Shut up and put your money where your mouth is

It’s been a week!

A week ago, markets shit themselves, and over the next few days as markets settled down, my inbox began to fill up with emails from global asset managers trying to explain the ruckus. Additionally, both mainstream and social media were filled up with “explanatory” articles and “insights” from commentators.

I’ve often said the VIX is a one-day leading indicator of market opinion – when a shock happens, everyone races to express their opinion on the cause plus the state of things. I’ve always thought that markets should be forward looking and understand the state of things before time. But I’m wrong. People much prefer hindsight, so much so that they are convinced that Harry Hindsight’s are what market experts should look like (and why such people have such large online followings and can make a business out if it) – those who pop up after the event to explain what happened … just as everyone is searching for reasons as to what has happened. Perception. Wall St. and the financial sector is superb at projecting an image of expertise while possessing very little. Sales and Marketing, people. Sales and marketing.

There is nothing new under the sun.

Here’s a couple of classics (i.e. post-market event ‘typicals’) that I observed this last week:

Academics backing away from their prior work, which has been premised upon observing historical data. Academic-types get very uncomfortable when they are called upon to stand behind their work in real-time situations. They are theoreticians, not practitioners. Making calls and standing by them is not their gig. They like clinical environments where dead data doesn’t come to life and wriggle about while they’re observing its entrails.

An example: A key driver behind markets tanking last Friday was the employment data, which indicated the triggering of the Sahm Rule. However, Claudia Sahm after whom the Sahm Rule was named, has subsequently said that she's not sure this rule will work on this occasion and that she doesn't think the U.S. is currently in recession, although the risks are rising. For background, the Sahm Rule was a side aspect to a research project for determining when fiscal stimulus (i.e. handouts, like those seen during the Covid-19 pandemic) should be employed in the U.S. economy. Because the project was for timing when to make handouts, Claudia Sahm has said that she made her rule VERY conservative because they had to be certain there was a recession. She wanted 100% accuracy. She said that, on average, a recession started approximately 3-months prior to when her rule kicked in. Last Friday, her rule kicked in, but now she's backing away because she's frightened of committing and making a recession call in real-time, but like a true academic, she's doing so by putting up a rationale for potential causes of why it may not work this time. Similarly, only a year or so ago, the person who first noted that an inverted yield curve preceded a recession also backed away from a real-time commitment that the inverted yield curve would work on this occasion. I should also note, as I've pointed out before, the Sahm Rule (like an inverted yield curve) is based upon ex-post data - that means AFTER THE FACT. It is not a correlative measure or a projection, but actual quantitative proof that the economy is contracting as evidenced by the labor market.The emails I received from global asset managers generally followed the same theme: attempting to calm people, saying pullbacks/corrections are normal market behavior etc., and even explaining away the employment data (i.e. choosing to interpret data so that it produced the narrative they wanted). None of these institutions published a cohesive picture of the state of the economy or anything that may have been able to locate where we are in the current economic cycle (unlike the work I do here), they were just dutiful obligations to send out a market update after recent events - a reaction. It was typical “stay the course” type content. This is common sell-side conduct.

An example: one asset manager's email tried to explain that rising unemployment and the Sahm Rule could be ignored because Nonfarm Payrolls added 114,000 jobs, which signifies a growing economy and that recessions typically see a negative Nonfarm Payroll print. This analysis was fairly loose in its accuracy and conveniently ignored the fact that the unemployment rate and the Sahm Rule are ex-post (after the fact) and are not subject to revision while Nonfarm Payrolls are subject to multiple revisions.

The above example of using Nonfarm Payroll data to explain away Unemployment data got me thinking. Could I observe anything from the Nonfarm Payroll revisions? Could the 114,000 new jobs added (as published last week) be subsequently revised away?

Indeed, it’s quite possible, maybe even probable.

The following chart shows the initial Nonfarm Payrolls data published each month and the subsequent revision to these payroll numbers. The revision data can be a bit noisy, so I turned it into a 10-month average to extract the signal from the noise.

We are in a period where Nonfarm Payrolls are being consistently revised lower by an average of approximately 50,000 each month. Consistently lower revisions, especially of this magnitude, typically indicate a recession, with only few exceptions:

The mid-1980’s. This was a time of the widespread adoption of neoliberal economic policies: privatization; economic liberalization; deregulation; the financial market "big bang"; Reaganomics in the U.S., Thatcherism in the U.K., Rogernomics in N.Z. etc. This time of structural change explains why Nonfarm Payrolls would be consistently revised lower outside of a recession.

2017-2019. This was a period when, for the first time since WWII, that working age population growth was matched by growth in the retiring population, i.e. a neutral rather than growing labor market.

The current period (since 2022) may include an aspect of an aging population and accelerating retirees, and also a reactive element post-Covid-19, but the persistence and the acceleration in downward revisions to Nonfarm Payrolls suggest recession is also present.

It is also worth noting that much of the other data that officialdom use as input for making their policy decisions (or determining the presence of a recession) is of this ‘multiple revisions’ variety. This is one reason that they are typically overly optimistic going into a recession. The good-looking data they gaze upon gets retrospectively revised away. It also highlights a significant flaw in their process. They use academic research to build their process, but academics use long-dead data (i.e. all the revisions have been done and dusted). So, now you might have an appreciation for the work I’ve put together on this website because it provides a real-time picture of what’s really going on and tells me what is coming up, allowing me to know our location within the economic cycle. And I’ve been quite accurate so far:

I called the top in interest rates in late 2023, when everyone else was hating on bonds.

In mid 2023, I called the pause in the fall of the inflation rate that hit earlier this year … and earlier this year when everyone was saying that inflation is a persistent and growing threat, I called the subsequent continuation of the downtrend in inflation that will hit this coming quarter.

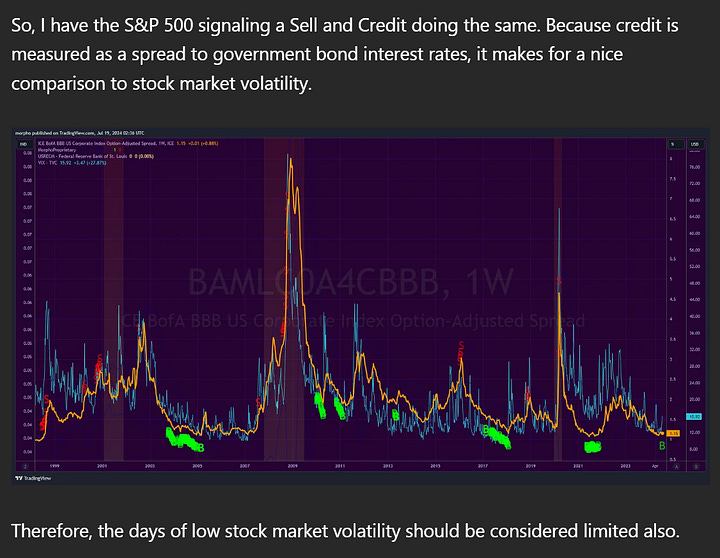

In the middle of last month, I warned of a turn in equities, jumping credit spreads, falling interest rates, and spike in volatility. I‘ve been warning of the potential for a large vol spike for some time because of the large volume of short-vol trades and 0DTE options.

And through it all, I called for recession of the hard-landing variety while everyone was saying, “soft-landing” or “no-landing” … and many still are.

I did get the recession timing a tad wrong, but not by much in the grand scheme of things. Hey! I’m not perfect. But I found out the cause of the delay, which enabled me to further improve my process, so even that’s a win.

I did all of this, not by just expressing my opinion as do all the noisemakers in mainstream and social media, and institutional fund managers plus the Wall St. crowd who run with the prevailing sentiment and market price action. I was able to do it because I applied myself over many years to building a robust and repeatable process of analysis, applying sound and consistent principles of exegetical interpretation. If there was any area that was simply my opinion, it was in the area of applying my observation of the behavior of people in relation to markets, which I have built over the last 35 years as a market practitioner. And I did all this because over those 35 years, I realized that officialdom, Wall St., the media (mainstream & the “experts” on social) don’t have a process. They’re all winging it - with the exception of one or two individuals, but most people don’t have sufficient knowledge or insight to be able to tell the difference.

Paywall peeks

Just for shits & giggles, here’s a look at some of the charts I posted behind the paywall in the section titled ”Charts galore” in my “Why bother?” article posted mid-July, so that those who have subscribed for ‘educational purposes’ under the freebie option can see some of what they’re missing:

Not bad, if I say so myself. And even the coding of my trading model I designed and built with the intent of capturing a specific thing.

In summary:

Academics and officialdom are still fence-sitting. Read this article by the Financial Times as a superb example of how academics and policymakers want to wait until it’s too late before committing.

Markets are in that nervous laugh phase after a big tremor, that collective sigh *phew* that we might have dodged the big one. I’ve observed this human behavior after earthquakes and in financial market shakeouts.

However, this market shakeout is what was needed to crack the fragile shell that holds our financial markets together. It has created uncertainty and that is sufficient to halt the momentum trade that we’ve experienced of late.

We will likely be in for some more selling in the near future. We’ve had the initial shock, but now Investment Committees at fund managers around the world will have begun gathering together to reassess their current portfolio positioning in light of recent events. This usually lags market shocks by several days to a few weeks. These sorts of people will be particularly influenced by the news that Warren Buffett sold half his stake in Apple and also unloaded his holdings in Bank of America, too. In the meantime, all the market punters have seen markets begin to recover and are starting to pile back in to make a quick buck on what they see as a profitable dip. So, we can expect a momentum swing as the big players look to reduce their risk asset exposure with sharp corrections in between the large down days.

Final thoughts

I have been truly surprised over the years to find out that people really aren’t interested in accurate forward looking market information (both institutional and individuals). If you ask them directly, they will say, “Yes, we want forward looking information”, but in practice, they don’t. I’ve shown some of my work to large global institutions, but what they’re really after is brand – a brand that they can sell because their customers (usually those higher up in an organization) recognize that brand and take comfort and a sense of security that that brand provides them (i.e. ass-covering should things go wrong). I mean, look at the brand names in the Financial Times article: “White House”, “Harvard”, “Chicago Fed”, “Yale”, “San Francisco Fed”, “Oxford Economics” … and they’re all fence sitting, needing greater certainty. For them, it will only be a recession when it’s a recession (i.e. when NBER has, in hindsight, stated a recession started sometime before the time that these people stated a recession was unlikely).

And we give such people our lifesavings and pensions to manage.

*sigh* C'est la vie.

That’s what you get for waking up in Vegas.