of an educator of financial experts (not just here, but in my offline life too). So far, John P. Hussman Ph.D has been the only one to see my insight on the SKEW Index for what it is, which he wrote about in his Dec ‘22 market comment. The best stuff I keep behind my paywall (and charge very little for). If the implications of just my most recent discovery were understood, any major Wall St. firm should be prepared to pay a very, very large sum to gain sole rights to it because it has the potential to be more profitable than the entire asset management industry’s collective attempts at AI/ML-based investing/trading & turn their entire approach to portfolio management on its head (if I explained it to them). But I want to help real people in the real world by educating them, and not let them fall under the sway of the sophisticated Wall St. institutional superiority myth.

I keep my best stuff behind the paywall because I know the finance industry would quite easily take my stuff and promote it as theirs. I’ve also found that my work appears in other people’s social media posts. Not only is the small financial hurdle of a paywall enough to keep imitators out, it’s a way for me to monetize my talent … although more “savvy” people do that social media constant noise producing thing to garner a large following, which they then convert to paying subscribers. However, I can’t do that to people - milk them financially knowing that feeding them noise is not helpful to them, in fact it’s harmful if they are trying to understand markets.

Perhaps those who have large followings need to imitate others’ work because they feel they must keep producing a constant stream for their followers? Who knows? Let’s look at some examples:

On 31-Dec-22 I posted the following charts:

Two yield curve charts. As far as I know, I came up with the top one all by myself having never seen it anywhere else before (note that the legend describes the source of the data & how it’s calculated, i.e. easy to replicate with that info.). I had also never seen the yield curve charted against the unemployment rate before.

Two days later, on 2-Jan-23, the same indicators appear in one chart on Twitter. Perhaps we had the same idea at the same time? It’s possible. But I do recall thinking that the interpretation given failed to recognize that a yield curve inversion indicates unemployment is about to rise. Interestingly, in my post of 10-Dec-22, I did describe the yield curve as a “real-time indicator of unemployment.”

Anyhow, despite poo-pooing the yield curve as a useful indicator on 2-Jan-23, it was re-posted without comment on 4-Feb-23 and got many comments by people starting to piece together that the inverted yield curve implies unemployment may be about to rise.

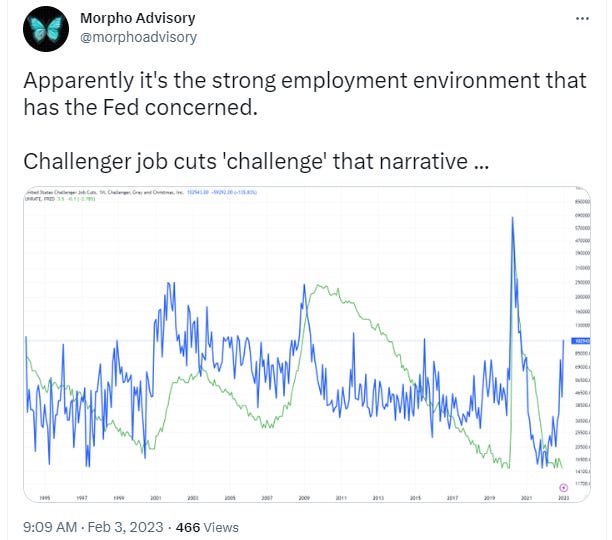

Now, here’s the funny thing. On Twitter the day before, I posted this one again …

And this one …

And this one …

And this one …

And this one …

That’s a lot of evidence that employment is not as healthy as officials suspect, which would given anyone with some knowledge reason to reconsider their opinion if they didn’t believe there was a meaningful signal before.

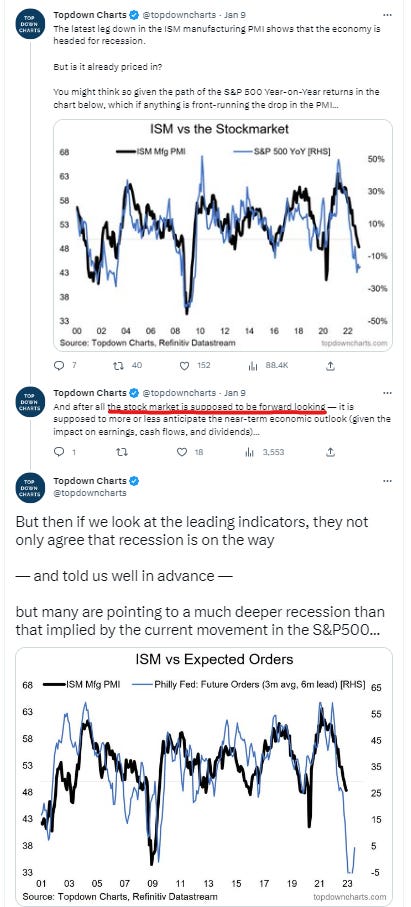

Coincidence maybe? I accept that it’s possible, but like I said, I definitely created the top-most of those indicators. How about this post on 9-Jan-23:

Which came 10 days after my post of 31-Dec-22:

Again, it’s quite possible that ‘great minds think alike’ and all that. However, I have certainly have it recorded in my work elsewhere that the future conditions forecast is produced from Philly Fed data.

I guess, if you’re running a business you want to put whatever you can out under your brand, so why not replicate without giving credit?

I accept that I’ve put this stuff in the public domain (often copyrighted), so I realize that others can replicate it … also I often describe what & where the information comes from (perhaps I’m naive in this regard and should make my chart legend labels more obscure). Still, it would be nice to be acknowledged for being the original source because that may help my business … like Dr. Hussman did (and still does after over 3 years since originally sharing my analysis with him) even though he has made a number of his own modifications to my original idea.

Like my comment to Dr. Hussman says, his type of integrity is rare in the world of finance.

Where do “experts” get their expertise from?

Anyhow, I guess imitation is a form of validation as Oscar Wilde suggested. I don’t know about you, but when I see someone quote another as the source, I go to that source and see what they’ve got to offer. I prefer to follow & learn from producers of original content … the ideas people, the creatives. Still, nothing wrong with aggregators, they play their part providing a source of sources (their talent is distribution).

I may not have the 150k+ Twitter followers or 12,000 Substack subscribers (that are in the process of being converted to paying subscribers - i.e. pay or leave) of my imitator(s), but I generate my own content, and importantly, I add value to the world of finance by uncovering never before considered insights that improve on understanding & investment outcomes (along with a ‘less is more’ ethos when it comes to understanding markets1 & educating), which is an incredibly rare feat.

Only time will tell whether there is demand for my talent, making it a commercially viable proposition for the benefit of all, or whether I simply keep it for my own investing purposes and let the blind continue to lead the blind. I admit that it will be easier for me to make investing profits if I leave people in their ignorance, but the world of finance really does need to change.

Morphology - the pUNk pERsPeCtIve on Investing is endorsed via imitation by people & businesses that many consider to be experts because I really am that good. Who knows? Maybe the word will spread.

When I see people hold to a ‘more is more’ philosophy and producing volumes of content, it is a clear indication to me that they don’t understand markets, and I’m talking professional market participants here.

I love this one! Very fascinating the timing of it all. An educator is a good term for you, because it still allows you the autonomy and creativity! Being your own boss suits x